House GOP cannot pass Trump’s tax bill as a far-right pushback in center holdouts and late-night sessions

House Republicans tense throughout the day trying to push President Donald Trump forward Tax and Expense Reduction Packagethe GOP leader persuaded a skeptical holdout and sent the bill to the desk by July 4th to persuade him to a skeptical holdout.

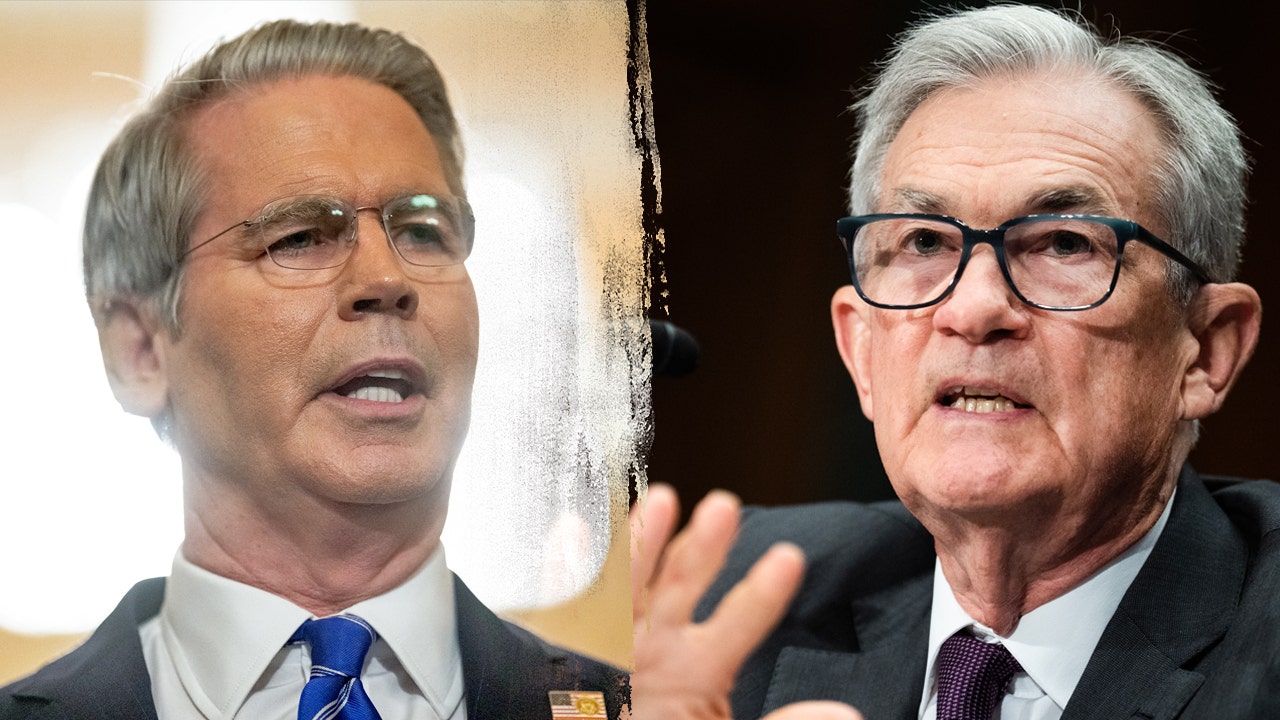

A procedural roll call was held Thursday morning, which began late Wednesday night, as several Republicans refused to vote. The outcome was at risk as there was little room for the slim majority. House Speaker Mike Johnson He was keen to remember the lawmakers to Washington and grabbed the momentum of the bill. The passage of the day before in the Senateand he vowed to push first.

“Our way is to plow it and get it done,” Johnson said. He was hoping to vote late Thursday morning. “We will meet the deadline of July 4th.”

But when the vote stalled Trump, he hosted lawmakers at the White House on Wednesday, talking to several people over the phone and assaulted them in a midnight post. “What are Republicans waiting for? He also warned against political fallout from delays in ‘Cost of your vote!!’.

The idea of calling immediately for the above vote 800 pages of invoice It was a dangerous gambit and was designed to meet Trump’s demand for holiday finishes. Republicans are struggling hard bill At almost every stage, it often succeeds with the narrowest margin. It’s only one vote. Their slim 220-212 majority has little room for exile.

