Major workers’ city law firms collapse

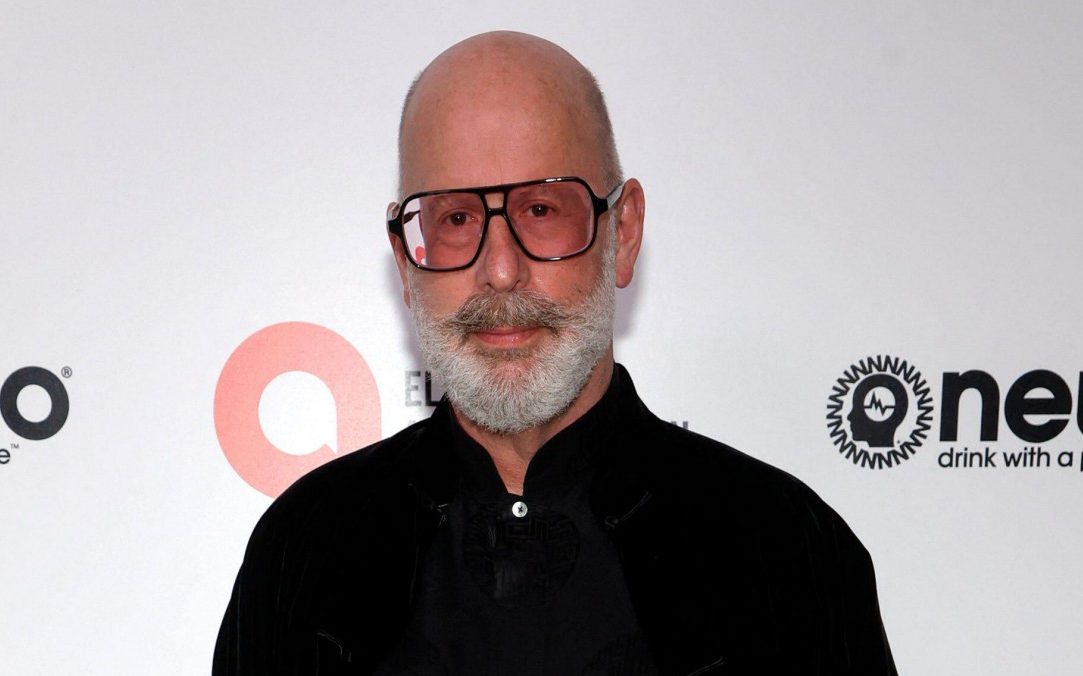

The big city law firm founded by billionaire workers Ian Rosenblatt has collapsed into bankruptcy due to a series of losses Awakening of racism scandals.

RBG Holdings, launched by Rosenblatt in 1989, said on Monday it would close a few days after the directors failed to appoint managers. Companies are generally unable to appoint managers if they lack sufficient cash to pay the costs paid to bankruptcy professionals.

RBG Holdings became the fourth UK law firm to hit the open market in 2018. Mr. Rosenblatt Helped to fund Keir Starmer’s election campaignsince joining the stock market, he has enjoyed paying millions of pounds worth of payments from the company.

However, its stock price has fallen more than 90% since its peak in 2021. Following the initial public offering, the city’s company pushed for business expansion, but this costly drive led to millions of pounds losses.

Investor trust is suffering from a famous racism scandal that saw RBG Holdings CEO Nicola Foulston, who was banished in January 2023.

The Chief Executive’s firing comes after Ms. Foolston was accused by former Rosenblatt partner Noel Deans for using the phrase “n—wood pile” at a business dinner.

Deans, an employment lawyer at Afro-Caribbean Heritage, claims he faced discrimination from Rosenblatt himself after he had trouble with the company’s founder’s decision to welcome him with a fist bump on the first day of his job. I did. Rosenblatt was ultimately exempt from racism by the Employment Court last year.

The collapse of RBG Holdings comes after the departure of top talent from two subsidiaries, Rosenblatt and Memery Crystal. Dozens of senior lawyers have left both companies.

While RBG Holdings is being discontinued, Rosenblatt is looking to continue his legal business through the newly established Rosenblatt Law, which was founded in January. Forty of Rosenblatt’s most senior lawyers have moved to Rosenblatt Law.

Rosenblatt has donated thousands of pounds to the Labour Party. In 2023, Telegraph was forced to pull back a £16,000 donation after Rosenblatt’s company was working on behalf of authorized Russian bank CTB Capital.

Rosenblatt is RBG Holdings’ largest shareholder and has acquired a 20.52% stake in the publicly available business. Other major shareholders of RBG Holdings include Asset Manager Abrdn and the London Listed Bank Close siblings.

RBG Holdings and Rosenblatt Law were requested to comment. Rosenblatt declined to comment.