(Bloomberg) – Federal Reserve Chairman Jerome Powell and his colleagues will step into the central bank’s boardroom on Tuesday to deliberate on immeasurable political pressures, evolving trade policies and interest rates at the time of economic transit shipments.

Most of them read from Bloomberg

In rare outbreaks, policymakers convened the same week when the government issues reports on GDP, employment and the Fed’s preferred price indicators. Federal Reserve officials meet on Tuesday and Wednesday, and are widely expected to not change prices again.

Forecasters expect a large amount of data to show economic activity rebounded in the second quarter. This was mainly due to a sharp narrowing of the trade deficit, with employment growth being eased in July. The third marquee report may show underlying inflation that was picked up slightly in June from a month ago.

The government’s advance estimate of GDP for the fourth quarter is projected to show an annual increase of 2.4% after the economy contracted by 0.5% from January to March, but Wednesday’s report will likely reveal only modest household demand and business investments.

The median forecast in the Bloomberg study calls for a 1.5% increase in consumer spending, marking the weakest consecutive quarter since the onset of the pandemic in early 2020.

At the end of the week, the July employment report is projected to show that businesses are becoming more intentional in their employment. Employment may have been eased after the increase in June and boosted by a jump in education pay, but the unemployment rate has reached up to 4.2%.

Private pay is projected to increase by 100,000 after a minimum advancement in eight months. Throughout the first half of the year, the pace of employment by companies has been eased compared to the 2024 average. Employment growth is also relatively small. Separate figures on Tuesday are projected to indicate a decline in job openings in June.

Several Fed officials have begun raising concerns about what they see as a vulnerable job market, including two people who said they are seeing benefits while considering current fee cuts. Pressure is also installed from outside the boardroom. President Donald Trump is Powell & Co for Consumers and Businesses. He has spoken out about his desire to see low borrowing costs.

What Bloomberg Economics says:

“We believe that a consumer-driven slowdown poses risks to the outlook. Retail sales in June beat expectations, but that could reflect a tax-driven price rise for certain product categories. Ultimately, the labour market is expected to continue to weaken this year — defining the path of consumption.”

– Anna Wong, Stuart Paul, Eliza Winger, Estelle Ow and Chris G. Collins, Economist. For a complete analysis click here

The president frequently denounces Powell for moving too slowly, and is also aiming for an overrun in construction costs associated with renovations to the Fed Eccles Building headquarters in Washington.

Powell and other central bankers have stressed the need for patience as Trump administration tariffs put a re-acceleration of inflation at stake. So far, price pressure has been modest since various US obligations on imports were imposed.

The government’s personal income and expenditure report scheduled for Friday in June is projected to show that the Fed’s favorable core inflation gauge has accelerated slightly from a month ago, indicating that tariffs are gradually being passed on to consumers.

Further north, the Bank of Canada will stabilize its borrowing costs of 2.75% for its third consecutive meeting, amid trade uncertainty, sticky core inflation, and an economy that many economists believe to be better than expected. Authorities will release a monetary policy report, but it remains to be seen whether to return to point forecasts or release multiple scenarios, as they did in April amid a volatile US trade policy.

Industry-based GDP data for May and flash estimates for June are expected to show contraction in the second quarter. Prime Minister Mark Carney is pushing to carry out a trade deal with Trump by August 1, but he and his state leaders have downplayed expectations, saying they are focusing on getting a better deal than anything else.

At the global level, Trump’s Friday deadline will also be central, with several economies still hoping to enter into trade agreements, including the European Union, South Korea and Switzerland.

European Commission chief Ursula von der Leyen meets with the US President of Scotland on Sunday afternoon to secure the agreement. EU officials have repeatedly warned that the deal is ultimately on Trump, making it difficult to predict the final outcome.

Meanwhile, US Treasury Secretary Scott Bescent and Chinese Deputy Prime Minister were scheduled to begin trade talks in Stockholm on Monday. The South China Morning Post reports that both countries are expected to extend the tariff ceasefire by another three months, citing an unknown source.

