Oil prices could skyrocket 10% after we attack Iran – “But don’t be fooled, this may not last long.”

The energy market is focused on afterwards The US bombed major nuclear sites in Iranthis is the top oil producer and is in a position to threaten important transportation points for global exports.

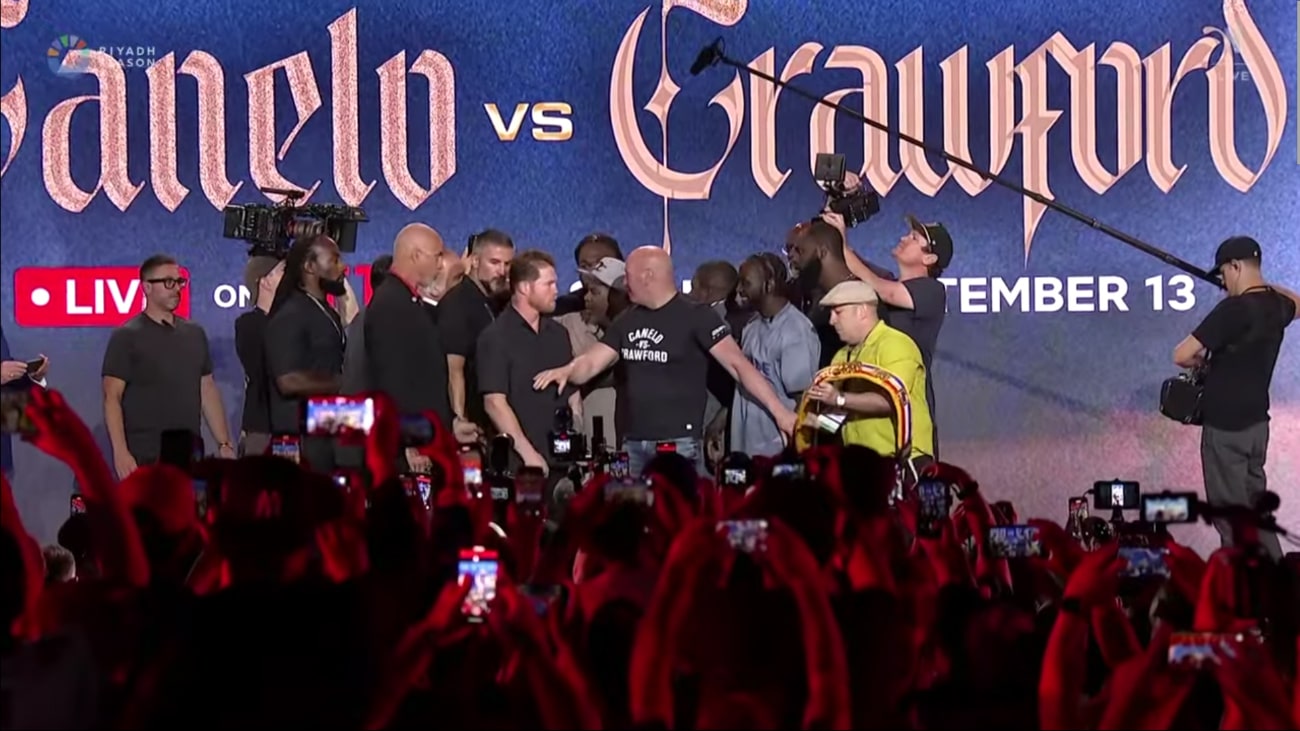

The attack draws the United States into a direct attack operation against Iran, escalating a conflict that began a week and a half before Israel launched its own vast airstrike campaign.

However, while the global market is expected to see its first shock, there are other mitigation factors that can ease the blow.

“As the risk premium rises, expect a sharp 7-10% gap to rise and open the oil. But don’t be fooled, this may not last long,” said the energy analysis company. kpler posted on x.

Based on Brent crude closing price on Friday, a 10% jump will send the global oil benchmark to nearly $85 per barrel.

Iran’s retaliation capabilities are constrained, Kpler notes, stating that it would close the Strait of Hormuz or attack on energy infrastructure belonging to the Gulf Cooperation Council.

Still, the geopolitical shock from the US unprecedented attack on Iran should result in more crude supplies reaching the market and mitigating price surges.

Kpler said there is a high chance that August early OPEC+ power will increase at over 411,000 barrels per day. This adds a series of similar production hikes over the last few months.

The Strait of Hormuz is Important choke points With the global energy trade. 21% of the world’s oil liquid consumption, or about 21 million barrels per day, flows through narrow waterways.

On Sunday, Iran’s parliament approved the strait closure, but security officials have not yet signed off.

Such closures may require the use of mines, patrol boats, aircraft, cruise missiles and diesel submarines, but cleaning the strait can take weeks or months.

In a note from last week, George Saravelos, head of FX Research German banksestimated that the worst-case scenario of complete disruption in Iran’s oil supply and the closure of the Strait of Hormuz could send oil prices above $120 per barrel.

However, closing the strait also suffocates Iran’s own oil exports, with over 90% of them going to China, destroying the Iranian economy.

As a result, the closure of the straits is Scope of Iran’s retaliatory options It would put the regime at risk. This means that Tehran’s reaction could come elsewhere.

“The cargo disruption is going to be a story to watch,” Kpler said. “Middle Eastern Bay and Red sea The threat has increased from Houthi’s attacks, particularly as they are poised to make more profitable in the west of Jet and Suez. ”