According to Jim Cramer, Texas Instruments Incorporated (TXN) stock has declined due to management tone.

Recently released Jim Kramer of 10 shares spoke as everyone said they won Trump’s Japanese trade.. Texas Instruments Incorporated (NASDAQ: TXN) is one of the stocks Jim Kramer has recently discussed.

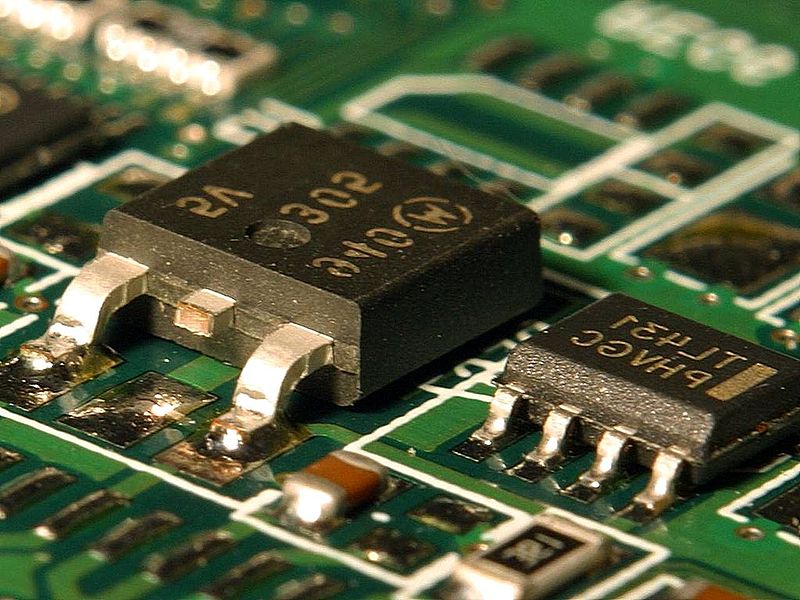

Texas Instruments Incorporated (NASDAQ: TXN) is a semiconductor company that manufactures and sells chips that include power management, microcontrollers and radar products. The company’s shares rose 13% after its latest revenue report in which Texas Instruments (NASDAQ: TXN)’s current quarterly midpoint EPS of $1.48 did not reach analyst estimate of $1.50. Cramer explained why the stock fell.

“This is where you say to people who have to listen to a conference call. The last quarter of Texas Instruments. They got a bit bullish. Outfit. And they basically said, listen, we’re not doing any better than we thought we were doing. I think the stock is way too low. This was about tone. It had a huge move, it had a huge. move. And that whole move was based on the fact the previous quarter, they seemed to be very optimistic. And now they’re back to the usual pessimistic ways. It’s all tone, it is. It’s all tone. And it bothers me because, I think there’s people at home who’re gonna, but it means you’re selling.

While we acknowledge the potential as an investment in TXN, our conviction lies in the belief that some AI stocks offer higher returns and hold the greater promise of limited downside risk. If you’re looking for a very inexpensive AI stock that is also a major beneficiary of Trump’s tariffs and supervision, check out our free report. Best Short-Term AI Stocks.

Read next: 30 stocks that double in three years and 11 Hidden AI Strains Buy Now.

Disclosure: None. This article was originally published Insider Monkey.