As activities drop to lowest levels in nine months, the existing housing market “Rengoku”

In June 2025, existing US home sales fell sharply, falling to their lowest levels in nine months as mortgage rates rose and record prices continued to hold back on many future buyers. According to National Association of Realtors (NAR), existing home sales have slipped 2.7% of seasonally adjusted annual 3.9 million transactions since May, surpassing analyst expectations for a more modest decline. Compared to last year, sales were generally flat and concentrated in several regions.

The housing market has traditionally been busiest in the spring, but this year’s important purchasing season has proven to be inactive. The one-month decline primarily reflects the challenges of affordability. The mortgage rate was covered by nearly 7% throughout April and May, when most closures in June were under contract.

“Since mortgage fees spiked in 2022, existing home sales have been in purgatory.” Lance LambertEditor-in-Chief resiclubI said Fortune Intelligence. “Part of that is because many markets are tense and affordable. It makes it difficult for sellers to find buyers at the purchase price. This is why active inventory is rising. And part of that is because many home sellers who want to sell and buy other things can’t afford to make the next payment or can’t give up on a lower mortgage rate.

Skyhigh prices

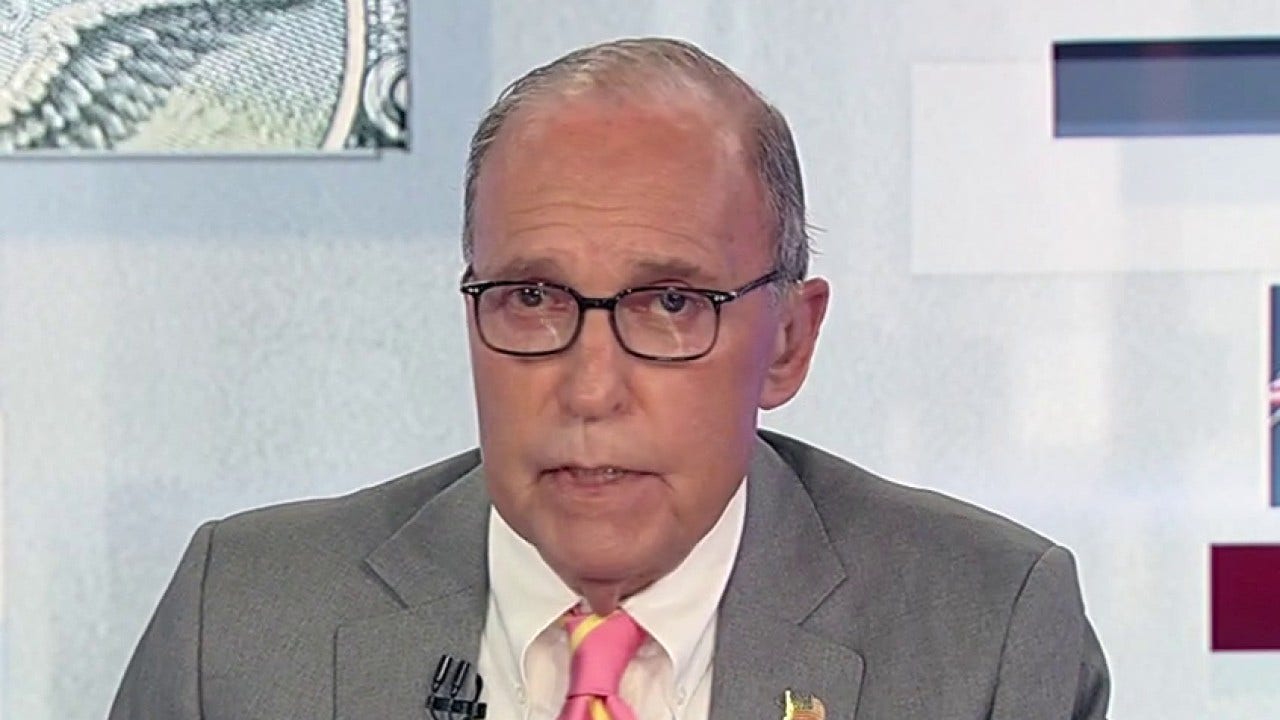

Nationally, home prices rose to an all-time high, supporting the market’s affordability pressure. Median price for existing homes reached $435,300 in June, up 2% from the same month last year, marking the 24th consecutive year price increase.. NAR Chief Economist Lawrence Yun sounded optimistic about this incredible climb.

Despite declining sales, inventory is gradually restructuring. At the end of June, 1.53 million homes were sold, up nearly 16% from a year ago.. This has resulted in stocks from markets being 4.7 months of supply, consistent with pre-pandemic norms since 4.0 months a year ago.

Regional dynamics were varied. Sales fell in the northeast, midwest and south, but higher in the west, with changes year-over-year reflecting these splits. Sales of single-family homes were 3%, but sales of condominiums and cooperatives were stable compared to May, but fell 5.3% compared to June 2024..

One positive for buyers: supply in the market and slightly longer time. Realtor.com reported That active stock in June rose for the 20th straight month, reaching nearly 29% year-on-year to climb 108 million homes, with the average home spent 53 days on the market.. However, these profits are offset by sustained sewage when compared to pre-pandemic markets, making price reductions more common, with nearly 21% of listings experiencing a downward adjustment..

“Multi-year supply drives record high home prices,” Yun said. Construction said it slows population growth and is holding back first-time buyers. “If the average mortgage rate drops to 6%, the scenario analysis suggests that 160,000 renters will become first-time homeowners, boosting activity from existing homeowners,” Yun added..

If mortgage rates drop later this year, Yun said he expects home sales to rise across the country due to strong income growth, healthy inventory and record numbers of jobs. “But for now, that’s a familiar story of peak prices and affordable prices. Major obstacles for US home buyers

For this story, luck Generated AI was used to assist with initial drafts. The editors checked the accuracy of the information prior to publication.