Elsewhere, central bankers in Japan and Brazil may not change fees, while expected cuts in South Africa, Chile, Ghana, Pakistan and Colombia. Investors will also monitor the forecasts for the new International Monetary Fund in Europe, reading the index of global purchasing managers, and barrages of GDP and inflation data.

Click here to find out what happened last week. Below is our rap of what is happening in the global economy.

Asia

The highlight of the Asian central bank was on Thursday, with the Bank of Japan expected to stabilize its benchmark rate at 0.5%. The US West Sea Governor’s response to the US trade agreement will be the focus after his agent stated that the agreement has boosted the possibility that economic forecasts will be met.

The massive amount of data reflects the impact of Trump’s tariff campaign. Trade figures come from the Philippines, Hong Kong, Sri Lanka, Thailand, South Korea and Indonesia, and manufacturing PMI figures is paid across the region.

China won two sets of July PMI data over the weekend, with official gauges higher than three months, and its S&P Global indexes can stay in the expansion zone. Industrial revenues, published on Sunday, revealed a second consecutive month of decline. Officials aim to increase their willingness to lower prices and curb excess competition that exacerbates pain from US tariffs.

Others that release PMI statistics include Indonesia, Korea, Malaysia, the Philippines, Thailand, Taiwan, and Vietnam.

Meanwhile, Australia will get second quarter data, which is expected to show that consumer inflation has cooled down a bit.

Pakistan’s central bank could cut interest rates on Wednesday, two days before the country (and Indonesia) took new inflation measurements.

Europe, Middle East, Africa

Output and inflation data across Europe stand at the central stage. Economists in the Bloomberg polls hope Wednesday’s figures will show that Euro area GDP remains flat for the three months to June, following a 0.6% expansion in the first quarter. That performance was lifted by Trade Front Road before Trump’s expected announcement of global import operations.

Of the Bloc’s biggest economy, Germany is expected to see its worst performance, with output down 0.1% from the last quarter. Spain is expected to continue to grow by 0.6%, while France and Italy are expanding slightly. The small economy will release numbers throughout the week, with Ireland (the wild card for the bloc’s economy) kicking things on Monday.

Meanwhile, inflation data for the Euro region on Friday has been set to confirm confidence that the European Central Bank is under control. Consumer prices are forecast to rise 1.9% in July, below 2% for the previous month, slightly below the central bank’s target. The underlying inflation measure remained stable at 2.3%.

As most of Europe is in vacation mode, only one ECB speaker has a scheduled look – Joselis Escriba, Spain on Monday – is the result of a monthly survey of central bank consumer inflation expectations, and its wage tracker will take place on Wednesday.

The Bank of England has moved into a quiet period ahead of its rate decision on August 7th, with economic releases on the UK agenda, primarily housing-related.

Rate decisions are scheduled across Africa:

-

A sharp slowdown in inflation could reduce Ghanaian officials’ basis costs by 250 points to 25.5% on Wednesday. Its actual rate is at least the highest since 2005, providing room for central banks to achieve the biggest cuts for over 20 years.

-

South Africa is expected to extend its longest mitigation cycle since 2019 as inflation is expected to remain benign. Economists surveyed by Bloomberg expect the central bank to cut 25 basis points to 7% on Thursday.

-

On the same day, Malawi policymakers are trying not to change the key rate at 26% due to restrictions on foreign exchange and persistent price pressures.

-

The technological recession in Mozambique will likely persuade policymakers to choose to mitigate further to stimulate the economy on Thursday. It has been reduced by 625 basis points since January 2024.

-

Eswatini, whose currency is locked in the Rand, will likely cut its benchmark to 6.5% on Friday’s quarterpoint.

latin america

Chile’s central bank is likely to make a first-rate cut in 2025 on Tuesday, opting for a quarter cut to 4.75%.

Consumer prices have cooled more than expected last month, with inflation once again slowing down along central bank forecasts, with headlines re-reading to a 3% target in 2026.

Mexican Flash second quarter data posted Wednesday should show that Latin America’s second economy will post a small quarter and year-over-year expansion amid resistance from Trump’s trade and tariff policies.

Most analysts see the second half of the year bringing greater challenges.

