Australia’s global lithium claims China’s management attempts and calls for government support

By Melanie Burton

Melbourne (Reuters) – Australia’s global lithium resources are pushing the government to curb what they call Chinese investors’ attempts to acquire cornerstone assets ahead of this week’s shareholders meeting.

The company considered last week that the national acquisition panel was rejected and cited global lithium as an illegal link among Chinese-related shareholders seeking to manage the mannalithium project in Western Australia. , relying on government intervention.

The company’s campaign raises a test of governments pushing critical mineral projects to drive economic growth and increase security links with its major global ally, the US, but its top resources customers I don’t want to anger China.

Global Lithium Management hopes that Australian treasurers, who receive advice from the Foreign Investment Review Board, will force shareholders to drive changes to the board to sell their shares. Treasurer can block votes at shareholder meetings on Thursday, the Western Australian Supreme Court said in its November ruling.

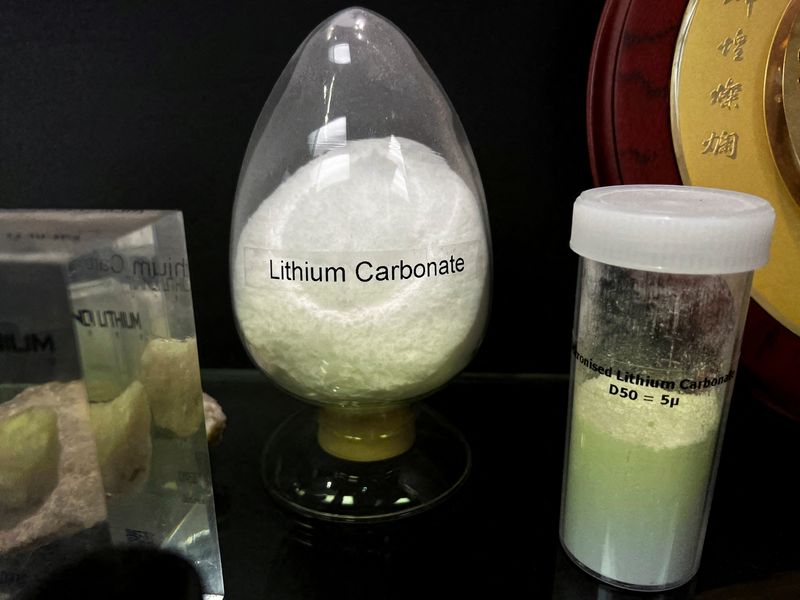

The company frozen development of the Manal Lithium Project late last year amid a long-term economic stolen in the battery raw materials market.

Director Dianmin Chen works with a group of foreign link investors who own 30% to 40% of the stock to manage the board and their key assets, and is a global lithium filed in a regulatory filing. management.

A potential illegality claim

Global Lithium Management, led by Executive Secretary Ron Mitchell, advises shareholders to reappoint Chen, appoint other Chinese-born directors, and reject the proposal to post the board on three directors. Masu.

Chen did not respond to requests for comment.

Mitchell argues that private associations between shareholders may violate Australian acquisition laws and foreign acquisition laws. He filed charges in a filing with the Australian Stock Exchange, the Western Australian Supreme Court, and in a report to the Australian Treasury Department last year.

“Concerns include the possibility of effective control transfer of Global Lithium’s 100% owned manal lithium project…without a control transaction being made or premium paid” “Extremely Seriously.”

Global Lithium and Mitchell said they cannot comment beyond official statements on the board’s fight as the issue lies ahead of regulators.

The Treasury said it could not comment on foreign investment litigation due to protected information provisions under the Foreign Acquisitions and Acquisitions Act of 1975.