Gold surges beyond $2,900 amid tariff threats and beyond new records

Friday surged to a new record, exceeding $2,900 on Monday. Escalating tariff threats prompted purchases, and Wall Street analysts remained bullish on Safe Haven’s assets.

Gold futures (gc = f) It rose more than 1.6% to around $2,935 last week after reaching an all-time high.

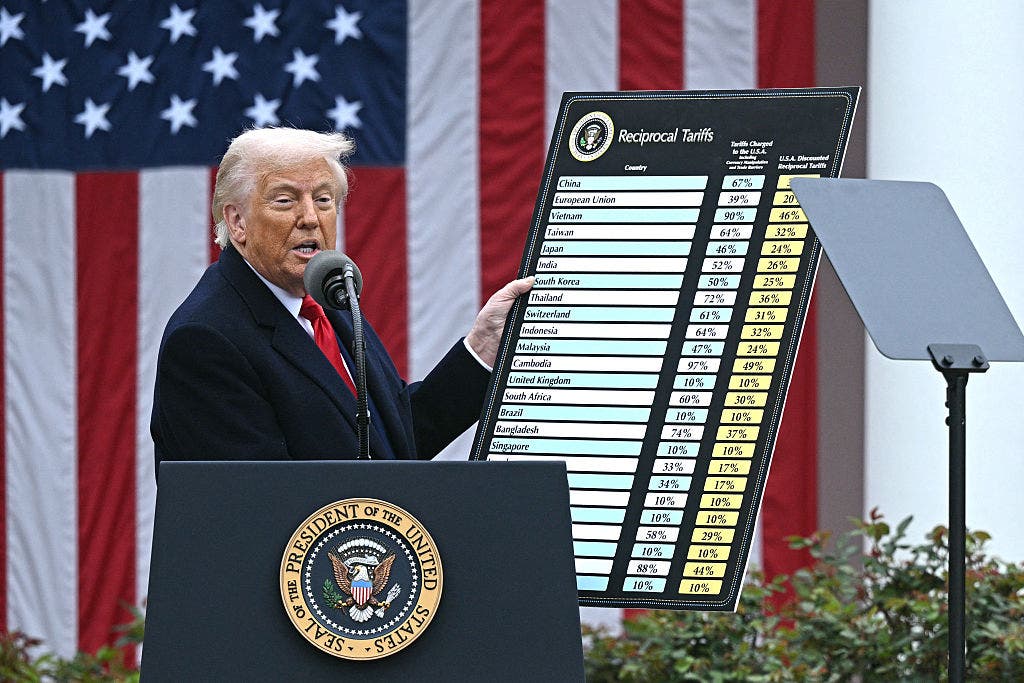

Over the weekend, President Trump announced he would introduce what he would introduce 25% tariff on all imports of steel and aluminum In addition to his existing duties, he is in the United States.

On Friday, the president also said he would announce a retaliatory fee plan for countries that tax US goods. Meanwhile, last Tuesday, a 10% tariff was effective on certain Chinese goods.

Wall Street analysts remain bullish on gold amid rising tariff threats.

“We continue to see gold as an effective portfolio hedging and diversifying device, and we believe that an approximately 5% allocation within a balanced portfolio of the US dollar is the best,” UBS Global Wealth Solita Marcelli, America’s chief investment officer at Management, wrote Monday. Note.

Goldman Sachs Analyst in late January Repeated their bullish appeal. About precious metals as the threat of escalating tariffs promotes ongoing demand.

“We see the opposite risks at 3,000 (per troy ounce) targets, from growing uncertainty in US policy and potentially sustained boosts to central bank and investor hedging demand.” writes the analyst. They added, “We expect the shortcomings of a modest tactic of gold prices if tariff uncertainty declines and positioning is normalized.”

In a memo on Friday, a JPMorgan analyst said in recent years that gold could drop if inventory was sold. However, tariff threats continue to raise prices.

“While bearish transmission from stocks can put pressure on gold in the near future, destructive tariffs will continue to promote bullion bullion cases in the medium term. Tariffs will be extended,” Anna said. The list is written.

Demand for gold Surged to new records According to a recent report from the World Gold Council in 2024.

“Central Banks continued to lift gold at a distracting pace in 2024,” the report said in accelerating purchases in the fourth quarter of last year.

Joe Cavatoni, a market strategist at the World Gold Council, has pushed Yahoo Finance with concerns that central bank purchases “need to add ongoing inflation, geopolitical tensions and diversification to portfolios.” He said that he was doing so.

The Federal Reserve fee reduction cycle, launched last year, has prompted a global inflow into physically supported gold exchange trade funds (ETFs).