While prices of oil futures skyrocketed on Friday behind Israel’s attack on Iran, there was no indication that oil-related facilities affected by the multi-faceted attacks by Israeli forces have been affected.

“Nuclear-free energy infrastructure has not been explicitly threatened by previous parties,” S&P Global Commodity Insights (SPGCI) (NYSE: SPGI) It was mentioned in a summary of the “fact box” of major energy-related developments resulting from Israeli attacks.

CME Commodity Exchange’s Ultra Low Sulfur Diesel (ULSD) settled at $2.3587 per gallon, up exactly 17 CTS/g or 7.77%.

ULSD settlement on Friday is the highest since February 27th.

The daily increase of 17 CTS/g is the highest since January 10th. The increase in ULSD in December 2022 increased when it rose above 18 CTS/g. However, the profit for the day was 5.97%. Today it was 7.77%.

The higher the ULSD level, the more the global gross market increases. This tends to rise or fall in proportion to products such as petrol or diesel in response to oil demand or actual or potential disruptions in demand. But that didn’t happen on Friday, but ULSD has raised two key crude benchmarks in percentage terms.

Global crude oil benchmark Brent rose $4.87/bCME allele settles at $74.23/b to an increase of 7.02%. West Texas Intermediate, the US crude oil benchmark, climbed $4.94/b $72.98/b. It marked a percentage gain of 7.26%.

What is at stake by the growing war, including Iran’s ability to produce crude oil, was spelled out by SPGCI in its fact box. The SPGCI segment, which houses the Legacy Platts business, said Iran produced around 3.25 million b/d of crude oil in May.

Of the countries of the OPEC+ group of oil exporters, only Saudi Arabia, Russia and Iraq produced more. According to the latest report from the Energy Information Administration, the US is the world’s largest crude oil producer with approximately 13.24 million b/D of produce.

However, since the 1979 Iranian revolution and its acquisitions by its Islamic leaders and violations with most other Arab oil producers, the oil consumer nightmare scenario was for Iran to take steps to close the Strait of Hormuz, the gateway to the Persian Gulf. Some of the oil exports from Saudi Arabia, Kuwait, the United Arab Emirates, Iraq and Iran all pass through the Strait of Hormuz.

However, despite these fears that have now been in place for over 45 years, the closure never happened. Several analysts on Friday said this isn’t likely to happen again.

The Hormuz Strait is “clearly a major concern,” Paul Sankey of independent research firm Sankey Research said in an interview with CNBC. But he added that if Iran takes steps to close the aisle, “all hell will be released. I am sure Donald Trump will be at the forefront of hell’s unlocking.”

However, Sankey did not completely underestimate the impact of the Israeli attack. He said, “The speed of movement we saw is as fast as we saw during the Russian invasion of Ukraine.”

“Nearly, the oil market has not been characterized as much as you would think of it as it responds to geopolitical risk,” he said. “Using this opportunity, we are responding to the Russian Ukraine. So why is that?”

Sankie said it would be difficult to rely on U.S. strategic oil reserves to fill the gap if production is lost from Iran. Reserves were reduced by the Biden administration to compensate for the losses and expected oil in Russia following the 2022 invasion of Ukraine.

According to Sankey, another option to bridge the gap is the reserve capabilities of several Middle Eastern countries. Saudi Arabia, Kuwait, United Arab Emirates, Iraq. But the problem with its reserve capabilities is that much of it is behind the Strait of Hormuz. “I think the market is priced a real fear about reserve capabilities,” Sankey said. “That’s why this move was very aggressive.”

“The key is whether oil exports will be affected,” said Richard Joswick, head of short-term oil analyst at SPGCI.

He noted that when Iran and Israel moved back and forth in attacks last year, oil prices initially rose. Higher levels did not stick long after it became clear that the attack would not affect supply.

However, the SPGCI report also cited JP Morgan Analyst. JP Morgan Analyst said the “worst kanario” lost output would result in a drop in Iran’s supply of 2.1 million b/d. This could cause the price of dated Brent to skyrocket. This is a physical benchmark drawn from the market of several different principles – from $120 to $130/b.

