CEO of a major bank to meet lawmakers on debanking solutions

Sen. Kevin Kramer (RN.D.) joins the “final line” to discuss the Trump administration’s “fresh” approach to leaving the foreign politics and out of the line.

CEOs of some of America’s biggest banks are scheduled to meet at a roundtable Thursday at Capitol Hill Deployment issues In the wake of last week’s hearing on the subject.

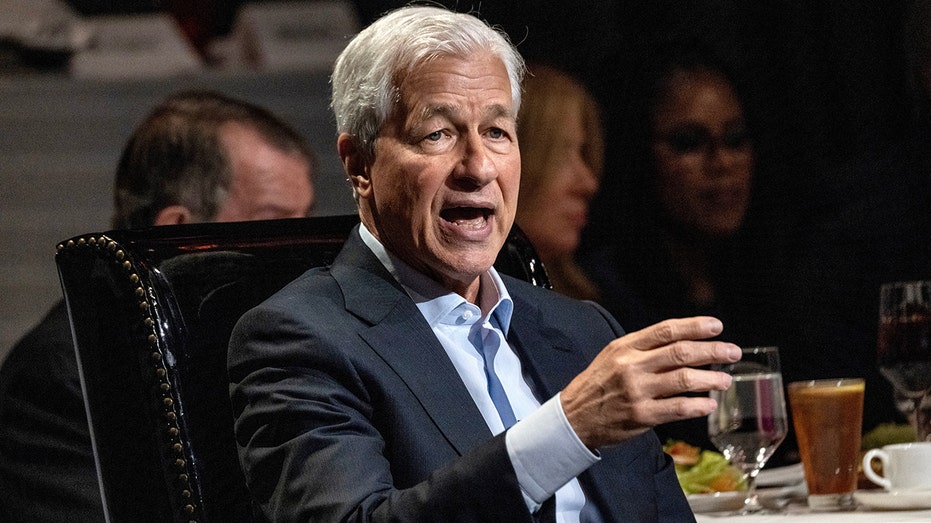

JPMorgan Chase CEO Jamie DimonBank of America CEO Brian Moynihan, Capital 1 Richard Fairbank, Wells Fargo CEO Charles Scharf, US Bank CEO Andrew Secole, PNC CEO Bill Demchuk, trawler player. Bill Rogers is expected to be at the roundtable.

The meeting follows a parliamentary hearing last week on debAnking. This often refers to the process in which banks close customer accounts in response to regulatory compliance concerns.

Companies and individuals involved in the cryptocurrency and digital asset industry are facing a runoff, just like the cannabis business in states where marijuana is legal. Regulatory guidelines relating to reputational risk have also led to missed cases involving the firearms industry and other conservative integrated entities.

Senate bank panel hears testimony of “very destructive” of de-covery

The senator will meet with the CEOs of major banks to discuss solutions to the issue of de-emergence. (Joe Raedle / Getty Images / Getty Images)

president Donald Trump Last month, he highlighted the politically motivated issue of decanking in his remarks to the World Economic Forum. There, while Moynihan relaxed his Q&A session with the President, he publicly denounced Bank of America for decutting conservatives.

Moynihan spoke to Fox Business on the way to Thursday’s meeting and was asked about Trump’s allegations. He replied, “We’ll take everyone away, thank you.”

Bank of AmericaJPMorgan Chase and other banks refused to block bank access to clients over political concerns.

Trump stands up against Bank of America CEO for not taking “conservative business”

Bank of America CEO Brian Moynihan has denied allegations that banks discriminate based on political views. (Cyril Marcilhacy/Bloomberg via Getty Images)

Dimon asked for more clarity about getting out by appearing on the bank’s Unshakeables podcast last month.

“I think we should be allowed to tell you… When we report things, the federal government should probably know about it, what we have to do and what we have to do and what I have to do There should be a much cleaner line about what they have to do,” Dimon said. “We’ve been complaining about this for years. We need to fix it.”

CEOs of major banks say Trump’s fiscal policy will be “the number one investment” for us

Jamie Dimon, CEO of JPMorgan Chase, is calling for reforms to bank rules to make decisions clearer. (Photographer: Victor J. Blue/Bloomberg via Getty Images)

Senators from both sides of the aisle acknowledged the need for solutions to resolve the issue at a Senate Banking Committee hearing last week, Chairman Tim Scott, Rs.C. Elizabeth Warrend-mass. , they say they want to work on a bipartisan revision.

slow. Kevin CramerRN.D. previewed today’s meeting on Fox Business Network’s “The Bottun Line,” saying it “a yearning to hear from everyone.” Cramer noted that he has addressed issues related to stripping out and introduced a law called Fair Access to banks that consider having a community of 41 people in the Senate.

“I don’t want to ask them to do something specific, but they intermittently discriminate across the entire industry, whether it’s the oil and gas industry, the private industry, the munitions and firearms industry or the code. I would like to ban the industry, or any number of industries, Cramer said, that is legal and protected by the constitution.

Click here to get your Fox business on the go

The big bank roundtable was first reported by Politico and confirmed by Fox Business.

Chase Williams from Fox Business contributed to this report