(Bloomberg) – Financial markets are set to resume on Monday, along with investors who focus directly on the escalation of geopolitical tensions as Israel and Iran continue to bombard each other without any signs of a pause.

Most of them read from Bloomberg

Israel reported a new missile attack from Iran on Sunday, saying it was simultaneously running strikes in Tehran as both countries faced the third day as it was the most severe entanglement of longtime enemies.

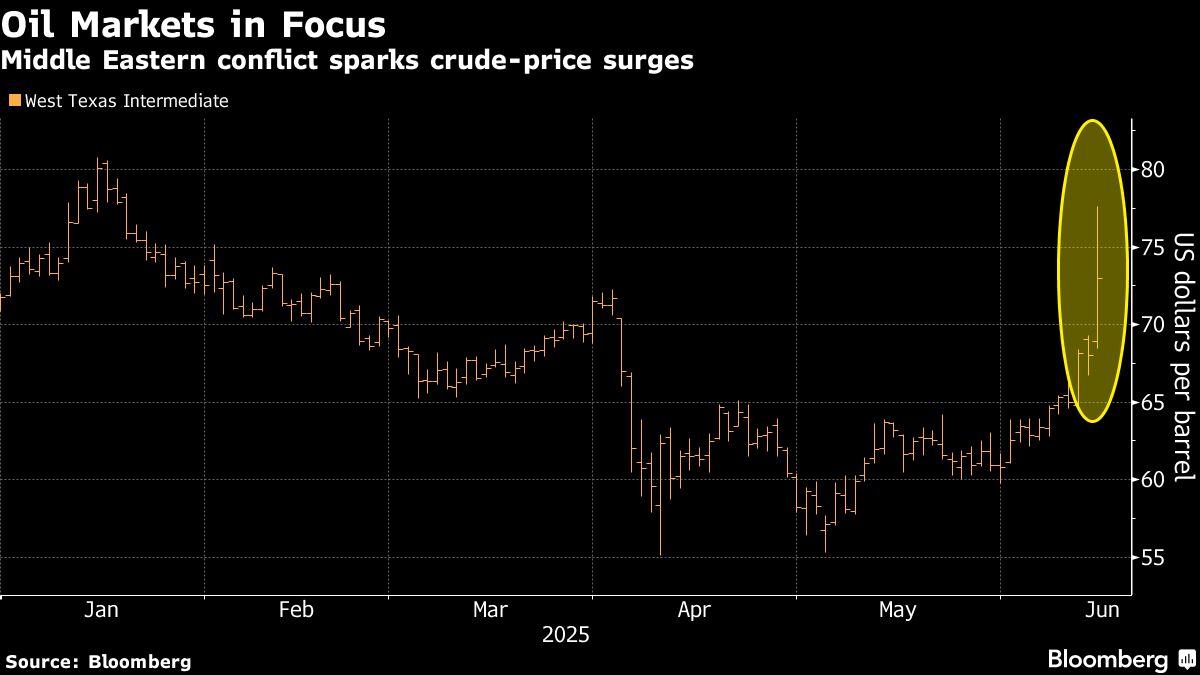

The biggest market response to date is in oil, and as the conflict on Friday could expand, it could surge over 7% on Friday, causing disruption in major oil-producing regions. While traditional shelters like gold and dollars rise, fresh inflation has weakened the Treasury.

The US currencies were mixed against their major peers in early Asian trading on Monday and bordered higher against the euro, but little changed against the yen. Norwegian krone slipped after oil was fueled last week.

Last week, some investors chose to wait to measure how long tensions last, with similar standoffs between the two countries in mind, which eventually left the gap. Still, current hostilities conflicts and expansion of strength could cast a shadow on risk assets on Monday. Already, the MSCI global index of developed market stocks fell the most since April on Friday, after Israel served as its first air force in Iran.

“This is a huge escalation to the point where these countries are falling into war,” said Michael O’Rourke, chief market strategist at Jonestrading. “The impact will be huge and will last a long time,” he said, weakness in the stock market is likely to be particularly likely after recent profits.

