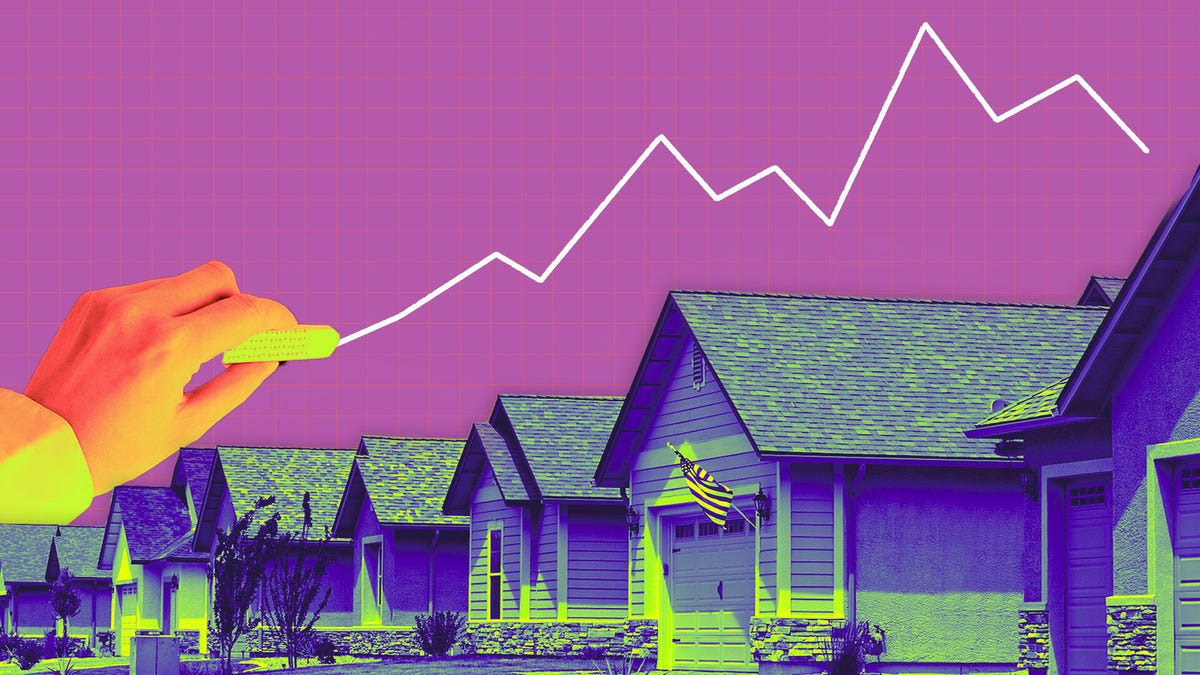

June Mortgage Fee Forecast: Can fees fall without FRED cuts?

Mortgage fees can change daily, and even hourly.

Housing market forecasts haven’t changed much. The stubbornly high mortgage rates rely on bystanders. After the average rate of a 30-year fixed home loan It’s backwards, past 7% last week, but not so much.

Meanwhile, Friday’s labor data release was Unemployment rate Keep the status at 4.2%, but that probably won’t cause enough alarms Federal Reserve System Interest rates will be reduced at future policy meetings held from June 17th to 18th.

As I have pointed out in the past, Slowing the job market It is more likely that central banks will reduce borrowing costs. However, while official labor data appears to be stable, experts warn that the worst hasn’t arrived yet. Unemployment claims and layoffs are risingbeware of employers as they inflate trade wars and government debt.

The Fed faces a challenging, balanced act of curtailing inflation and keeping unemployment low.

Inflation is expected to rise as a domestic company Gives expensive obligations to consumers In the form of higher retail prices.

“As long as tariffs remain high, the Fed will be worried about sustained high inflation that cannot be ignored,” he said. Chen ZaoRedfin’s Head of Economic Research.

Most experts say it’s unlikely that the housing market will change significantly in the coming months. Mortgage rates are in a retention pattern, as there is no clear consensus on what happens next in economic and fiscal policy.

Future home buyers should expect interest rates to remain close to 6.8% for the remainder of 2025. Redfin Prediction.

How will the Fed have an impact on mortgage fees?

Following the signs of cooler inflation, the Fed cut interest rates three times in 2024, with borrowing costs slightly less limiting. but, The Fed holds stable interest rates Since then, I have waited to see the long-term implications of the president’s policies, before it drops the rate again.

The Fed’s actions don’t immediately determine mortgage rates, but they indirectly affect how much it costs to borrow money across the economy.

I don’t expect financial markets Interest rate reduction Early until September.

“There’s too much uncertainty about tariffs, inflation and what will happen to the broader economy,” he said. hsh.com. “If the conditions don’t support it, they may not be cut at all.”

A decline in interest rate cuts combined with the administration’s budget bill is expected to significantly increase the deficit and could sustain upward pressure on long-term bond yields. 30-year mortgage rate As we closely track Treasury yields over the decade, rising bond yields lead to higher mortgage rates.

On the other hand, if unemployment rates start to rise due to recent waves Layoffcentral banks may consider easing policies to avoid a deeper recession. It would put downward pressure on the Treasury bond yields and mortgage rates.

Can a recession lead to a lower mortgage rate?

For mortgage fees to drop significantly, the overall economic situation requires a lot of breakers to win.

“If there is a new announcement from the Trump administration, or if the global economic situation weakens, the situation can change rapidly,” Lisa Startevant said. Bright MLS Chief Economist.

a recession It’s not a near-front conclusion, even though it’s still a possibility. Unemployment rates have been rising, consumer spending has slowed, and economic growth has declined in the first quarter of 2025. The prospect of slowing down weighs heavily on consumer trust. Stagflationa recession characterized by high inflation is also a threat.

If lower mortgage interest rates are a by-product of the recession, buyers worried about work safety and Provides high living expenses You will be hesitant to assume mortgage debt.

“When people are worried, they’re unlikely to make big decisions, like buying and selling a house,” Startevant said.

What do housing market experts recommend?

in Today’s Affordable Housing MarketFuture buyers have multiple reasons to postpone homeownership plans. High mortgage rates and growing anxiety about economic instability have kept overall activity low.

“It’s a good time to be aware given so many unknowns. But there’s little reason not to take advantage of the opportunity if the market offers potential home buyers in a home they love and can afford,” Gumbinger said.

Homeowners offer the promise of building generational wealth through long-term financial stability and equity.

if You are waiting for your mortgage rate to drop Before you buy, be aware that the large economic issues affecting the housing market are beyond your control. Instead, they said they could focus on how to lower individual mortgage rates. Hannah JonesAdvanced Research Analyst Realtor.com.

For example, you can shop for lenders Save the borrower Up to 1.5% mortgage rate. Each lender offers different rates and terms, so you can negotiate a better rate at any time. If you’re ready to buy economically, you can do it anytime Refinance Your mortgage is on the road.

Jones said others Strategies to lower mortgage rates Includes improved credit scores, creating larger down payments, and choosing a more affordable home.

Experts recommend you set up a budget and stick to it. Creating a realistic financial plan Can help you decide If you can handle the costs of homeownership and provide guidance on how big your mortgage should be.

See this: Six ways to lower your mortgage interest rate by more than 1%

Details of today’s housing market