Australian insurance stocks slide after threat of collapse of opposition leaders

Rishav Chatterjee and Rajasik Mukherje

(Reuters) – Australian insurance companies fell sharply on Monday after opposition leader Peter Dutton threatened to dissolve them and accused them of exploiting clients.

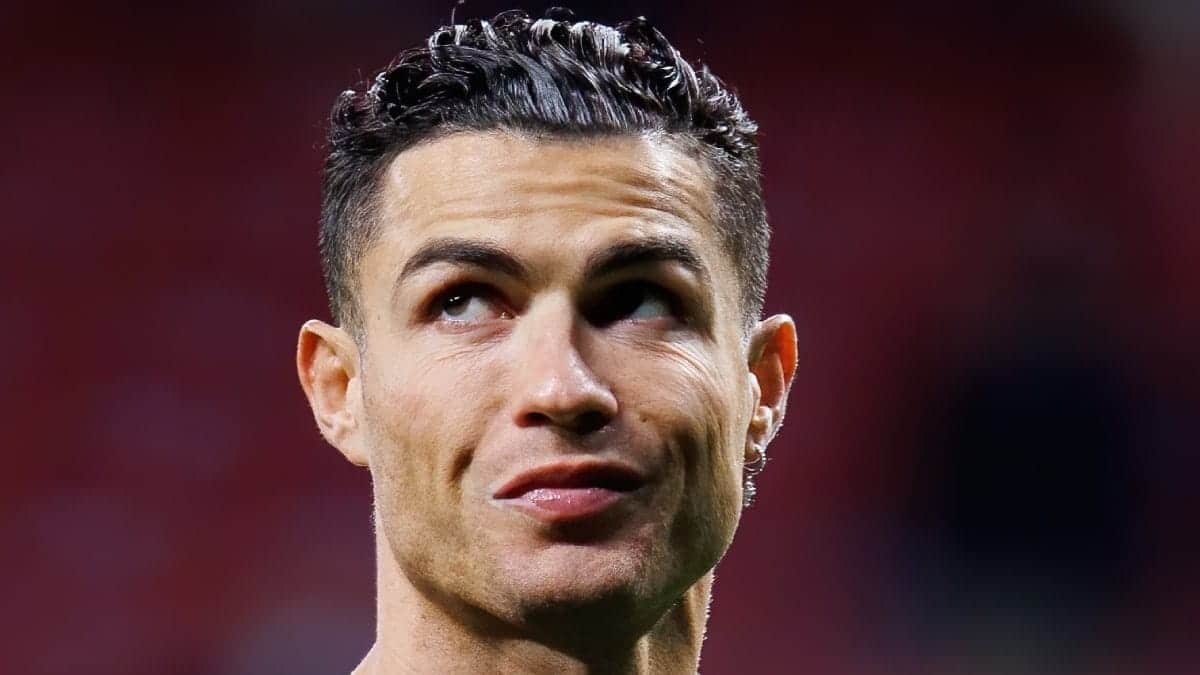

In an interview with Sky News, Liberal Party leader Dutton said his government will scrutinise insurance industry practices if he is elected federally.

“In the insurance market, we intervene and make sure that consumers go fairly, because at this point there are too many people insured, and as a result, people are not insured.” Dutton said on the broadcast. Sunday.

The Australian insurance market is dominated by key players SunCorp Group, Insurance Australia Group (IAG) and QBE Insurance. SunCorp stocks fell 21.3%, IAG fell 4.1%, and QBE fell 1%.

SunCorp stocks have slipped to their lowest since May 30, 2024 and are the lowest since June 2020, while IAG stocks are more than three months low.

The liberal coalition of Australia’s opposition parties is leading the incumbent vote, while federal elections grow within three months, according to new opinions.

Last week, IAG reported first half revenues, where topline growth and dividend estimates were lacking while SunCorp traded Ex-Didividend on Monday.

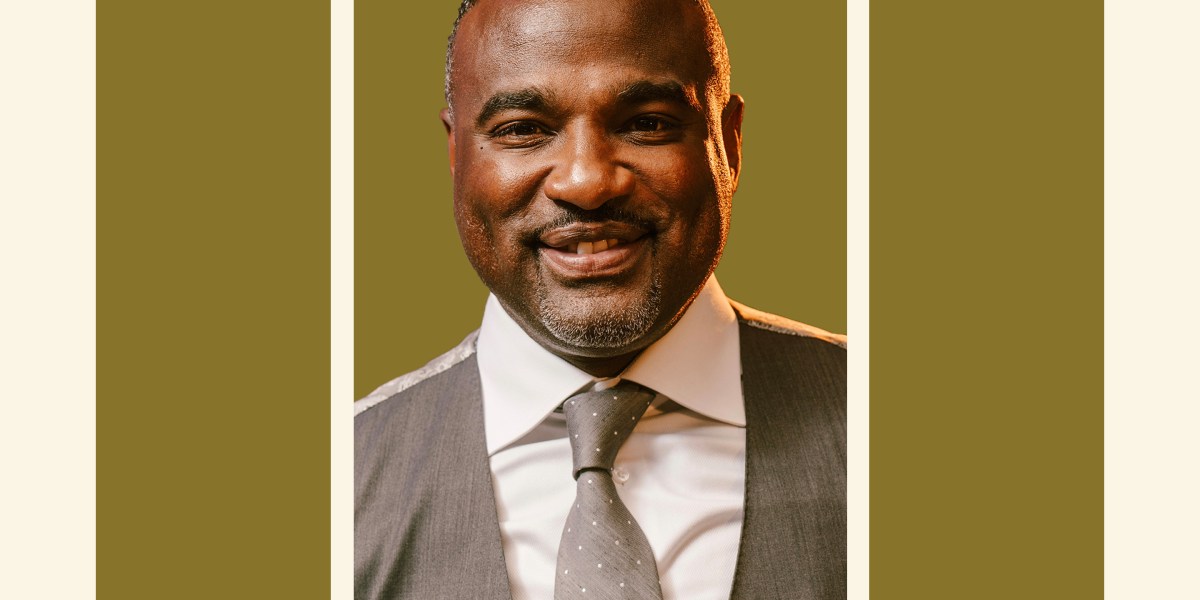

“Peter Dutton’s comments probably didn’t have any feelings about the insurance company either,” said Tim Waters, a market analyst at KCM Trade.

“At this stage, it remains a floating idea, but that insurance companies and their practices are attracting attention from opposition leaders and therefore could get back on track and fall into closer policy scrutiny. I’ve commented.”

Premiums have skyrocketed over the past year, with data from the Australian Bureau of Statistics revealing an increase of 16.4%, the biggest increase in around 30 years.

Increased mortgage repayments amid the cost of a living crisis has broadened household budgets.

“Insurance customers need to request better deals from the state government,” said Andrew Hall, CEO of Australia’s Insurance Council.

“State and territorial governments collect taxes on more insurance products than insurers make profits. Repealing state insurance taxes reduces premiums by 10-30% and provides immediate living expenses. Masu.”

(Reporting by Rishav Chatterjee and Rajasik Mukherjee of Bengaluru, edited by Jacqueline Wong)