Airbnb’s cache cow can thrive despite its challenges

-

Airbnb faces the hardships of regulatory that management must try to overcome.

-

The company benefits from its important demographic tailbone.

-

Airbnb is a cash flow machine and is the perfect inventory to own.

Travel Industry It’s an advantageous yet difficult area for doing business. This is especially true when it comes to short-term rentals. Navigating local regulations and international expansion while satisfying thousands of hosts and even more guests is some of the difficult challenges that it faces Airbnb (NASDAQ: ABNB)one of the leaders of the space.

Its management is working to increase cooperation with the region and maintain its ability to operate freely while promoting what it considers common sense regulation. Still, in some major markets such as Hawaii, New York City and Paris, local and state governments are imposing strict restrictions on how short-term rentals are run. Many homeowners associations also have rules that are not friendly to owners who want to turn their property into short-term rentals. However, not all news is bad for Airbnb.

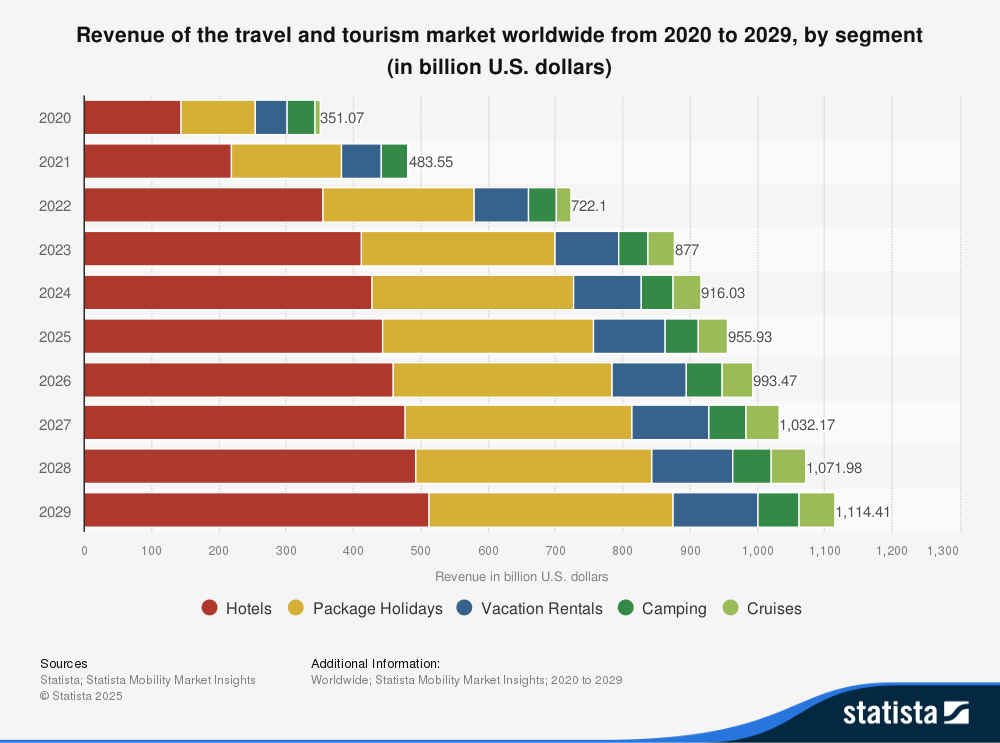

The market it operates is large and continues to grow. There is also a demographic tailwind, as younger generations tend to be more attracted to Airbns than their parents. Short-term rentals (labeled as vacation rentals on the chart below) account for a significant portion of the market, which is projected to exceed $1.1 trillion by 2029.

What does this mean for Airbnb? Cash, and lots.

Airbnb is just the core software platform. There is also a customer service element. However, companies in this industry lack the factories, expensive equipment and other major infrastructure that many other industries have. The purchase of real estate and equipment is often referred to as CAPEX ( Capital expenditure) and reduce the amount of cash the company can hold. Free cash flow is handled by software companies such as software companies. Cloud Strike (NASDAQ: CRWD) and Palantir (NASDAQ: PLTR)often trades at a higher rating than companies in other industries.

for example, Intel (NASDAQ: INTC)a semiconductor designer and manufacturer, spending $5.2 billion on CAPEX in its most recent quarter. This is 40% of revenue. Airbnb spent just $14 million last quarter on CAPEX, weighing less than 1% of its revenue. Meanwhile, its free cash flow — the amount remaining after operating expenses and capital expenditures — has skyrocketed.

The above $4.4 billion is 40% of revenue for the same period. A 40% free cash flow margin is an incredible figure and is the pinnacle for shareholders.