FOMC Announcement: Powell is likely thinking about oil, tariffs and Trump

If the Federal Open Market Committee (FOMC) wanted to meet with greater clarity this month, they would I’m seriously disappointed.

Instead of a clearer path laid out before, Jerome Powell and his companions sat in the news. Increased geopolitical conflicts in the Middle East– Continuing uncertainty over tariff contracts with key partners, and Moody’s downgrades to US credit, boosting crude oil prices to potential.

Of course, the elephant in the room would be President Donald Trump’s response if FOMC again refuses to pay attention to his wish to cut the base fees again.

The blending of the problem will lead to most analysts suspecting that the base rate will be stabilized at 4.25-4.5%. This is a relatively harsh stance, according to Dovish economists who argue that the economy is dealing with relatively well, according to data.

In a memo shared with Fortune this week, Macquarie Group’s economics director David Doyle wrote that the Fed was walking a “tightrobe.”

“It’s likely that FOMC will be stable again this week,” Doyle continued. “Market responses are likely driven by communication and potential guidance for further reductions. Dot plots could push out the proposed timing of rate reductions. This could lean a bit, suggesting a 25 bps reduction in 2025 and a 75 bps reduction in 2026 (from 50 bps annually in March).”

Doyle added Chair Powell, adding, “While recent inflation developments may explain encouragement, they downplay their relevance due to the uncertainty of recent crude oil prices due to tariffs, fiscal policy and geopolitical developments.”

The overall expectation from Wall Street is that the base rate does not change, but here are some of the headline factors that could influence Chair Powell’s final decision, which will be announced later today.

Problem 1: Oil

Tensions in the Middle East are escalating by the day after Israel and Iran launched their attacks On both sides, each other Target senior military officials.

Despite the US saying it won’t get caught up in the conflict, President Trump yesterday said to the true social media site social media sites that “we now have full and total control of the sky over Iran,” suggesting Iranian leader Ayatollah Khamenei is a simple target despite the hidden side. Khamenei wouldn’t say “for now it’s been taken away.” Trump added.

Escalating tensions in the Middle East have raised doubts about oil supply and Iran threatens to close the straight for Hormuz. Oil flow through the straits accounts for approximately 20% of the world’s oil liquid consumption. I’m writing the US Energy Information Agency.

Macquarie’s global energy strategist Vikas Dwyvie, luck: “We expect oil prices to remain volatile in the coming weeks as both Iran and Israel maintain their military strength. Regardless of military or diplomatic progress, Brent hopes to gather towards the $80 level before hitting the plateau, as perceived risks of actual oil supply destruction will be largely discounted.

“From the $80 plateau, the next price movement will, in our view, be driven by what happens to Iran’s oil export infrastructure. If damaged or destroyed, we believe that oil will be $100 due to the direct loss of Iran’s exports and the risk premium associated with Iran’s response.

“There are likely sales of diplomatic solutions, profits and hopes for new shorts, but we hope that we will buy until the market confirms the risks of the oil supply.”

This does not make Powell’s life easier, as oil is a key factor in determining US inflation.

Issue 2: Policy Uncertainty

Policy from the White House adds more uncertainty to the already blurred picture.

Trump’s “big and beautiful building” frowned upon the amount he could do Contributes to US government bonds, Despite some deficits, it is offset by inflation, but by financial customs policies.

Lack of action from The oval office won’t impress Moody’sdowngraded US debt from AA1 to AAA a month ago. This is once again a problem for Powell, as the recurring moves push the Treasury, causing government borrowing costs that could potentially reduce the impact of inflation on consumers.

However, as she wrote in a note shared by Jim Reid of Deutsche Bank. luck This morning: “Ahead of the Fed’s decision, the US Treasury Department gathered yesterday on a flight to Quality.

“This means that the two-year yield (-1.5bps) has dropped to 3.95%, the 10-year yield (-5.7bps) has dropped to 4.39%, and the 2-year yield (-1.5bps) has dropped to 4.39%.

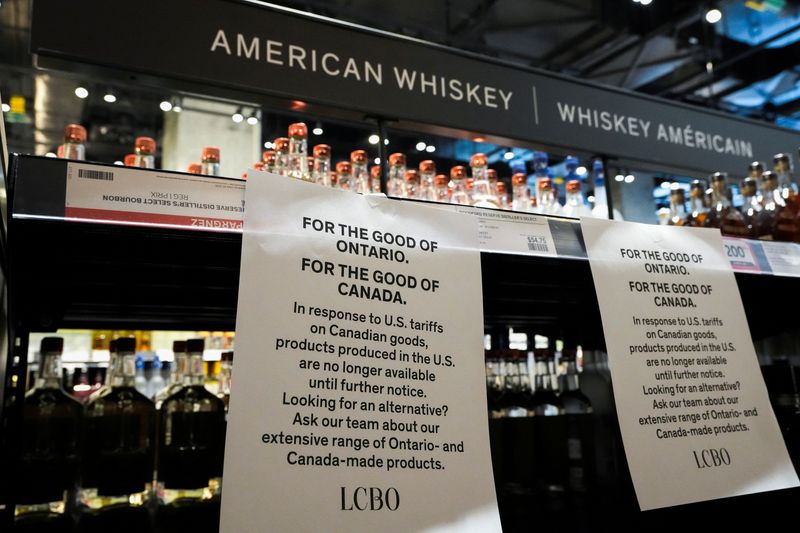

Another question is, of course, customs. Powell is already waiting for businesses to see if they will hand over the increased costs to consumers.

Macquarie’s global FX and Rate Strategist Thierry Withman pointed out “levels of inflation data after the liber station’s announcement.”

“In fact, inflation has recepped as demand for the underlying concept has weakened. Jay Powell is leaning towards the view that it will sound more “flashing” than next week in May. It believes that the combined information arising from tariff and labor market data has forced the FRD to now cut policy interest rates. ”

Question 3: Trump

Powell must also survive the storm that may come in the form of President Trump who made it He reveals he wants to cut fees to the Fed.

Trump has retreated from a market-worried threat that the Fed may be under threat, but he has not kept a secret in the fact that he wants “too lattice powell” to cut the base rate.

Meanwhile, Powell argues that politics has no effect on the Fed’s decision-making at all.

Richard Clarida, former vice-chairman of the Federal Reserve between 2018 and 2022, said the White House would effectively stop changing central bank independence despite the threat from Trump that could threaten Powell over a lack of action.

“We might go to a world where the Fed loses some power in a regulatory sense,” Clarida said. Market Watch In an interview released yesterday. “However, the Fed seems to maintain its independence, whether it raises interest rates or lower.”

As a chairman following Powell, Clarida added that Trump’s nomination was not the only factor. “I think the market can have a say,” he explained, explaining that if the candidate for the Fed’s chairman was not truly independent or committed to lowering inflation, stocks and bonds would be a volatile vehicle.