Emotional trading will destroy your portfolio if you let it do: Veteran Trader

Listen to the traders and subscribe Apple Podcast, Spotifyor wherever you find your favorite podcast.

Longtime stock traders know the highs associated with ongoing returns on investments. However, even the most experienced investors can be very easy to kneel down to a sudden market recession.

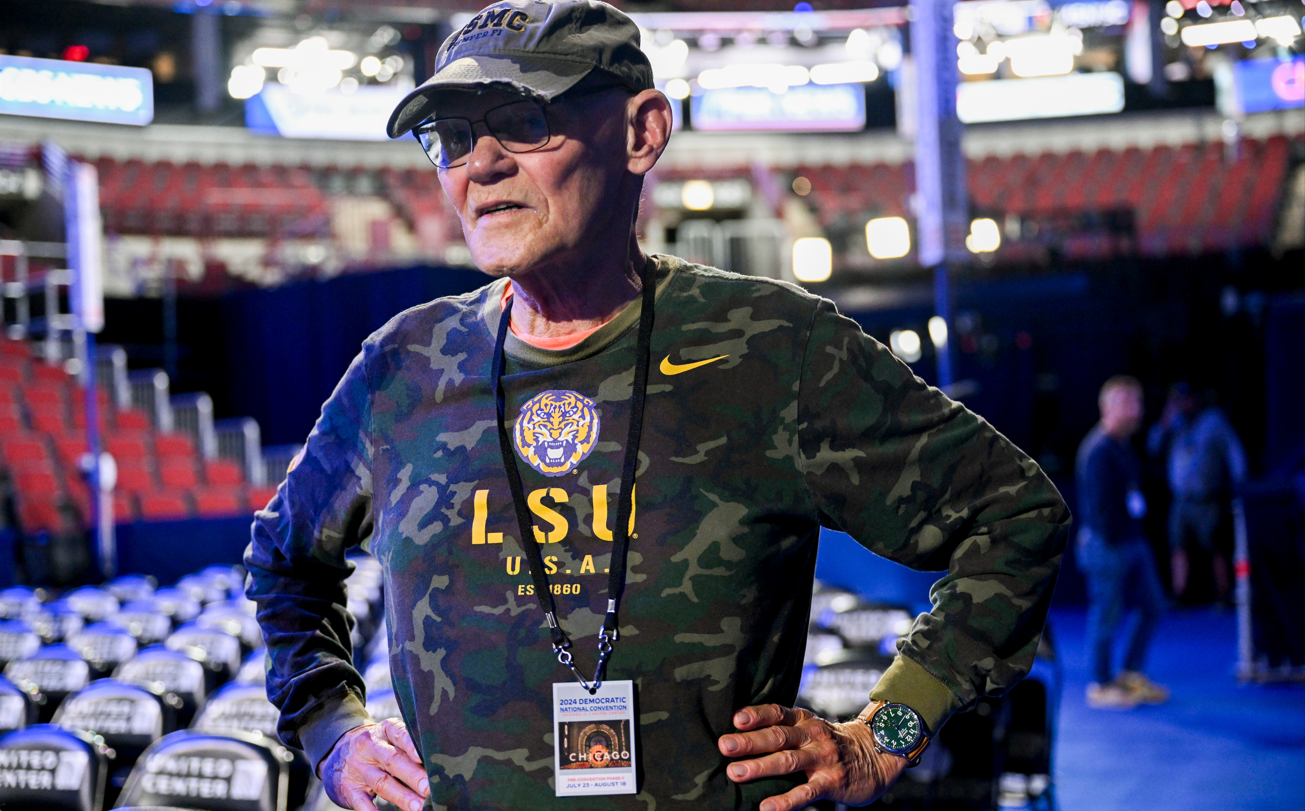

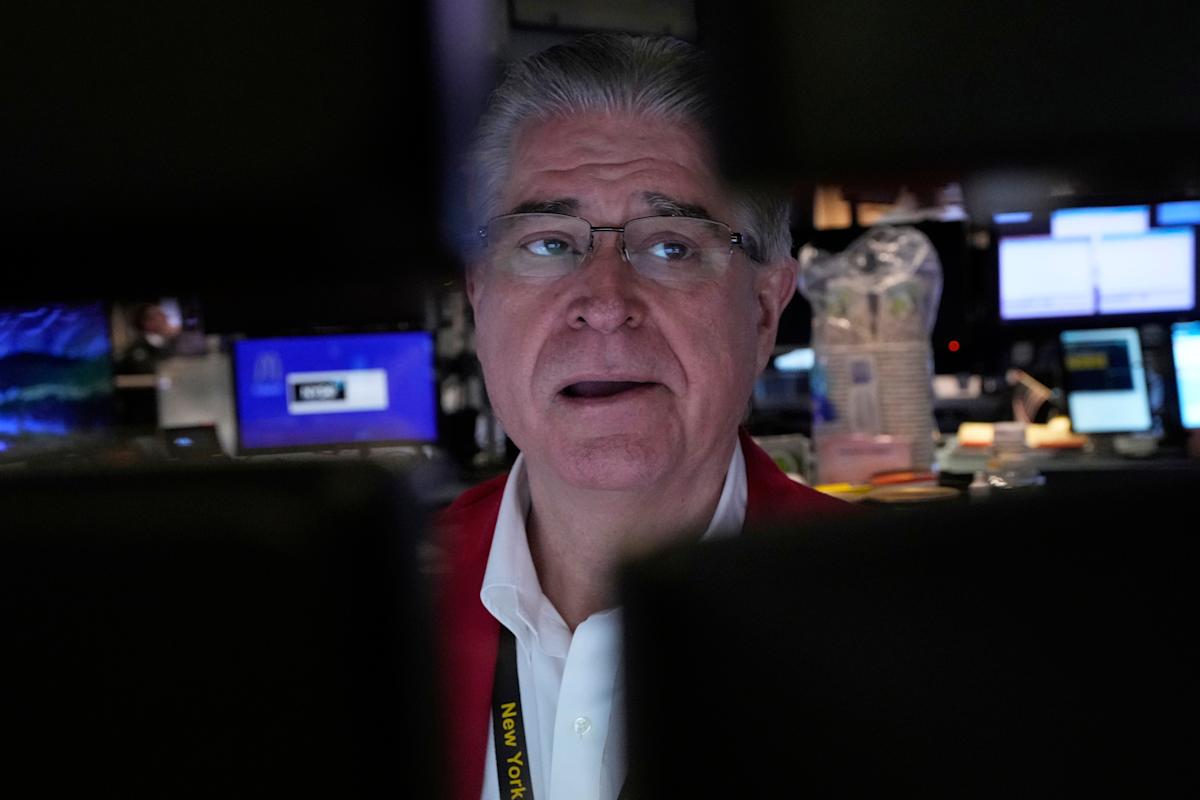

The potential for a looming recession on the economy makes it even more likely that the temptation for some investors to bail out the moment investment launches tanks. However, according to trader talk host and veteran trader Kenny Polkari, these fears will inform you that your trading will “destroy your portfolio.”

“The market doesn’t care about your feelings,” Polkari said in an episode of the Trader Talk Podcast (see the video above or listen below). “They don’t care if you’re afraid, hopeful, angry, hopeless. The market moves to the basics, revenue data, economic data, reality.”

“It doesn’t move by your gut emotions,” he continued, warning that getting investors to determine their emotions is a “disaster recipe.”

This embedded content is not available in your area.

It’s easy to see why even experienced traders are tempted to bail out faster than they would later. On Friday, JP Morgan became the first Wall Street Bank Predicting a recession in 2025 meanwhile Yardeni Research has increased the odds of the recession to 45%.

“I’m always watching that,” he said at the opening of Trader Talk. “Traders jump into the market and they get fired. They chase the momentum, feel euphoria, and when they suddenly refuse, they get up and panic. Here’s the truth.

“If you want to succeed, separate your emotions from the action,” he continued. “Make decisions based on strategy, discipline and analysis, not impulse. Define entries, set stop losses, and know the exit before entering the buy button.”

read more: How to protect your money during economic turmoil, stock market volatility

Continuous adjustments to trading strategies based on analysis and data are difficult, especially as the US market is becoming increasingly unpredictable. Kristina Hooper, Chief Global Market Strategist at Invesco, admitted that the outlook for 2025, released in November 2024, is “probably quite traditional.”

“Our hope was to avoid a global recession and (similarly) the US,” she said. “In fact, the US will have a very modest slowdown, re-controlling growth and bring in other western developed countries.”