Analytic investors and advisors flock to “buffer” ETFs as the market is sold

Suzanne McGee

(Reuters) – Investors are evacuating the increasingly intense US stock market by pouring into the upper limit of potential profits that will earn them in exchange for cushions on potential losses, a kind of fund traded on exchanges that offer trade-offs.

A CFRA study found that “buffer” ETFs had a $2.5 billion inflow as the market pulled back rapidly. The category has seen $4.7 billion inflows so far this year, as the Benchmark S&P 500 Stock Index fell by 6%.

According to the CFRA, the biggest decline in the S&P 500, such a buffered ETF pulled in a net worth of $140 million.

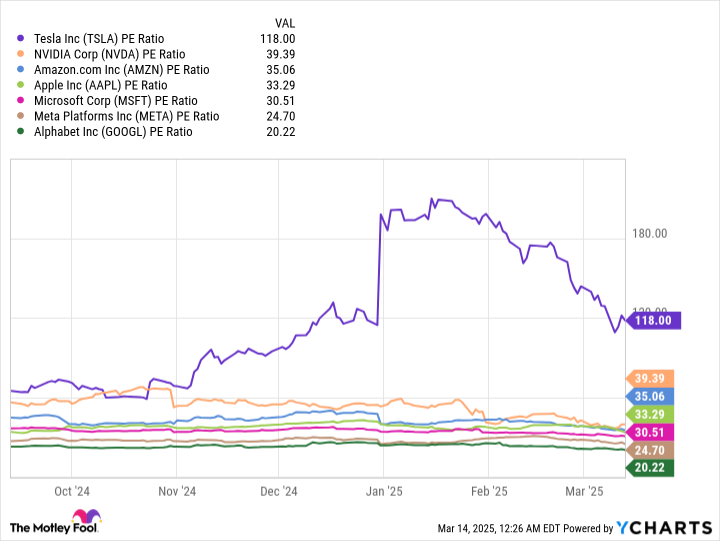

“At one point, the stock market party had to stop,” said Dinon Hughes, a partner at Nvest Financial, a financial planning firm in Portsmouth, New Hampshire. Hughes began relocating several of his clients’ stock market holdings to buffer ETFs last year as stock valuations rose and expectations for clients to stand up against choppy markets and selling.

Buffer ETFs, provided by asset managers such as Innovator Capital Management, BlackRock, and Allianz Investment Management, use options to limit how much investors lose in the sale of the market. Protection is funded by selling other options to remove the possibility of unlimited profits if the market is higher.

The degree of potential profit depends on the market background, and as investors abandon potential profits in exchange for more protection, a higher volatility environment translates to lower potential potentials.

Financial advisors like Hughes are increasingly attracted to them as a way to persuade their clients not to abandon their stock in a fierce environment.

“A year ago we were reaching out to them and their clients to talk about the concept,” said Graham Day, chief investment officer for innovators. “Now we’re the ones who answer calls from them as they’re trying to remove some chips from the table.”

In an advisor survey conducted last week, innovators found that 82% of the advisors who voted were more concerned about stocks than other asset classes.

The shares have been sold in recent weeks as investors’ concerns about the economic outlook are exacerbated by President Donald Trump’s uncertainty over tariffs.

“When we receive these shocks, it creates a new level of both uncertainty and urgency,” says Johan Gran, head ETF market strategist at Allianz. “Of course, volatility spikes have always been there, but now there is a huge surge in volatility from the new administration.”