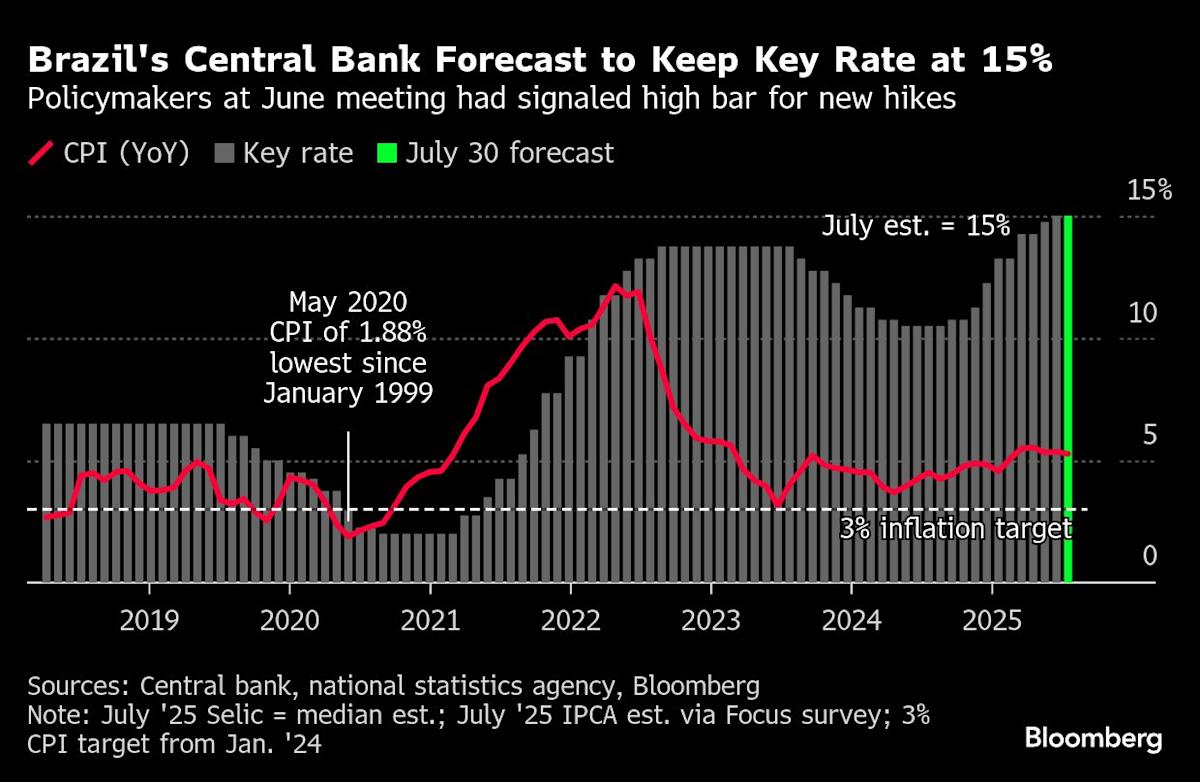

In the second central bank rate decision of the week, Banco Central Do Brasil is widely expected to draw a line under a 7-meat 450 basis tightening campaign and keep the key serric rate at 15%.

Although recent inflation prints and short-term expectations have begun to decline, policymakers last month have shown that borrowing costs are likely to remain stable for a long period of time.

In Columbia, headline inflation rates are running above Banrep’s acceptable range, and core readings remain stubbornly rising, but policymakers probably saw enough cooling in June’s consumer price data, justifying the quarterpoint cut to 9%.

Peru on Friday will launch a consumer pricing report for the region’s major inflation targeting economy. The early consensus for economists is that annual reading in July approaches printing at 1.69% in June.

– Supported by Alexander Weber, Andrew Atkinson, Brian Fowler, Eric Hertzberg, Mark Evans, Monique Vanneck, Piotl Skolimowski and Robert Jameson.

(Updated in the US trade ceasefire in the 16th paragraph)

Most of them read from Bloomberg BusinessWeek

©2025 Bloomberg LP