Federal Reserve Chairman Powell testifies that the US economy is in a “solid position.”

Powells testifies at regular check-ins to update Congress on the economy, interest rates and what challenges lie ahead.

Federal Reserve Chairperson Jerome Powell He said the economy is in a “solid position” as it monitors inflation and labour market data on signs that central banks need to adjust their monetary policy.

“Despite rising uncertainty, the economy is in a solid position. Unemployment remains low and the labour market is approaching maximum employment,” Powell said in opening testimony before the House Financial Services Committee on Tuesday.

“Inflation has dropped significantly, but it has slightly surpassed its 2% long-term target. We are paying attention to risks on both sides of the dual mission,” the chairman said. Federal Reserve System A double mission to promote stable prices over long-term and maximum employment.

The Fed refrains from cutting interest rates due to uncertainty about its trade policy as president Donald Trump We are leviing customs duties on our US trading partners. Duties are generally taxes on import taxes paid by importers, and importers often pass these additional costs to consumers.

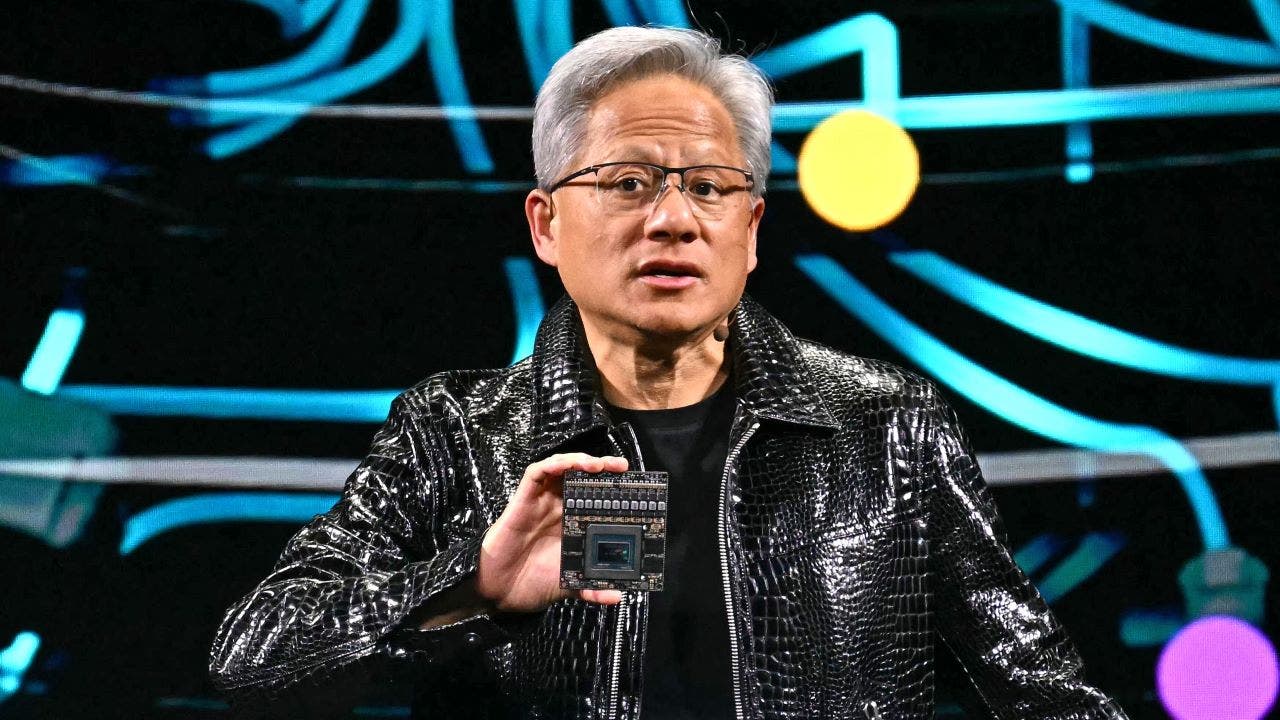

Federal Reserve Chairman Jerome Powell said the economy is in a solid form despite growing uncertainty. (Photo by Olivier Douliery via Getty Images/Getty Images/AFP)

“The impact of tariffs depends, among other things, on the ultimate level. That level of expectations, and therefore the associated economic impact expectations, peaked in April and then declined,” Powell said.

“Even so, this year’s increase in tariffs is likely to boost prices and weigh economic activity,” he said. “The impact on inflation may be short-lived, reflecting one-off changes in price levels. Inflation effect Instead, it could be more permanent. ”

“Respondents to the consumer, business and professional forecasters survey point to tariffs as a driving factor. However, beyond next year or so, most measures of long-term expectations are consistent with the 2% inflation target,” he added.

Fed governor breaks ranks with Powell, signal rate reductions could begin next month

When asked about when inflation from tariffs could appear in the data, Powell explained that when he spoke to retailers he often hears that much of what is currently on sale is in stock before the tariffs come into effect.

“We expect more tax inflation to manifest, but honestly, we don’t really know how much it will be handed over to consumers. We don’t know until we see it, it could be lower than we expected.

Last year’s Fed’s three interest rate cuts (such as the 50 Bayes point cut in September and two 25 basis points cuts in November and December) were discussed as lawmakers were asked whether the conditions were currently similar and could lead to interest rate cuts.

“Unemployment rates were actually rising to almost the perfect point. I was very clear about this. We were very clear in real time about this. In a time when unemployment rates are not reaching nearly 1%, we have never actually experienced a much higher level of unemployment and recession.

The Federal Reserve leaves unchanged key interest rates for the fourth consecutive meeting

He said the September cuts were aimed at supporting the labour market as the federal funding rate was “a very restrictive level” of 5.3% and the Fed was the last large bank to cut.

Powell also said inflation is projected to continue to decline last fall.

“If you just look at the basic data and you don’t look at the forecast, you’ll say we’ve been continuing the cuts. Of course, at this point, all forecasters are hoping to see some important inflation coming out of the tariffs soon,” Powell said. “We can’t ignore it… we just say, look more, see more.”

Click here to get your Fox business on the go

This is a developing story. Please check for updates.