Local risks

In the region, most Middle Eastern stock indexes fell on Sunday. Egypt’s main gauges are the worst performance, seeing the biggest losses in over a year on concerns that Israel’s gas production will cause fuel shortages. In Saudi Arabia, the decline in tadaur gauges is limited by Aramco, which is based on rising oil prices. Israeli benchmarks ended higher as military supplier Elbit Systems Ltd recovered.

Traders are weighing fresh geopolitical risks at a time when they are also tackling volatile global trade relations, new tariff outlook from US President Donald Trump, economic transcendence currents, ongoing conflict between Russia and Ukraine, and rising political tensions in the US.

“Unless oil continues to rise and inflation rates increase, this is likely more likely than panic, as other stories drive the market,” said Dave Mazza, CEO of Roundhill Investments. “It may offer opportunities for purchases, but in a market that has been gathering rapidly from the recent lows, it will be difficult to get profits from here.”

Below are comments from strategists and analysts on how investors will respond on Monday.

George Saravelos, global head of Deutsche Bank AG’s FX strategy

In the most negative scenario of complete disruption to Iran’s oil supply and closure of the Strait of Hormuz, oil could exceed $120 per barrel. Under a more restrained scenario of 50% reduction in Iran’s exports without wider disruption, the surge in oil prices is limited to current levels, meaning this is the scenario currently being priced on the market.

Wolf von Rotberg, bank equity strategist J. Safra Sarasin

The market must be prepared for long-term uncertainty. The conflict could be dragged over more days. The risk is distorted on the downside. Hedging against potential oil chain destruction through exposure to energy markets and additions to gold may see an accelerated structural rise, but it is the best way to protect your portfolio from further escalation in the Middle East.

Hasnain Malk, Teller strategist

The surge in oil prices reflects the risk that Iranian exports will go offline, but there is no serious disruption to the Strait of Hormuz. However, Eastern European markets provide examples of how quickly local markets can recover if there are indications that conflict will not spread.

Martin Bercetche, founder of Frontier Road Ltd.

Volatility stays here and the market has not yet been tailored to the question mark of geopolitics. This weekend was an escalation, so the market needs to react negatively, but knowing the uncertainty continues, he doesn’t try to guess where the market is heading.

Alexandre Hezez, Chief Investment Officer, Group Richelieu

Oil prices that have been falling for months and that central banks allowed rates to be lowered are now a very destructive factor in the economy, potentially leading to a previously excluded scenario: bulls. How will the central bank respond in the event of an oil crisis? There are clearly risks in both inflation and growth. The only protected assets remain oil and gold. The dollar is expected to strengthen.

Gilles Guibout, Head of European Equity at Axa Im

This is a catalyst that is likely to cause further profits in the stock. Stock markets have recently garnered sharply at high ratings, especially in the US, amid low expectations of a weaker economy and growth in earnings per share. There’s actually nothing about the market tail fin. As for the sector, oil majors are likely to have heavy demand as the sector has been slowing down recently. Surges in oil prices are changing travel direction.

Christopher Dembik, Senior Investment Advisor at Pictet Asset Management

Since Wednesday, hedge funds and traders have been covering up by purchasing VIX calls. They could strengthen these positions and tactically join gold, particularly defensive stocks. As for oil, hedge funds have been net buyers since the end of May, but the rest of the markets were on sale at the same time. There is no reason to settle these positions. It’s different for institutional investors. Many have simply added hedges, but have made little changes to their allocations, knowing that this type of geopolitical event will have little impact on the portfolio in the medium term.

Anthony Benichou, Cross Asset Sales Trader at LiquidNet Alpha

When it comes to oil, Saudi Arabia has enough reserve capabilities to control things, and Iran doesn’t have many good options. If they strike US assets, they risk drawing the US directly into conflict. There will be no real oil shock unless the US is involved. Supply appears to be stable despite strikes at Iran’s Tablis refinery. OPEC can easily make up for any loss, as did during the Russian and Ukrainian turmoil.