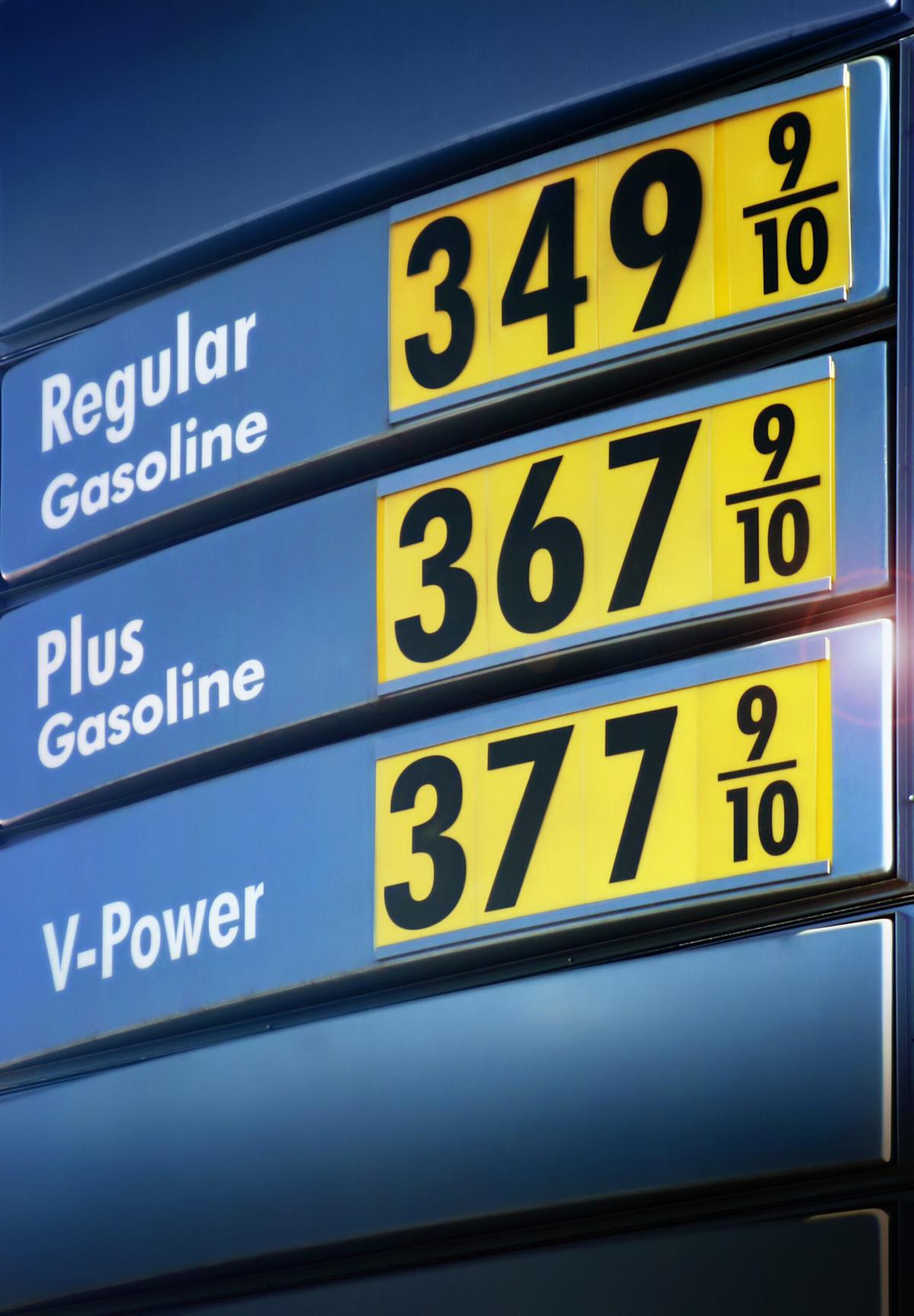

Retail prices will take longer to move large and small futures prices, but wholesale prices are expected to move on the same day to reflect rising futures prices.

Pilot Flying J makes retail pump prices available Downloadable spreadsheets. As of 2pm on Friday, there were no signs of a surge in retail diesel prices as a result of the Israeli attack. The increase was small, and was an amount considered part of normal daily fluctuations.

Given the attack, the lack of movement is not surprising. A hurricane Stopping the pipelineprice spikes could be faster. That hasn’t happened yet.

Patrick Dehaan, head of oil analysis at Gasbuddy, which tracks retail prices, said in a post on X that diesel could rise between 10 and 30 cts/g over the next two weeks.

More Articles by John KIngston

On the Chicago stage, Chrw talks about Tech and Staffing. RXO is looking at the order hit capacity of the language

Logistics GDP sharing will rise in 2024 and unlikely to drop: CSCMP Report

Trump Signature Bill Zev Kills Zev-related Waiver, Conditions Sues Suspects

Posts Israeli attacks will increase diesel and crude oil spikes, but Iran’s oil facilities will not be affected It appeared first FreightWaves.