Is Acadia Healthcare Company Inc (ACHC) the top stock with extraordinary volumes?

Recently I published a list Top 20 Falling Stocks with Unusual Volume. In this article, we look at where Acadia Healthcare Company Inc (NASDAQ:ACHC) exists against other top fall stocks of unusual volumes.

Uncertainty about tariffs and macroeconomic conditions has undermined investor confidence, resulting in a decline in stock prices. Some stocks are under pressure for the two reasons mentioned above, while others are simply traversing the market direction or soaking for company-specific reasons.

Regardless of why the stock goes down, a stock fall offers a fresh investor the opportunity to enter at a good price. Once the risk sinks, these stocks usually recover quickly. We decided to uncover these stocks and see if it makes sense to put money in to exploit the ongoing market turmoil.

To create a list of the top 20 stocks falling at extraordinary volumes, we looked at stocks with market capitalization of over $300 million, and used relative volumes to detect unusual volume activity.

Relative volumes can easily detect volume spikes by comparing daily volumes to the stock’s average trading volume over three months. These spikes usually indicate that something important is happening. This, when combined with a price drop, becomes a red flag that investors cannot ignore.

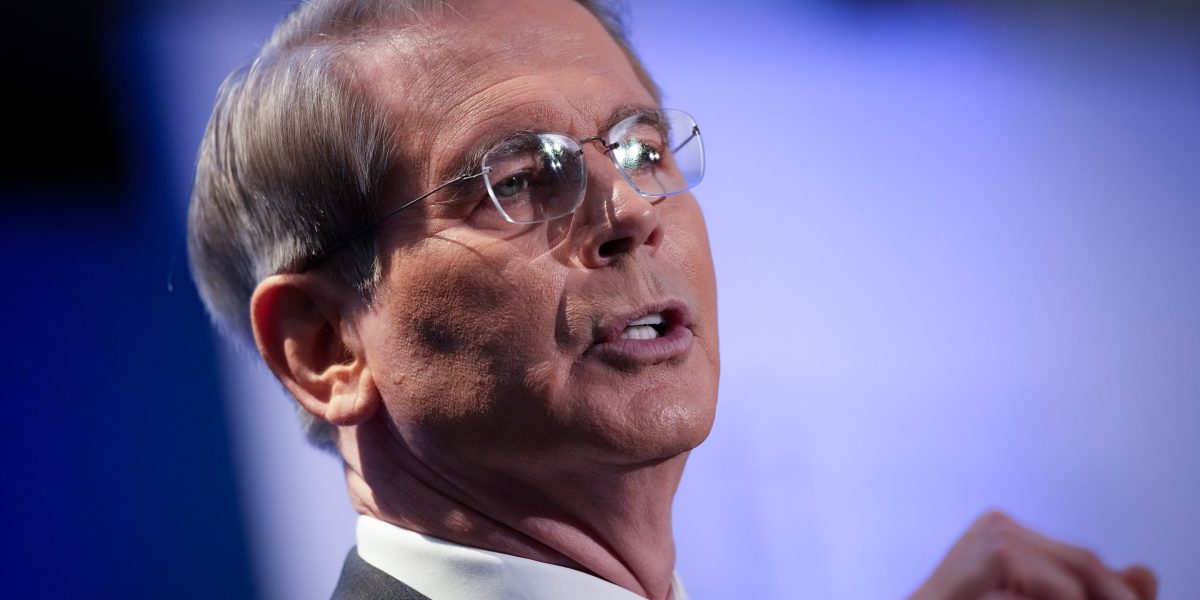

A medical professional discussing treatment plans with patients in outpatient clinics.

Acadia Healthcare Company Inc (NASDAQ: ACHC) is a behavioral healthcare service provider. It operates and develops a comprehensive treatment center, acute inpatient mental facilities, residential treatment centers, and specialized treatment facilities consisting of residential recovery and eating disorder facilities. The company’s stock is down 11.71% in a week at a relative volume of 3.17.

The company acquired an upgrade earlier this year. Keybanc Capital Markets analyst Matthew Gillmor upgraded the company in 2026 to overweight from the sector’s weight, against the backdrop of EBITDA’s expected potential momentum.

Analyst Matthew Gilmore said:

“I think there’s a chance that ratings might start to normalize in 2025 (>9x) as the focus is on fade in 2024 and negative press headlines for the 2026 EBITDA.”

Similar sentiments were shown by another analyst just a few days ago. Guggenheim analyst Jason Cassolla upgraded his shares with a price target of $36. He was optimistic about the industry’s long-term outlook.