Andrea Touni, head of sales trading at Saxo Bank France

Technically, for stocks, this dispute is not a game changer. It is localized and its real main influence lies in the oil. I don’t think that Iranians will block the Strait of Hormuz, but that will of course change the dimension of conflict. The same is true when the US is directly involved, but that is unlikely to happen now. That being said, the opening is clearly not great tomorrow.

Arthur Jurus, Director of Investment, OddoBHF Switzerland

Long-term rises in oil prices will force current banks to maintain rates at current levels for longer. The main uncertainty lies in the evolution of the US dollar, sandwiched between a potential oil shock and the ongoing financial restructuring pursued by the US administration. Global economic growth could also be revised downward again. In this environment, people with high quality stocks, strong cash flows, low debt and aggressive revenue momentum can outperform.

Rafael Twin, head of capital market strategy for the capital city of Tikehau

Currently, geopolitical risk premiums are limited across the stock market, but you can imagine them starting to price. At the same time, there is definitely a change of government as far as safe shelters are concerned. The dollar has not acted as a typical hedge that previously opposed this type of event. Now it is gold or silver, or the various kinds of valuable things that play its role.

Dennis Debusschere, founder of 22V Research

To the extreme, hedging war and geopolitical risks is really difficult. Does it make sense to lighten up a little with Nvidia ahead of the nuclear event? Would you like to put a little risk premium into the world’s disaster? no. It makes sense to own a tail hedge for such outcomes.

To envision sustainable sales in the market based on war, air strikes, etc., investors need to call that they are likely to have a lasting impact on inflation, revenue, or real interest rates. This is the important factor. Therefore, if inflationary spikes are expected to be temporary and there is no obvious negative side revenue risk in US stocks, it is beneficial to buy war-related dips.

Doug Ramsey, Chief Investment Officer of Ludd Group

I certainly don’t see dip as an opportunity to buy. Consumers and CEOs are already very low in trust, and conflicts can knock it down to another notch.

Steve Sosnick, Chief Strategist of Interactive Brokers

In the short term, as the situation develops, it could mean risks for US stock headlines over the weekend and the next few days. There are all sorts of ways this could go south. Given the positive momentum and feelings among traders, they feel this is merely a modest attention for now. When geopolitics works, I prefer to look at products and bonds. They are not distracted by the story. Oil traders tell us they are not indifferent. It may not be panic, but it is clearly not optimistic.

Vincent Juvyns, ING’s Chief Investment Strategist

I don’t expect to sell. The market is probably a bit enthusiastic, but I’m not expecting defeat. Even if you are neutral in your asset class, I don’t think there’s a need to reduce your stock exposure. At this point, our basic case scenario is that conflicts do not spread to major regional crises.

Ben Emons, founder of FedWatch Advisors

Financial situation tightens due to rising oil prices, rising yields and declining stocks. So it could be a continuation of what happened on Friday. The key is where the oil goes from here. Bonds lack safe shelter as oil prices change the image of inflation.

Michael Brown, strategist of the Pepperstone Group

I struggle to see this as a major game changer over the medium and long term, but when history is a guide, the market tends to be very quick to price geopolitical risk, but it also tends to consume fear as fast as well. Gold and crude oil could be big winners in the short term. I think it’s a sustained upside-down of crude oil when further conflict escalation is needed, which is likely to be targeted at Iran’s crude infrastructure.

Marko Papic, Chief Strategist at BCA Research

Investors must be agile. In a very close plan, the market will use this conflict to sell out bumper crops after May. However, this is a very DIP risk. In particular, the inflationary effect of rising oil prices is temporary and does not affect monetary policy. For Israel and Iran, the central bank will not raise fees.

Art Hogan, B. Chief Market Strategist at Riley Wealth Management

One of the most difficult parts to interpret how we respond to current events and recent past geopolitical events is that economic costs are extremely difficult to model. While we are still in the escalation stage of this current attack on Iran, we find it difficult for investors to gain confidence in returning to the market until they reach where the exit ramp can be seen in this current attack.

– Support from Elena Popina, Ikin Shen, Ye Shen and Vildana Hazik.

(Update by early currency transfer)

Most of them read from Bloomberg BusinessWeek

©2025 Bloomberg LP