Dow futures rise as stock eye records rise ahead of US-China talks and inflation reports

- Inventory futures were ticked Sunday night as the S&P 500’s recent rally saw President Donald Trump’s trade war smashed the market, as stocks grew within 2.4% of its record high in February. It comes before a big week.

US stock futures were pointed out on Sunday night, ahead of a big week highlighted by US-China trade talks and fresh inflation data.

Friday’s strong employment report added more fuel to the rally that raised the S&P 500 to within 2.4% of its all-time high in February before President Donald Trump’s trade war subsided.

Dow Jones’ industrial average futures rose 54 points (0.13%). The S&P 500 futures added 0.11%, while Nasdaq futures rose 0.08%. Tesla Stock may then appear to be more negative side Trump said his relationship with CEO Elon Musk has ended..

The 10th Treasury yield fell to 4.506% for less than one basis point. The dollar fell 0.08% against the euro and 0.11% against the yen.

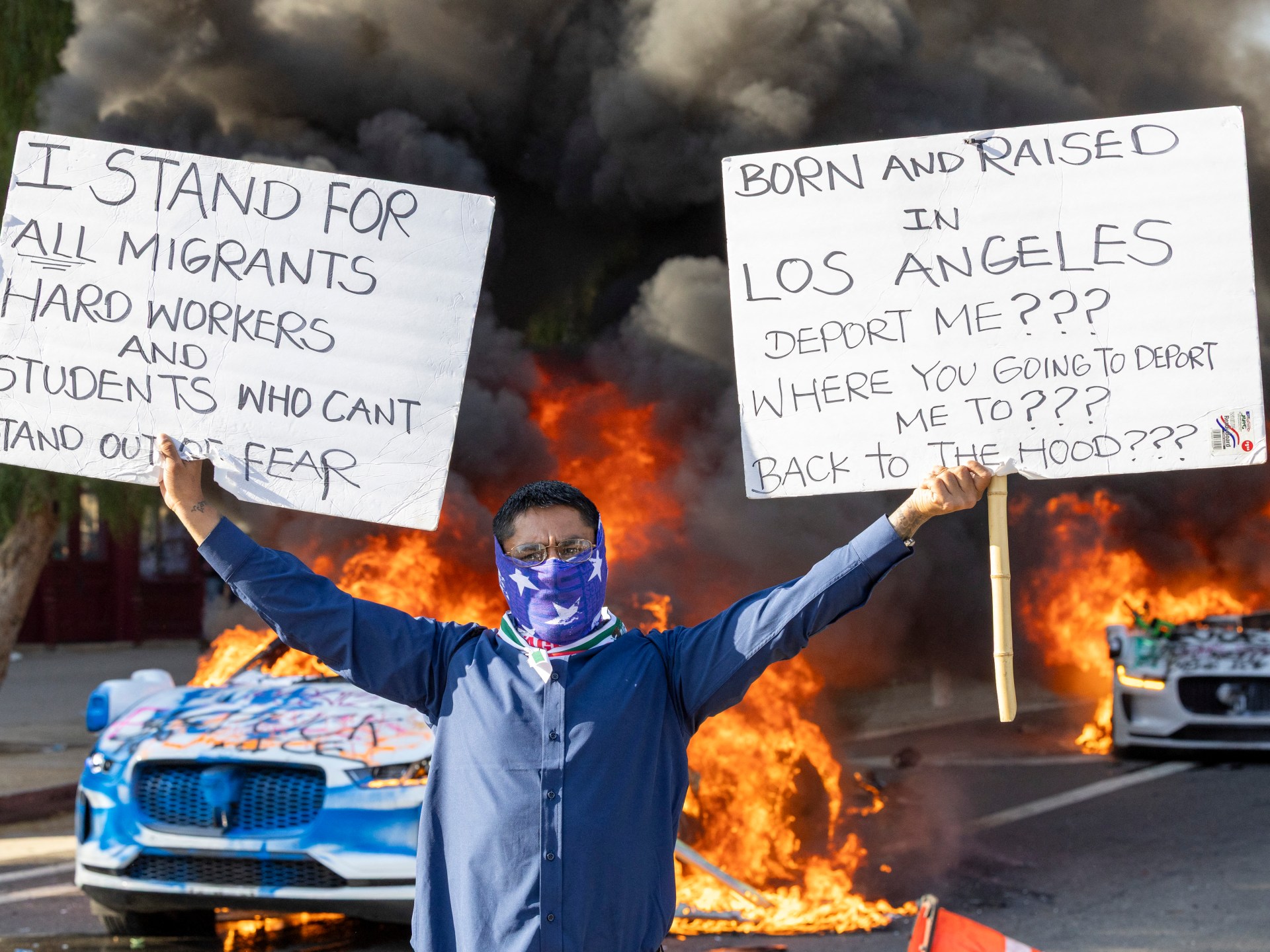

Wall Street may not respond Trump sends National Guard troops to Los AngelesHis overall immigration crackdown represents a Labor supply shock to the economy That affects the dollar.

Gold was soaked at 0.25% at $3,338.30 per ounce. US oil prices rose 0.28% to $64.76 per barrel, while Brent crude rose 0.21% to $66.61.

On Monday, US and Chinese officials will meet in London and begin another round of trade talks after agreeing to suspend their exorbitant high tariffs in Geneva last month.

Since its de-expansion in the trade war, both sides have denounced others. Abolish their trade. For the US, a key fixed point was the availability of rare earths, which is controlled by China and is important for the automotive, technology and defense sectors.

Kevin Hassett, director of the National Economic Council; It sounded bright on Sunday That discussions in London could lead to a resolution.

“It’s very pleasant to see this deal close,” he told CBS News.

Meanwhile, the Federal Reserve will be paid for new inflation data as the Federal Reserve remains in standby mode to assess how much Trump’s tariffs are moving needles to prices.

The employment report, which exceeded Friday’s forecast, eased fears about the recession and put pressure from the Fed to cut fees to support the economy. In other words, any rate reduction may have to come as a result of cooler inflation.

The Labor Bureau will release its monthly consumer price index on Wednesday and producer price index on Thursday.

Also, on Wednesday, the Treasury will issue monthly budget updates, providing clues as to how much debt the federal government is issuing amid concerns about the supply and demand of bonds.

This story was originally introduced Fortune.com