Euros will rise after we and the EU reach a comprehensive 15% tariff contract

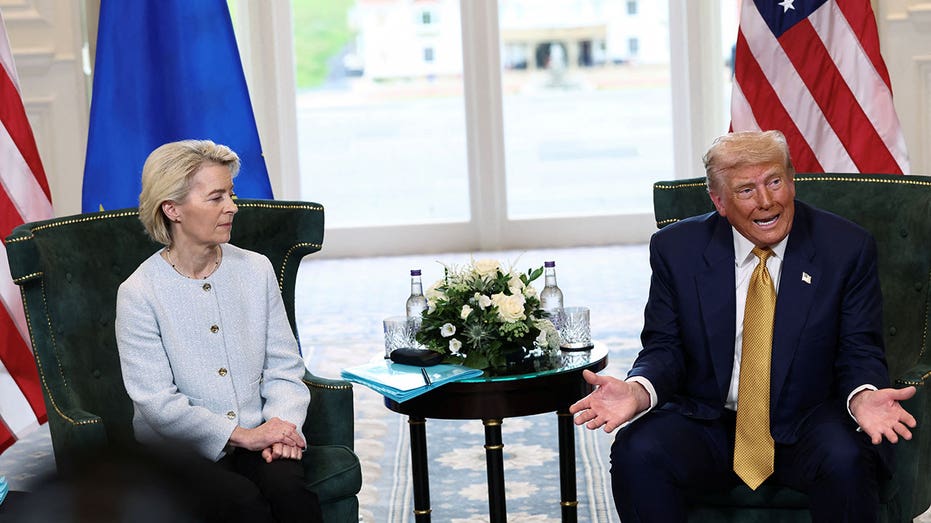

President Donald Trump has announced a trade contract between the United States and the European Union with President Ursula von der Leyen of the European Commission.

EUR Rose on Monday after the US reached a framework trade agreement with the European Union.

US President Donald Trump European Commission President Ursula von der Leyen announced the deal at a meeting in Scotland on Sunday.

This transaction shows a 15% tariff on EU goods imported into the US. This is half of what Trump threatened to impose from August 1st.

“We agree that the direct tariffs will be straightened to the cars and everything else being a straight 15% tariff,” Trump announced from Scotland. “That’s why we have a 15% tariff. European countriesit can be said that it was essentially closed. ”

EU chief agrees with Trump on China’s trade issues and declares “Donald is right”

US President Donald Trump will meet with President Ursula von der Leyen of Turnbury, UK, Scotland, on July 27, 2025. (Photo by Reuters/Evelyn Hockstein/Reuters)

Von Der Leyen said that in addition to making $600 billion from other investments in the US, it will also purchase $150 billion worth of US energy as part of the deal.

US trade with the EU is out of bluff. Trump needs to keep tariffs strict to fix it

The framework deal is similar to what was created with Tokyo Negotiators last week, with Japan investing around $550 billion in the US and a 15% tariff will be imposed on automobiles and other imports.

By the beginning of Monday, the euro was around $1.18.

The latest developments are as investors’ attention has been transformed into corporate revenue and central bank meetings in the US and Japan.

US President Donald Trump will meet with European Commission President Ursula von der Leyen (not pictured) in Turnberry, Scotland, UK, on July 27, 2025. (Photo by Reuters/Evelyn Hockstein/Reuters)

Rodrigo Catril, senior currency strategist at National Australia Bank, predicted this week “from the fact that he knows the rules of the game purely.”

File: The figure, taken on July 17, 2022, shows US dollar and euro bills. (Reuters/Dad Luvik/Illustrated/Reuters Photo)

“Now that’s become more clear, you’d think you’re a little more motivated to look at investment, see expansion and see where the opportunities are, not just in the US, but around the world,” Catril said on the NAB podcast.

Meanwhile, senior US officials are expected to meet with Chinese counterparts in Stockholm later on Monday, aiming to extend the trade ceasefire and prevent sudden tariff hikes.

China is facing an August 12 deadline to reach a durable trade agreement with the US, and while a breakthrough is not expected in China talks in Stockholm, analysts said another 90-day extension of the trade ceasefire struck in mid-May is likely.

Click here to get your FOX business on the go

The US dollar moved forward on Friday, bolstered by robust economic data suggesting that the Federal Reserve could take some time to resume interest rate cuts. Both the Fed and the Bank of Japan are expected to be stable at this week’s policy meeting, but traders will focus on subsequent comments to measure the timing of their next move.

Anders Hagstrom, Stephen Sorace and Reuters of Fox News Digital contributed to this report.