Warren Buffett still issued Wall Street’s most difficult warning. I couldn’t clarify

Quarterly, investors are worriedly waiting for release Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) 13F filing. The Securities and Exchange Commission (SEC) requires that most large funds disclose the shares they owned at the end of each quarter. This allows the public to see which stock funds are being bought and sold.

Many investors are focusing on Berkshire Hathaway’s 13th Floor Filing, as no one runs in the conglomerate Warren Buffettperhaps the greatest investor ever. The Buffett and Berkshire holdings not only give us a glimpse into the companies they like, but also give us a glimpse into how some of their biggest investment spirits think.

On Berkshire’s latest 13th floor, Buffett issued a tumultuous warning to Wall Street about the stock market. It couldn’t be clarified.

There is no shortage of investors who believe the market is overvalued. After all, we were in the bloom market for over two years and wider benchmarks S&P 500 We recorded consecutive annual revenues of over 20%. Buffett appears to be one of these investors. In 2024, Buffett and Berkshire stocked up on cash, with more than $320 billion in cash and a short-term Treasury bill at the end of the third quarter.

Berkshire too More stocks sold Contains some larger chunks of such biggest positions than purchased in 2024 apple and Bank of America. If you’re an investor studying Buffett and Berkshire, you know they have the knack for a weathering recession and a serious market slump. This great timing comes from the reasons why Berkshire stocks have been crushing the stock market for decades.

On the recent 13th floor of Berkshire, the Omaha oracle issued a turbulent warning to Wall Street. Berkshire has left two exchange trading funds (ETFs) that track the broader market. SPDR S&P 500 ETF (New sampling: spy) and Vanguard S&P 500 ETF (nysemkt: flight).

Now when someone is selling stocks, that doesn’t necessarily mean that the company is in a bad place. Perhaps insiders needed cash to make large purchases. However, in this scenario, Berkshire knows that, given its large stockpile, it doesn’t require cash. It’s not more clear that Buffett and Berkshire’s teams believe the market is overvalued. Berkshire purchased both of these ETFs at the end of 2019, this is the first time they have changed positions in over five years.

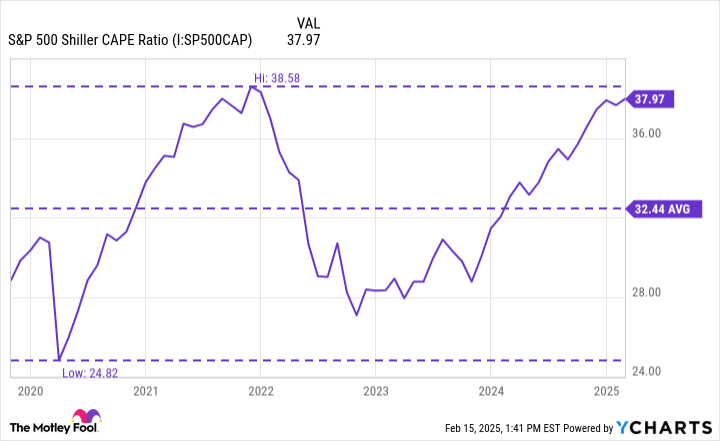

This is not so surprising given that some indicators suggest that the market is overvalued or that the economy could soon plunge into a recession. Some examples include inverse yield curves and Syrah Cape ratios. This smoothes out the irregularity by comparing the price of the S&P 500 with the 10-year average inflation-adjusted profit. As can be seen below, CAPE ratios are trading above the five-year average and above the highs seen before the market was sold violently in 2022 (as of February 16th). It’s there.