Trump’s tariffs hurt US stocks more than other markets

(Bloomberg) – President Donald Trump’s tariffs were meant to make America great again, but they caused more damage to US stocks than other markets.

Most of them read from Bloomberg

US stocks have had the worst in the major asset classes since Trump took office on January 20th, with the S&P 500 index falling by about 8% and the Nasdaq 100 index exceeding 10%. Other victims include not only Australian and Canadian stocks, but also dollars and Canadian stocks, while the euro, yen and Chinese yuan are all on the way.

Trump’s aggressive trade stance, along with maintaining ties with allies, is perhaps the biggest factor in the global market as investors predict his tax collection will curb US growth. The president’s policy flop soaked volatility and increased demand for shelters such as gold and Swiss francs.

Manish Balgava, CEO of Strait Investment Management in Singapore, said: “These early market responses suggest that investors are re-adjusting expectations about the new administration’s policies, particularly the economic impacts on trade and fiscal policies.”

The Bloomberg Dollar Spot Index, which measures greenback performance against groups of currencies in developed and emerging markets, has fallen by more than 3.5% since Trump took office. Conversely, the pound appeared as the biggest winner by strengthening 6.4%. The euro rose 5.6% thanks to German defence spending plans in response to Trump’s stance on the Ukrainian war.

Greenback slides support even the currencies of several countries that have been subject to US tariffs. The Mexican peso rose more than 3%, while the offshore yuan won more than 1%. The Canadian dollar had little changed.

Read: US share of global market capitalization in 2025: MLIV Pulse Results

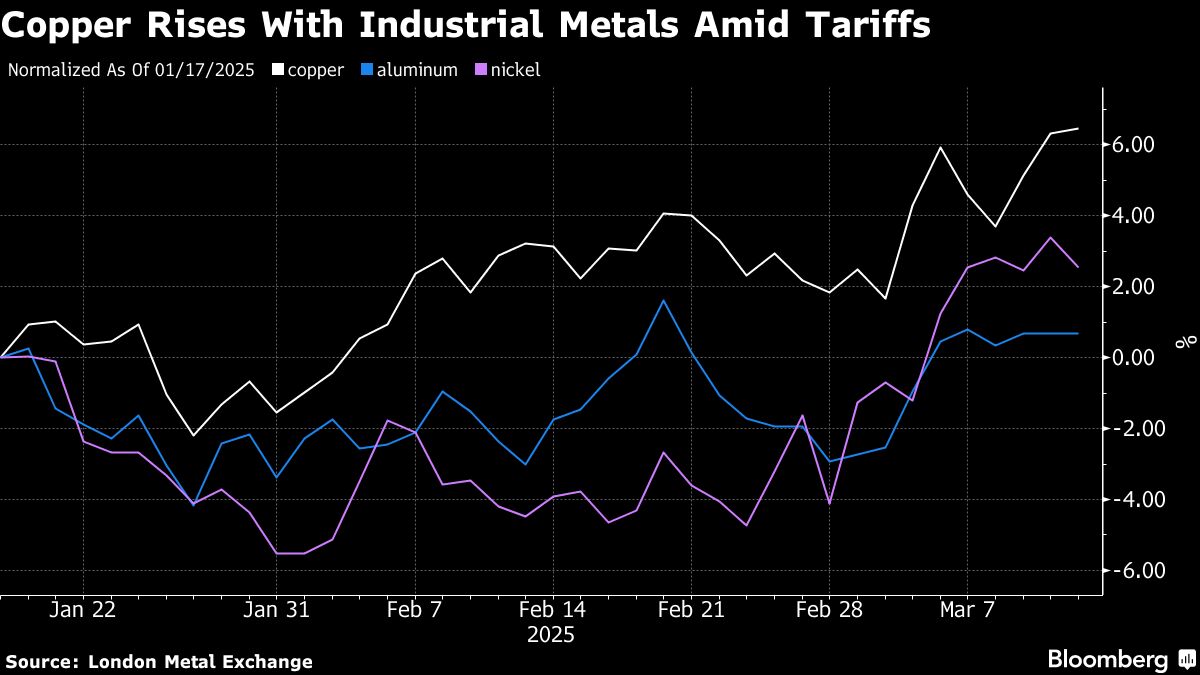

In the meantime, copper rose to five months high, leading to an increase in industrial metals as investors were priced with the distortions they bring to the global trade flows of commodities. Trade disruptions weigh the prices of key agricultural commodities from soybeans to corn. Gold has hit a string of record highs since Trump returned to the White House.