Oil prices crash after Iran hits us base

Just hours after the US launched an attack on Iran’s uranium enrichment facilities, Iranian parliament has expressed support for the closure of the Strait of Hormuz, one of the world’s most important routes for fossil fuel transport, particularly the Strait of Hormuz. The Middle East conflict, which began on June 13, 2025, is on the 10th day following Israeli airstrikes targeting Iranian military bases and commanders. Things have escalated dramatically as Israel joined Israel to directly bomb Iran’s nuclear enrichment sites.

On Monday afternoon in the eastern US, Iran fired six missiles at a US military base in Qatar, and an explosion was reported through Doha. According to axios. In response, Qatar closed airspace “until further notice” and the United Arab Emirates (UAE) also closed airspace.

Despite the attack, oil prices have fallen by more than 7%. wti crude oil It’s below $70 per barrel. According to Bloomberg’s Javier Blas, the market sees Iran’s missile strike as a “tummy counterattack.” The Strait of Hormuz remains open and oil from Iran’s Hague Island is still flowing.

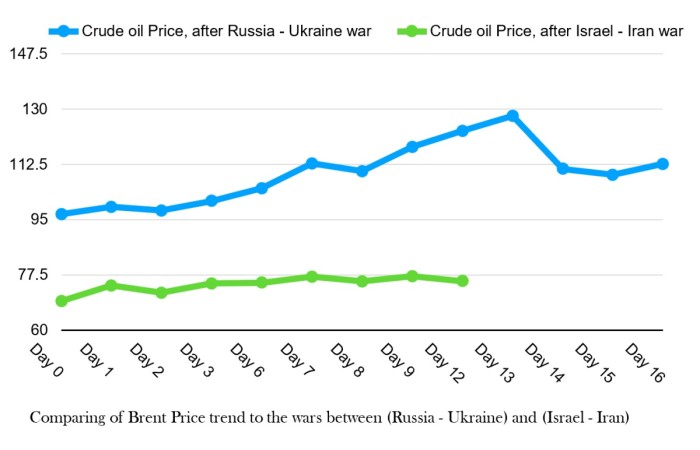

The initial impact of the conflict on the oil and gas markets remained relatively limited, with Brent’s crude oil prices gradually rising to US$79 per barrel. Despite escalating tensions and Trump’s two-week warning, prices had dropped to US$75 by the end of last week. This was in contrast to the early days of Russia’s invasion of Ukraine in 2022, when oil prices rose by about 17%, reaching over 110 US dollars per barrel in the first week. The slight increase seen in the current conflict was primarily due to increased shipping costs, including tanker fees and ship insurance premiums.

Related: Rami warns Iran against Hormuz’s lockdown

Market trajectories can change dramatically if oil and gas transport routes are under persistent threats rather than being exposed to temporary or symbolic disruptions. Strait of Hormuz– employed between Oman and Iran – exists as an important link between the Persian Gulf, the Gulf of Oman and the Arabian Sea. This is the world’s most important oil transport chokepoint with an average daily flow of 21 million barrels, accounting for around 21% of the world’s oil liquid consumption and around 25% of global liquid transport.

By Shahrar Sheikhlar on owrprice.com

More Top Leads from Oulprice.com