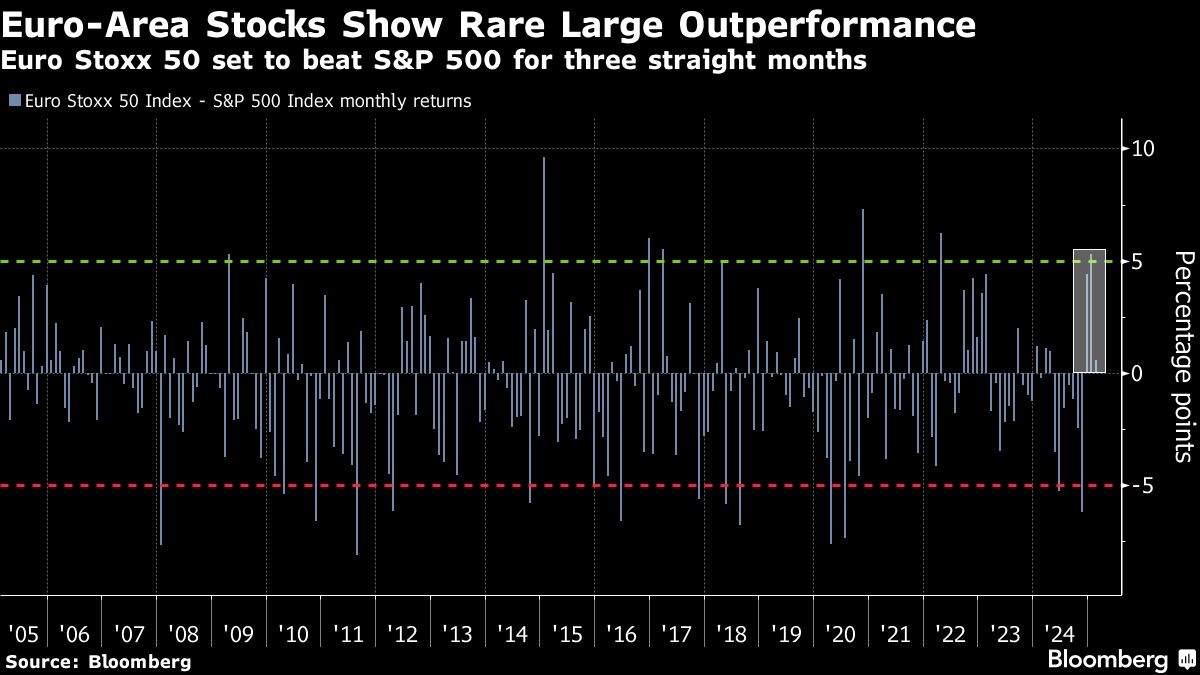

BOFA strategist Hartnett sees a decline in the global advantage of the US stock market

(Bloomberg) – Bank of America Corp. strategists hope that outperformance in the US stock market will continue to decline after the relentless run halted in early 2025.

Most of them read from Bloomberg

Strategists, including Michael Hartnett, have all brought higher returns than Wall Street’s S&P 500 years. That’s because the so-called seven grand tech companies can’t provide the driving force they’ve made for a long time.

Read: S&P 500 Rally is Threatened when Magnificent Seven Slows Growth

BOFA strategists also point to the declined narratives around the US economy that structurally support their rivals, and investors betting on geopolitical stability in the Middle East and Ukraine.

They recommend that they be a long Chinese stock, as they do not expect to escalate trade and technological wars with the US.

Hartnett’s team says that across Wall Street, most regional stocks are “at the pinnacle of our exceptionalism.” However, they warn that investors may earn profits against European stocks after German elections within weeks, if peace between Russia and Ukraine begins this month or the coming days.

On bonds, Bofa expects Treasury yields to fall below 4% as President Donald Trump is working on government spending and trying to stop the debt spiral.

Citing EPFR Global Data, Money Market Funds added that in a week, $16.6 billion won share capital and left behind stock funds.

Most of them read from Bloomberg BusinessWeek

©2025 Bloomberg LP