New York Women Lawn Boyfriend $200k – He lost it all in the code and parted ways with her. But Dave Ramsey has a plan for her

Imagine saving and eagerly saving your life just to see your partner blow your money off $200,000 with a crypto scheme. That’s exactly what happened to a New York caller Ramsey Shownow single and left for just $95,000 in her name.

Lisa’s question: What is it now?

At 55, she currently works as a server in a high-end restaurant, trying to find a way to rebuild her financial future. Her biggest fear? That it’s not enough for her to retire.

Lisa tells Dave that she gave her (now ex) boyfriend money because she believed they were there for a long time. They were together for seven years and were not married, but she thought the relationship would last.

Instead, he ended the relationship after losing most of her life savings. He currently makes small monthly payments, but she said it mainly covers interest and is not sure if she will get the principal back.

“If I’m going to get the money back, I’ll leave it in God’s hands,” Lisa said.

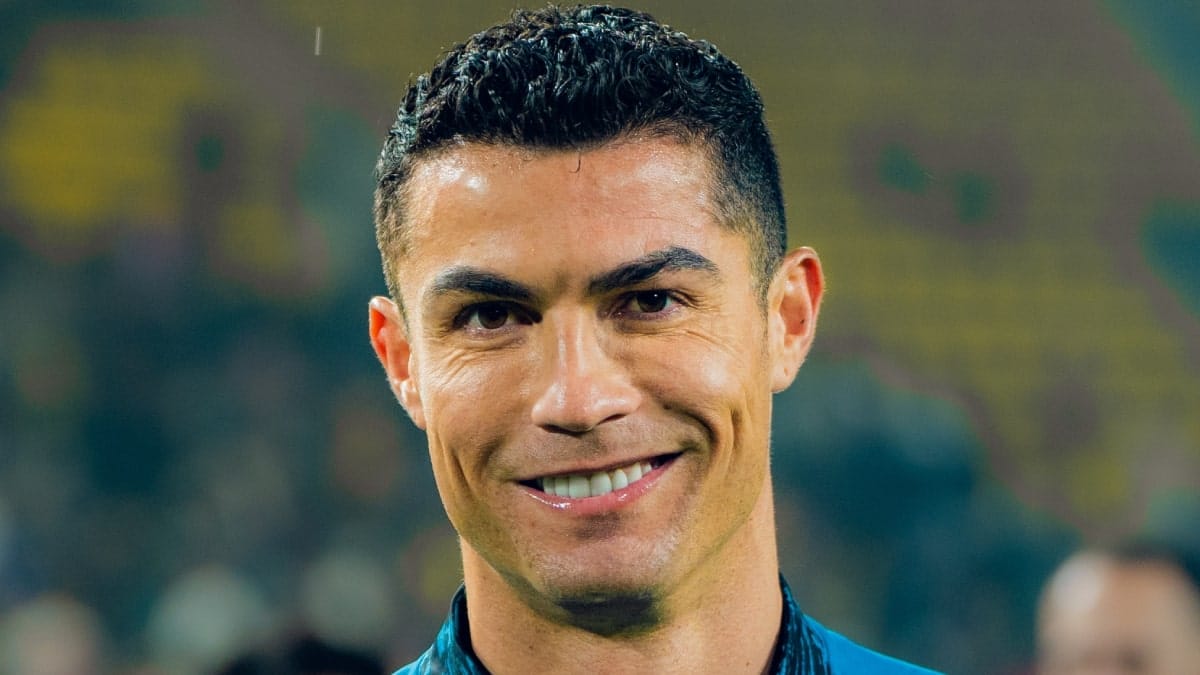

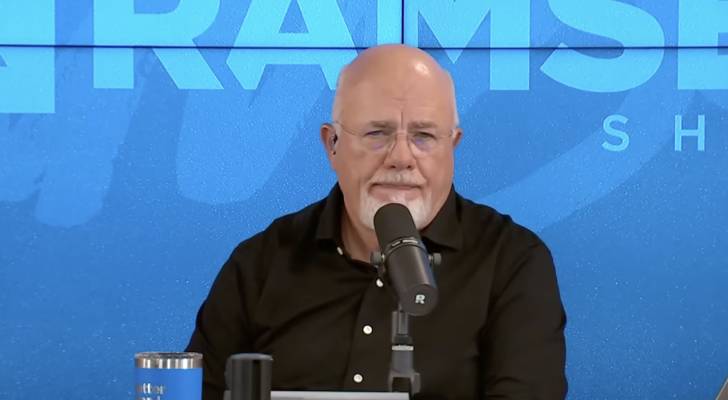

meanwhile Dave Ramsey He admitted how painful the situation was, and soon found a silver lining.

“Let’s pretend that didn’t happen,” he said. “If you call and say, ‘I’m 55 and I have $95,000,’ they say, ‘Yes, it’s fine.’ ”

Still, there are conditions to be OK. Ramsey has made it clear that Lisa’s savings alone won’t carry her through retirement. She needs to continue her job, avoid debt and invest wisely. Key is not only planning on $95,000, but what she will do with it.

Ramsey outlined a step-by-step investment strategy.

-

Put the Emergency Fund aside: Maintain a 3-6 month cost High income savings account. For her, that’s about $15,000.

-

Invest the rest: Move the remaining $80,000 to the Good Growth Stock Mutual Fund.

-

Use a Roth IRA: Help us take advantage of tax-free growth each year.

-

Consider her workplace 401(k): Although there are no employer matches, Ramsey suggested that a portion of her income be donated to her 401(k) due to her low annual contribution limit.

-

Invest 15% of her income: She earns around $60,000 a year, and she should aim to invest around $9,000 a year in her retirement account.