As Trump rekinds trade war, the focus of the oil market will turn to demand

(Bloomberg) – US President Donald Trump’s chaotic tariff strategy has been disrupting the oil market for months, but his new attack on trading partners this week solidifies consensus on at least one issue.

Most of them read from Bloomberg

Oil investors have missed most of the trade news for weeks as the Middle Eastern conflict ordered price measures, but Trump’s recent barrage of tariff letters includes some of the highest tax rates ever, reviving concerns that the world trade war would reduce crude oil consumption.

The outlook for a decline in demand is taking another blow to a market that has already suffered from widespread expectations of big eaters later this year. In addition to the trade war, the economic outlook of China’s top crude importers has fueled concerns that the market will struggle to absorb excess supply later this year.

“The focus is all about demand and tariffs,” said Joe Delaura, global energy strategist at Rabobank.

The rapidly weakened outlook has caused the most sharp decline in hedge fund sentiment since February. According to the Commodity Futures Trading Committee, the money manager cut bullish position to 29,994 lots in the week ended July 8th. The short-only bet has risen to five weeks’ height, the numbers show.

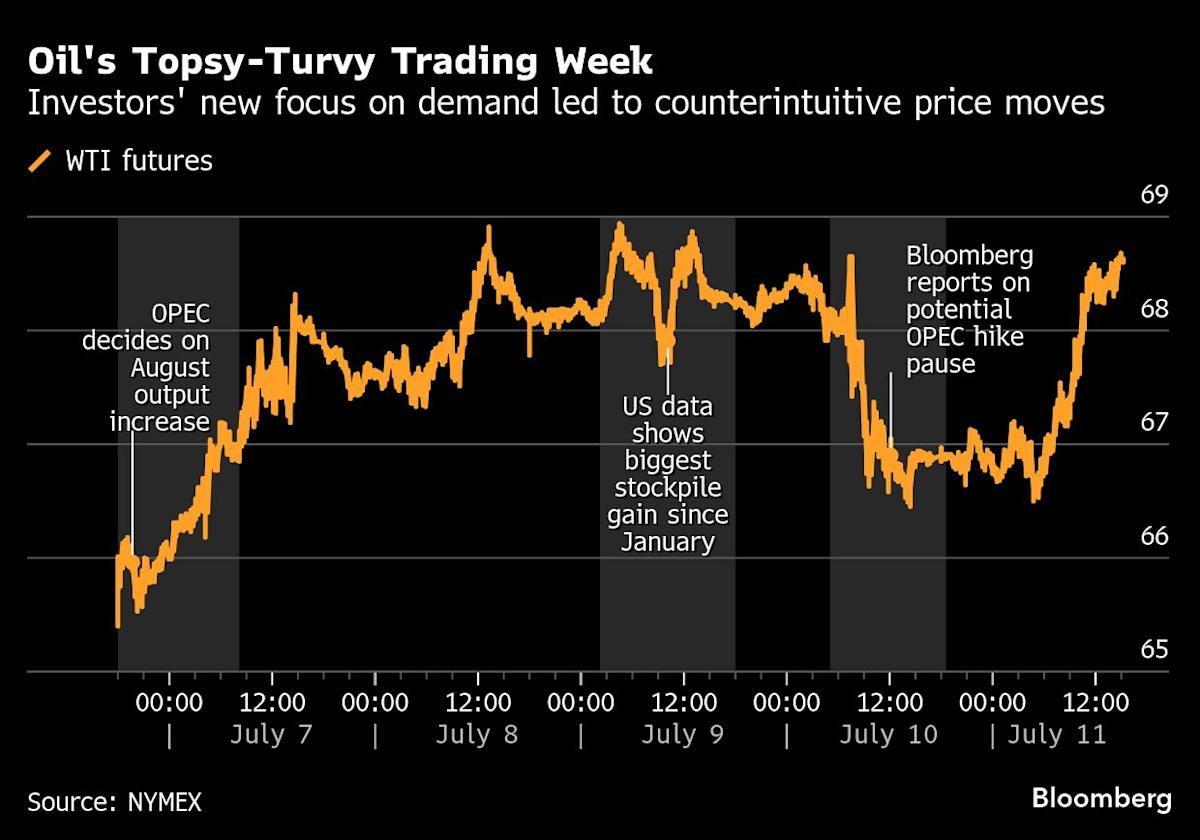

Price movements this week show the amount of demand concerns driving the market. Oil futures went up on Sunday after OPEC+ messed up its decision to regain more production than expected in August, and instead Saudi Arabia hiked prices for Asian customers.

Topsy-Turvy trade continued on Wednesday. This comment from UAE Energy Minister Suhail Al Mazrouei commented that it needed more barrels, despite data showing that crude oil stocks have risen the most since last January.

“If the crude doesn’t sell from the bigger than expected OPEC production winding and 7 million barrels of crude oil builds, what exactly is it supposed to sell?” said Jon Byrne, an analyst at Strategas Securities.

Crude had one selling last week, but once again ignored the physics of the typical oil market. Bloomberg reported that OPEC+ could halt power hikes, but instead of rising futures at supply limits, they fell 2.2% as investors interpreted the news as a sign of a limited belief that demand could keep up with power.