Japan will manipulate the yen to weaken the yen, the Finance Minister says

By playing Kihara

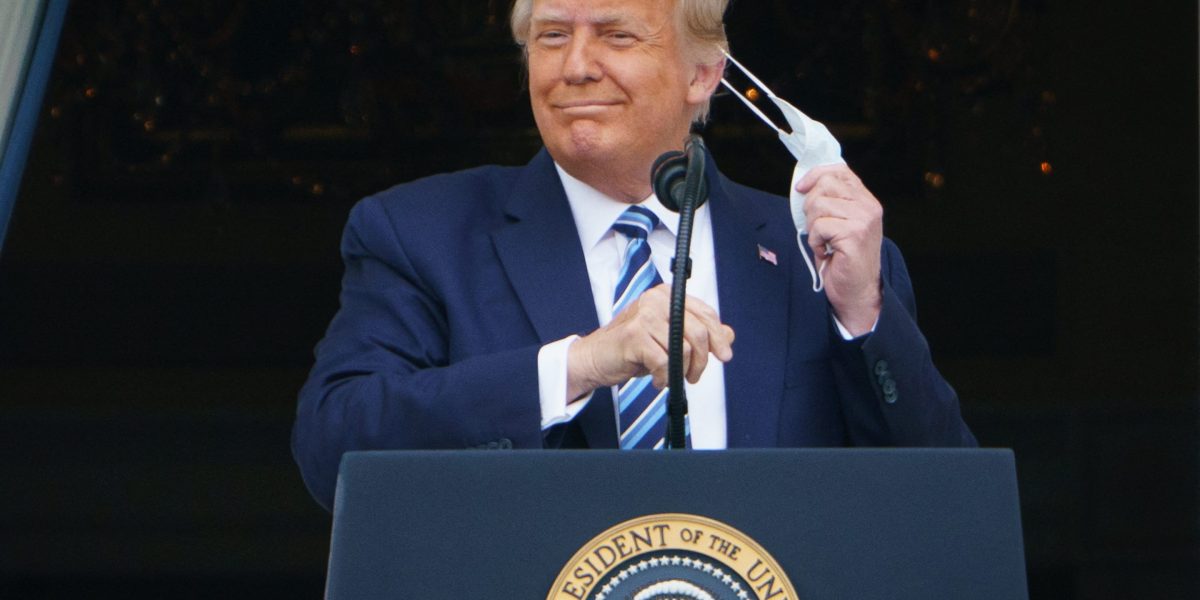

TOKYO (Reuters) – Japan will not manipulate currency markets to weaken the yen, Finance Minister Katsunobu told Congress Friday on Friday, refuting accusations from US President Donald Trump, and Japan deliberately depreciated the currency to support exporters.

The statement came before Kato’s scheduled visit to Washington next week. There, a bilateral meeting with US Treasury Secretary Scott Bescent can be held on the sidelines of the G20 Finance Leaders and the Spring IMF Conference.

The bilateral conversation, if held, will be the main venue for Japan and the US to discuss troubling topics of exchange rates as part of broader tariff negotiations that began Wednesday.

“Japan does not manipulate the currency market to deliberately weaken the yen, as seen in the fact that our latest action was to carry out interventions that take on the yen,” he told lawmakers when asked about Trump’s comments criticizing Japan for giving Japan a trade advantage by weakening the yen.

While he said he knew the US was interested in discussing the issue of exchange rates, Kato declined to comment on what could actually be discussed. He also said the date has not been revised yet for possible meetings with Bessent.

The recent profits of the yen have been driven in part by market expectations that push the US to take part in a coordinated effort to weaken the dollar and reduce its huge trade deficit.

In March, Trump told Japanese and Chinese leaders that they couldn’t continue to reduce the value of their currency.

Bessent also said he looks forward to discussing tariffs, non-tariff barriers and exchange rates with Japan.

Japan’s top trade negotiator, Ryosei akazawa, added that the exchange rates were not issued in trade talks with the US on Wednesday, and the two sides had postponed a previous agreement that the issue of currency would be set aside for a meeting between the financial leaders.

“If the US wants, the finance minister is likely to engage in discussions about exchange rates,” Akasawa said at a press conference Friday, adding that the debate between the financial directors of both countries over currency charges will be part of a broader package of the bilateral trade agreement.

Akazawa’s comments have shifted market attention to the possibility of a meeting with Bescent next week with Kato.

Policymakers from around the world will gather in Washington for the Spring International Monetary Fund (IMF) conference, which will be held from Monday through April 26th.