Enterprise Products: Trump exports “weaponized” ethane to backfire to the US

Leading the US energy product exporter Enterprise Product Partners The Trump administration warned that continuing to “weaponize” fossil fuel shipments to China would backfire only for US shippers.

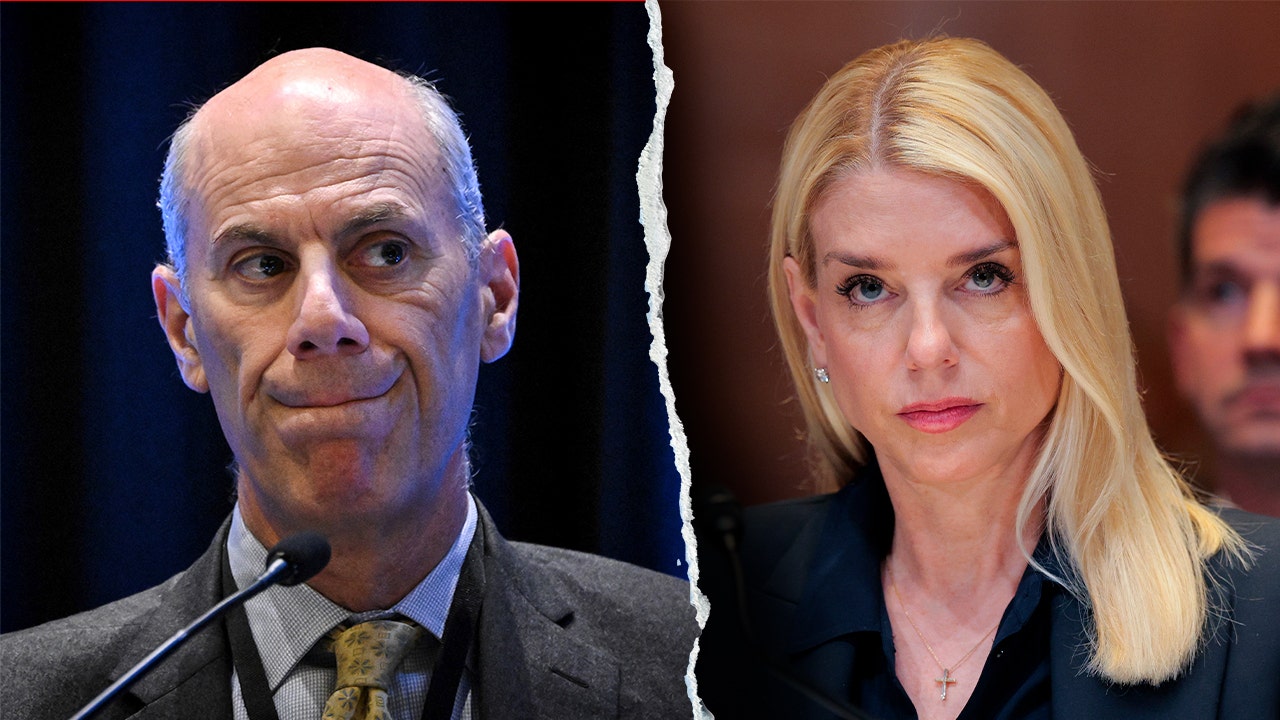

Enterprise CO-CEO Jim Teague filed a complaint during a July 28th revenue call about two months after the US Department of Commerce. Temporarily banned the export of ethane China as China negotiates the tool as a tool negotiation tool after China places restrictions on exports of certain rare earth metals to the US Teague.

The two countries lifted restrictions in July as part of a trade ceasefire, but the long-term trade agreement has been negotiated and is still pending.

“We were clear about the risks of weaponizing US energy exports,” Teague said in a revenue call. “These types of behaviors rarely hurt the intended target, often backfires and hurts our own industry more.”

China is the largest importer of ethane in the United States and the most common building block of petrochemists and plastics around the world. The US is Only major ethane exportersChina is completely dependent on American exports. About half of US ethane exports go to China, and the freight is not easily redirected to other countries. Enterprise (Fortune 500 No. 78) is the main ethane exporter of the Houston Ship Channel Terminal.

“We are fortunate that this administration understands the important importance of energy and global trade, even if the Commerce Department may need a little reminder,” Teague said. “Unfortunately, we may face similar challenges in the future.”

Specifically, the Commerce Department temporarily required businesses and other exporters to apply for special federal licenses to export ethane and butane to China for clear reasons of “unacceptable risks.”

Tony Chovnek, Vice President of Enterprise Executive, said the Commerce Department’s actions would cost the company to at least one customer of ethane that is not from China.

“If it had been and problems, you just cut off such counterparties and really compromised the US brand for reliable supply and energy security,” Chovanec said of the Commerce Department’s actions. “It was disruptive, but in the short term, we managed it with a diverse contract mix.”

Apart from China, Enterprise said it would ship ethane to Mexico, Brazil, Europe, India, Vietnam and Thailand.

I’m looking for an alternative

In a new report, East Daily Analytics Company said China may try to develop alternatives to US ethane to avoid geopolitical disruptions. China could encourage countries in the Middle East and Europe to further develop their own ethane exports to diversify their supplies.

“In recent years, ethane in the US has been a quiet powerhouse of global petrochemists. It is cheap, abundant, and perhaps isolated from geopolitics. That assumption is no longer preserved,” East Daily said. “The US-China trade war revealed a critical truth. There is no large-scale alternative to US ethane. In the past, stable raw materials were caught in cross-current trade policies and long cycle demand risk.”

In the meantime, Enterprise has doubled ethane and propane export companies, including expanding its Houston Ship Channel facilities.

This month, Enterprise opened the first phase of its new Neches River Ethane Ethane export hub in Texas, near the Louisiana border. The facility will initially be able to ship 120,000 barrels of ethane per day. The second phase that will be online in the first half of 2026 will be more than twice the export capacity to 300,000 barrels per day.

According to the U.S. Energy Information Agency (EIA), it is usually produced as a by-product along with oil or natural gas, with US natural gas fluids more than doubled to more than 7 million barrels per day in a decade, of which 6 million barrels are ethane, propane and butane. That spike caused a boom in construction for US petrochemical plants and a burgeoning export market. Ethane is usually converted to petrochemical ethylene, which is used to make products such as polyethylene, the world’s most common plastic.

“The US ethane and ethylene appetite remains strong in both Asia and Europe,” Teague said.