The three mystery whales each spent over $10 billion.

AI Microchip Suppliers nvidiathe world’s most valuable companies are market capitalised and rely heavily on a small number of anonymous customers collectively donating tens of thousands of dollars of revenue.

AI Chip Darling again warned investors with quarterly 10-Q filings filed with the SEC, but warned that each order had each exceeded the 10% threshold of NVIDIA’s global consolidated turnover.

For example, an elite trio of particularly deep customers purchased individual products and services worth between $10 billion and $11 billion in the first nine months that ended in late October.

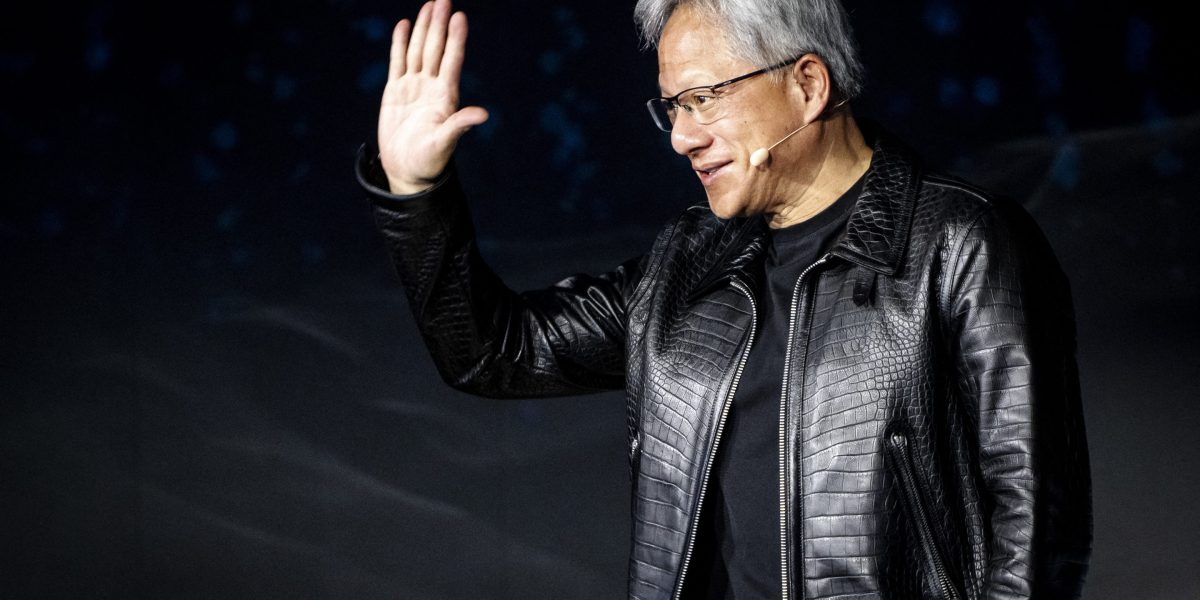

Fortunately, this is what Nvidia investors have. It won’t change immediately. Mandeep Singh, Head of Global Technology Research at Bloomberg Intelligence, believes that founder and CEO Jensen Huang’s spending will not be stopped.

“The data center training market could reach $1 trillion without any actual pullbacks,” he says. By that point, Nvidia’s share will almost certainly fall significantly from its current 90%. But that could still be in revenue of hundreds of millions of dollars each year.

nvidia remains in place of supply

It is very rare for businesses to concentrate this risk among a small number of customers, except for defense contractors living away from the Pentagon. 4 trillion dollars.

Looking at Nvidia accounts strictly on a 3-month basis, Four anonymous whales It totally consisted of almost all of the $2 sales in the second fiscal quarter. This time, at least one of them was dropped. Now only three people meet that standard.

Shin said luck Anonymous Whale may contain Microsoft. Metaand perhaps super micro. However, Nvidia declined to comment on the speculation.

Nvidia only called them customers A, B and C, and it is said that they all purchased $12.6 billion in goods and services. This was more than a third of Nvidia’s total $35.1 billion recorded in the third quarter from late October to late October.

Their share is also split equally at 12% with each accounting, suggesting that they are more likely to receive the maximum amount of chips they have as they wish ideally.

This is what his company does Supply is constrained. Nvidia outsources the wholesale manufacturing of industry-leading AI microchips to TSMC in Taiwan and does not have its own production facilities, so it cannot simply pump out many chips.

Intermediary or end user?

Importantly, Nvidia’s designation of a major anonymous customer as customer A, customer B, etc. is not fixed from the accounting period until the next accounting period. They can change places and do, and nvidia keeps their identity secret for competitive reasons. Without a doubt, these customers don’t want to be able to see exactly how much money investors, employees, critics, activists and rivals spend on Nvidia chips.

For example, a party designated as “Customer A” has purchased approximately $4.2 billion in goods and services over the past quarterly fiscal period. However, it appears that it was explained in the past that it was small as it did not exceed the 10% mark in the first nine months in total.

Meanwhile, “Customer D” appears to have done the exact opposite, reducing Nvidia chip purchases in past financial quarters, but still accounts for 12% of current sales.

It’s hard to say if they’re an intermediary, as their names are secret I’m having a problem Super Microcomputerdata center hardware, or end users like Elon Musk’s Xai. The latter came out of nowhere to build that new thing, for example Memphis Computation Cluster Just three months later.

Nvidia’s long-term risks include the transition from training to inference chips

Ultimately, however, only a handful of companies have capital to compete in AI races, as training large language models can be prohibitively expensive. Typically these are cloud computing hyperscolours Microsoft.

Oraclefor example, we have announced a recently announced plan. Zettascale Data Center There are over 131,000 NVIDIA cutting-edge Blackwell AI training chips, which are more powerful than individual sites that still exist.

The electricity required to run such a large computing cluster is estimated to be comparable to almost the output capacity.20 nuclear power plants.

Bloomberg Intelligence Analyst Singh believes Nvidia’s only long-term risks. One, some hyperscolours may reduce orders Finallydilute its market share. One such candidate is alphabetthere is that My own A training chip called a TPU.

Second, its advantage in training is not consistent with inferences that run the generated AI model after it has already been trained. Here, the technical requirements are not as cutting edge. This means there’s far more competition from rivals like AMD, as well as companies with their own custom silicon. Tesla. Ultimately, inference becomes a much more meaningful business as more and more companies use AI.

“There are a lot of companies trying to focus on that inference opportunity, because you don’t need the best GPU accelerator chip for that,” Singh said.

When asked if this long-term shift to reasoning was greater risk than ultimately losing share in the market to train a chip, he replied, “Absolutely.”

This story was originally introduced Fortune.com