New York’s Federal Reserve has found a “slight share” of companies that say they’ve raised prices for products that are not affected by tariffs

- As businesses cut the costs of customs duties on consumers in the form of rising rates, The New York Federal Reserve discovered last month that many companies were increasing prices for products that are not affected by tax. The economists said these pricing options take advantage of unpredictable tariff uncertainty, but could also exacerbate the possibility of inflation.

Not only are businesses ratcheting prices of imported products to offset the costs of tariffs, they are also increasing the costs of goods that are not affected by those taxes. investigation and beige books Report It was released on Wednesday.

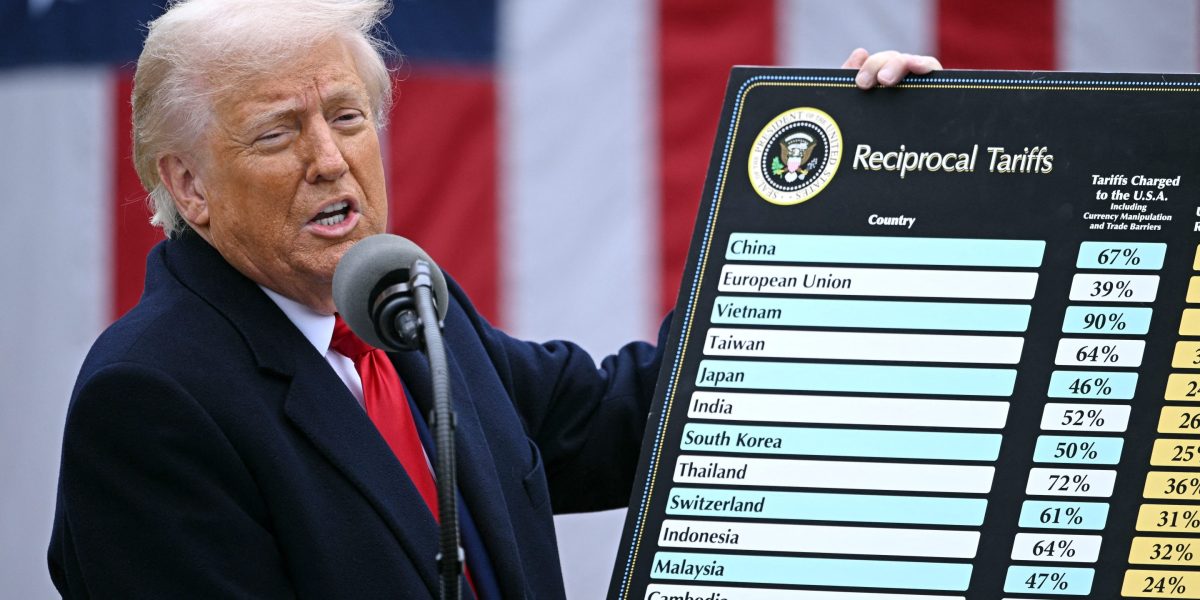

The survey was managed by approximately 110 manufacturers and more than 200 service companies in New York and New Jersey from May 2 to May 9. At the time, Trump had not yet reduced China’s tariffs from 145% to 30%. an Increase taxation For 25% to 50% steel and aluminum, it came into effect Wednesday.

The Trump administration is also preparing Supreme Court showdown Following a US court on whether the president has the authority to impose taxes on the constitutionality of tariffs.

A “slight share” of companies surveyed by the Fed in early May said the rise in prices for products that are not affected by President Donald Trump’s swept tax is part of a strategy in favour of the broader impact of the tax.

“The heavy construction equipment supplier said they raised the prices of products that are not affected by tariffs to enjoy the extra margin before the tariffs increased costs,” Beige Book Report said.

Economists primarily expect tariffs to fail to hit profit margins or will lead to price increases for unwilling companies. The Congressional Budget Office warned It could be inflation.

A survey of the NY Federal Reserve confirmed the intentions of companies to set pricing, with “most companies” passing at least a portion of the tariff costs in the form of prices, with about a third of manufacturers and 45% of service companies “passing full” price increases.

Price rise under “uncertainty cover”

Economists warn that the strategy of increasing prices across the board, even for products that are not affected by tariffs, could be a sign of companies feeling pressured to manage ongoing economic uncertainty.

“(It’s) a general unpredictability. Taking advantage of a general inflation environment could be another reason,” said Susan Ariel Arson, a professor of international affairs research at the Elliott School at George Washington University. luck. “No one knows that tomorrow, Trump is about to raise tariffs on tariffs and other trade barriers. His trade approach is not consistent or predictable, his approach is not transparent and he is not really motivated by market conditions.”

When businesses feel the need to raise prices for broader products in response to tariffs, they “have made the potential for inflation even greater,” Arsonson added.

According to Rebecca Holmes, a lecturer at the London Business School and a faculty member of Duke Corporate Executive Education, companies considering rising prices will do so under this “cover of uncertainty.”

“We’re going to see some companies trying to do some things they might have sat,” she told F.Ortune. “Maybe you’re going to lay off. Maybe you’ll cut down on the product. Maybe you’ll raise the price of something you’ve been a little hesitant.”

With so much uncertainty and businesses can only make many price changes per year, some of the decision to raise prices for a wide range of products could also be linked to trying to predict products that could potentially be subject to future tariffs, Homkes said. Otherwise, the company will consider the products that the customer will order together. If one of these products is subject to customs duties, if another product is not customs duties, the company may still choose to increase the price of both products.

Homps argues that these price increases, while being a blow to consumers, are a last resort for businesses and only happens after companies run out of other options, such as absorbing costs.

“We have to pass these costs on,” Homps said. “If they don’t pass these costs, what does that lead to? It’s less input and less employment, including the need to lay off. So we’re taking all these variables into consideration.”

This story was originally introduced Fortune.com