Athleta poachs female Nike executives to new CEOs

Just six years ago gap Inc was telling it to investors Athleta Yoga clothing brands are approaching It will be a brand that costs $2 billion a year It attracted a large number of fans who were attracted to high quality hip activewear, so it was cheaper than that. Lululemon Athletica.

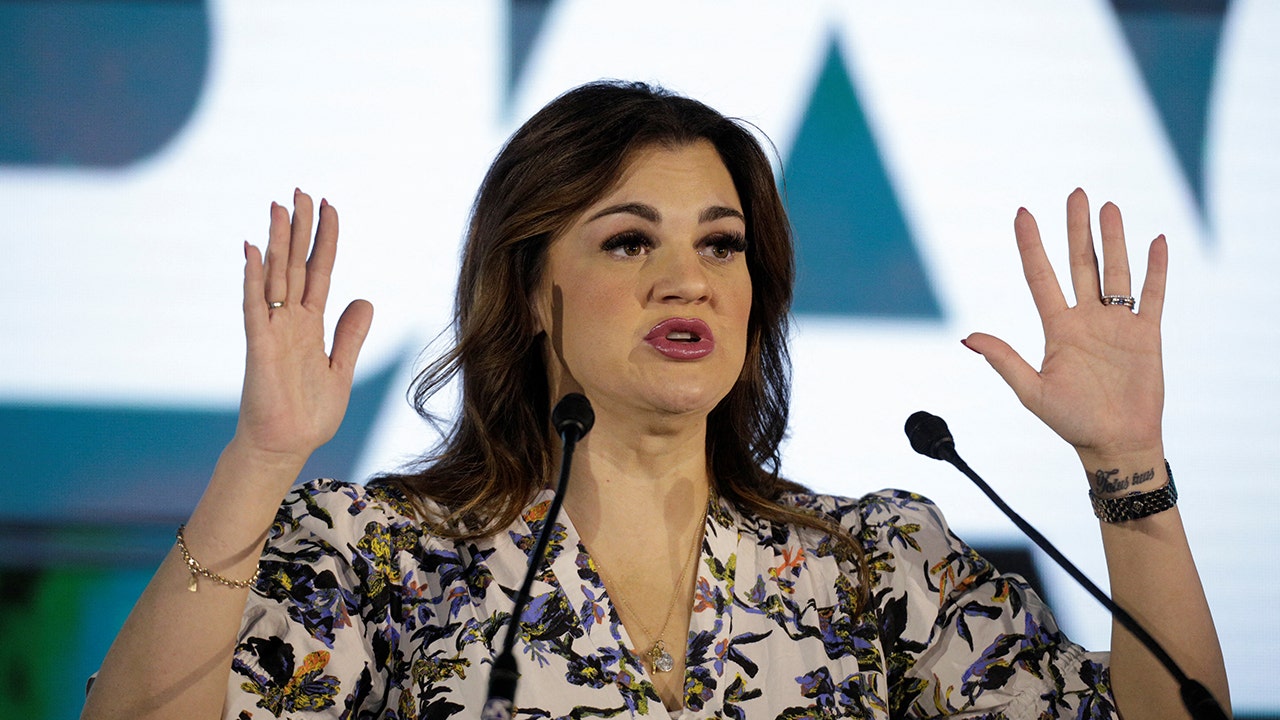

But it was the CEO of two. Gap Inc, which owns Old Navy and Banana Republic, said Tuesday it was replacing Athleta CEO Chris Blakeslee and tapping 20-year veteran Maggie Gauger. NikeTo try her hand in re-seminating a brand that was once considered a key motor for Gap Inc’s growth, despite being smaller than its sister brand. The once-high-flying brand has been shaking since its sales peaked at $1.45 billion four years ago. Last year, business revenues were $1.3353 billion, roughly equaling the previous year, and fell sharply in the first quarter of this year.

Gauger’s appointment returns to returning to the helm of a brand known for its “Her Power” slogan, a label for women and girls, and a brand known for empowering them in the world of sports. “Maggie blends proven business transformation capabilities, deep consumer centricity, product flow and a sincere commitment to empowering women and girls,” said Richard Dixon, CEO of Gap Inc, who led turnaround for two years in a statement.

Blakesley’s appointment was made before Dixon became CEO. It was announced exactly two years agothere was obvious excitement and the perception that landing him was a coup. After all, Blakeslee was from athleta rivals Alo Yoga and Bella+Canvas. Additionally, Aro has generated a lot of buzz and challenged the advantages of long-term category leaders like Lululemon.

However, Blakesley, who inherited a brand that deals with product flop spats and peak athlete wear trends, was unable to produce the same heat in Athleta. (He replaced his current CEO, Mary Beth Loughton. Raymonths after leaving in 2023, after what Bob Martin, former interim CEO of Gap Inc. called an ongoing “product acceptance challenge.”

After halting bleeding in 2024, the decline in athleta has resumed this year. The 8% drop in quarter equivalent sales reported in Athleta in May could have sealed Blakeslee’s fate. “We’re working to reset our brands and improve our time-consuming products and marketing,” Gap Inc said in a revenue report in May.

So it’s up to Gauger, who has been focusing on leading women’s businesses in North America, dealing with slow innovation, chasing fashion trends, alienating longtime loyalists in the process, and focusing on Athleman’s performance of innovation, focusing on consumers when Athleman sees differences in a very busy segment of North America.

At Nike, Gauger focused on growing Nike’s active and athlete products and creating customer loyalty. “I am encouraged to work at the intersection of sports, style and culture with brands that have strong objectives and still undeveloped potential,” Maggie Gauger said.

Since Dixon’s arrival, Gap’s brand of the same name and old navy have been helped by a faster rhythm of innovation and greater efforts to connect the brand to a wider culture. Therefore, it’s no surprise that Dixon wants someone he’s chosen to do the same for the athleta brand.