Several Republicans have balked the Senate version to be required to suck up rubber versions within 24 hours of passage. Many moderate Republicans in competitive districts are opposed to cutting Medicaid Senate bills, but conservatives have accused the law of being strayed from fiscal goals.

Johnson and his team fall to convince them that negotiation time is over. They needed assistance from Trump to close the deal, and lawmakers headed to the White House on Wednesday for a two-hour session to speak to the president about their concerns.

“The president’s message was, ‘We’re on the roll,” said Rep. Ralph Norman. “He wants to see this.”

Republicans rely on the holdings of a majority in Congress to push their baggage down a wall of unified democratic opposition. There were no Democrats in the Senate who voted for the bill, so there was no expectation to do so in the House.

“Hell no!” House Democrat leader Hakeem Jeffries said it is adjacent to a fellow Democrat outside the Capitol.

In the early warning sign of Republican resistance, the resolution setting conditions for debating Trump’s bill barely cleared the House Rules Committee on Wednesday morning. As soon as I came to Full House, it was stuck as GOP leadership delayed his return to Washington, waiting for lawmakers who had negotiated closures with holdouts.

By dusk, pizza and other dinners had arrived at the Capitol, so the next step was uncertain.

Trump urges Republicans to do the “right thing”

The bill will be extended from Trump’s first term, providing permanent personal and business tax credits, along with temporary new ones that it promised in its 2024 campaign. This includes allowing workers to deduct tips and overtime salaries, as well as a $6,000 deduction for seniors earning less than $75,000 a year. Overall, the law includes a tax cut of around $4.5 trillion over a decade.

The bill also provides about $350 billion to defense, Trump’s immigration crackdown. Republicans pay that partially by reducing spending on Medicaid and food aid. Congressional Budget Office is due to be added by the bill. 3.3 trillion dollars to federal debt for the next 10 years.

The House passed a version of the bill in a single vote in May despite concerns about spending cuts and overall price tag. Now, in many ways, we are asked to make a final pass to a version that exacerbates these concerns. For example, it is quite high that the Senate bill predicts its impact on the country’s debt.

“Let’s go to Republicans and everyone else,” Trump said in a late-night post.

High prices against Trump’s bill

Johnson meets Trump’s timeline and is about to bet that Republicans who are hesitating will not surpass the president because of the heavy political prices they have to pay.

They simply turn to Senator Tom Tillis, who announced his intention to oppose the law over the weekend. Soon the president was sought a major senator challenger and criticising him on social media. Tillis quickly announced he would do so. Don’t ask The third term.

One House Republican, Kentucky Rep. Thomas Massey, one House Republican, opposed the bill, was Target Through Trump’s well-funded political tactics.

Democrats are targeting vulnerable Republicans, and they join in the opposition

Adjacent to almost every member of his Caucus, New York Democratic leader Jeffries delivered a pointy message. By voting “No,” all Democrats will just flip the four Republicans over to prevent the bill from passing.

Jeffries evoked the “courage” of the late Senator John McCain, giving a thumbs up on the GOP efforts to “repeal and replace” the Affordable Care Act, and in 2026 he picked Republicans from districts, including two from Pennsylvania.

“Why will Rob Bresnahan vote for this bill? Why will Scott Perry vote for this bill?” Jeffries asked.

Democrats described the bill in disastrous conditions, warning that Medicaid cuts will kill lives and that food stamp cuts will “literally tear food from the mouths of children, veterans and seniors,” Jeffries said Monday.

Republicans say they are trying to make a safety net program right-sized, primarily for a population designed to serve pregnant women, disabled people and children. Waste, fraud, abuse.

This package includes new 80-hour work requirements for many adults receiving Medicaid, and applies existing work requirements to the Supplemental Nutrition Assistance Program. snapto more beneficiaries. The state will also increase the cost of food benefits.

However, the driving force behind the bill is tax cuts. If Congress doesn’t act, many will expire at the end of the year.

The Tax Policy Center, which provides a nonpartisan analysis of tax and budget policy, was projected next year that $150 tax credits for Americans at a minimum quintile, a $1,750 tax cut for the middle quintile, and a $10,950 tax cut for the top quintile, is expected to bring taxes to $150 next year. This is compared to what you will face if the 2017 tax cut expires.