ClearBridge Dividend Strategy TE ConnectivityPLC (TEL) has been added to DIP

ClearBridge Investmentsthe investment management company has released its first quarter of 2025 investor letter “Clearbridge Dividend Strategy.” A copy of a letter can do so I downloaded it from here. Clearbridge’s dividend strategy was resilient and achieved positive returns despite a 4.3% drop in the benchmark S&P 500 index. Despite growing economic and market attention, the company believes its portfolio is well positioned given its focus on its assessment and ability to make the storm worse financially and generate stable, strong dividend growth. Plus, check out our top 5 holdings funds to find out the best picks of 2025.

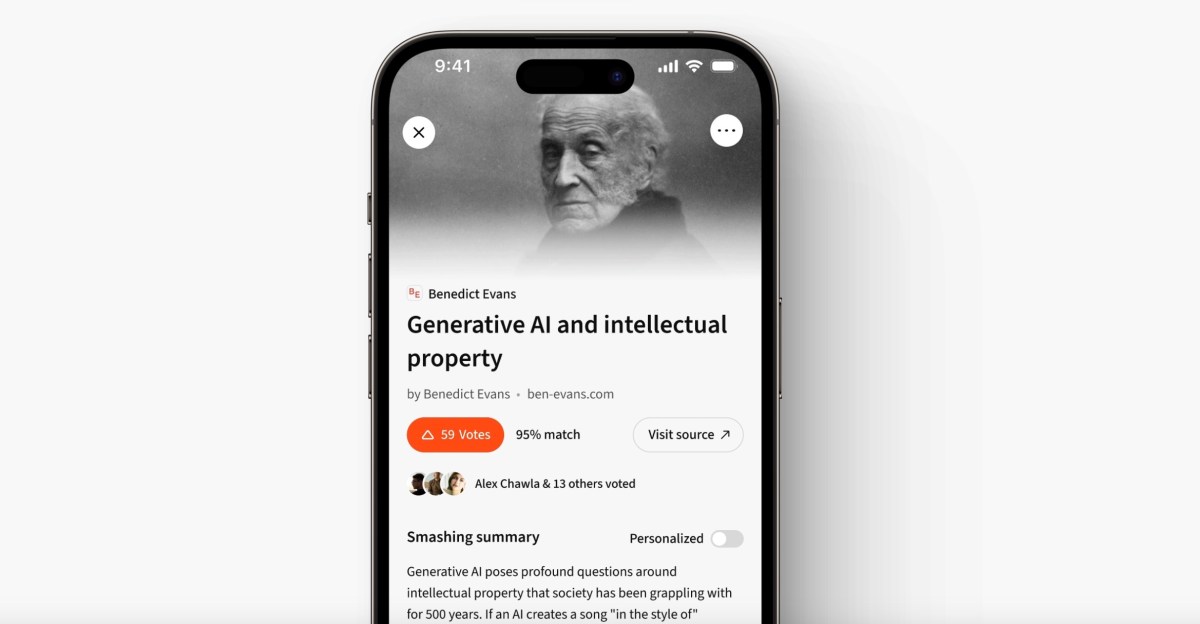

In its first quarter 2025 investor letter, Clearbridge’s dividend strategy highlighted stocks such as TE Connectivity Ltd. (NYSE:phone). Te Connectivity Ltd. (NYSE: TEL) manufactures and sells connection and sensor solutions. TE Connectivity PLC (NYSE: TEL)’s one-month return was -14.57%, and its shares have lost 16.48% of its value in the past 52 weeks. On April 7, 2025, TE Connectivity PLC (NYSE: TEL) stock closed at $123.50 per share, with a market capitalization of $36.8447 billion.

Clearbridge’s dividend strategy stated the following in its first quarter 2025 investor letter regarding TE Connectivity PLC (NYSE: TEL).

“In the meantime, we have started positions for CVS, Inditex and Inditex. TE Connectivity PLC (NYSE: Tel). Bad execution at CVS’ health insurance business, Aetna, and lower retail profits, have led to a decline in stocks that have generated attractive entry points. It is expected that Medicare Advantage Program’s underwriting improvements will result in significant profit growth over the coming years, leading to a revaluation of the stock. TE Connectivity creates connectors for a wide range of applications, including automobiles, data centers, and medical devices. The main end of automobile and industry markets is under periodic pressure that weighed inventory and provided an attractive entry point for this powerful business. ”

Engineers who assemble sensors on automated assembly lines.

TE ConnectivityPLC (NYSE: TEL) is not listed 30 Most Popular Stocks of Hedge Funds. According to the database, the 50 hedge fund portfolio held the TE Connectivity PLC (NYSE: TEL) at the end of the fourth quarter. This was 44 last quarter. Increased currency exchange headwinds in the first quarter of 2025 had a negative impact on TE Connectivity PLC (NYSE: TEL). sale $3.84 billion. While we acknowledge the potential of TE Connectivity PLC (NYSE: TEL) as an investment, our belief lies in the belief that AI stocks offer higher returns and hold a greater commitment to doing it within a shorter time frame. If you’re looking for AI stocks that are as promising as Nvidia, but traded at less than five times the revenues, Cheapest AI stocks.