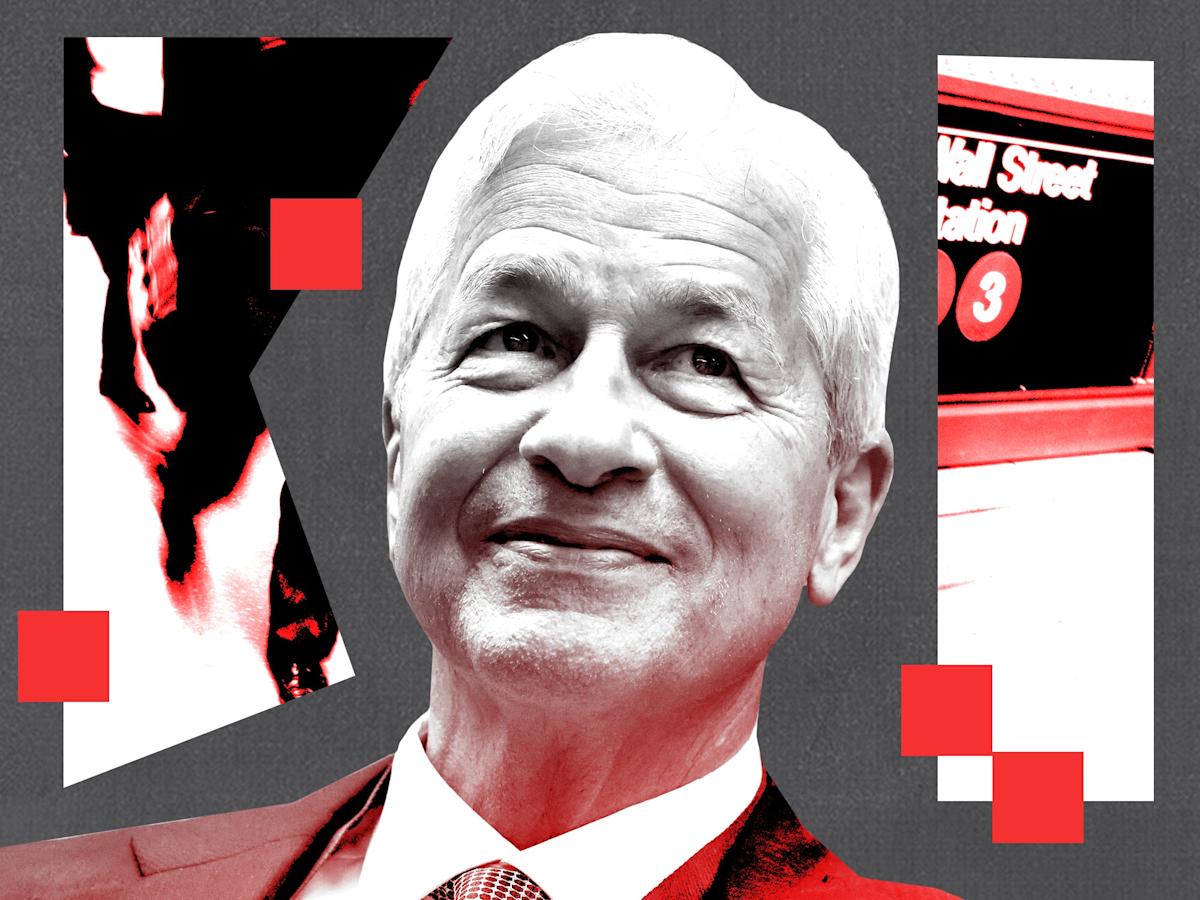

Private equity brought Jamie Dimon’s warning to his heart. This is why.

-

JPMorgan recently drew boundaries in the sand through a recruitment of new private equity bankers.

-

Within days, Apollo and General Atlantic said they would resign from practice this year.

-

Below we present some of the other factors that may have played a role in their decisions.

Jamie Dimon talkpeople listen.

Earlier last week, the CEO of JPMorgan denounced the practice of private equity companies hiring junior bunkers for future jobs. A few days later, the shopping store Apollo Global Management and Atlantic General Hearing the warnings, he announced that he would be suspending recruitment tactics.

Even Apollo CEOs Mark Rowanseemed to trust Dimon for his company’s decision.

“When someone says it’s obviously true, I feel compelled to agree,” Apollo CEO Rowan told Business Insider last week.

Dimon, who has it? Proven impact Economy and workplacenot used to criticizing private equity recruitment practices.

he Blast They told Georgetown University students last year that they were “unethical” and that he believes he wants to ban them.

“I think it’s wrong to put you in that position,” Dimon said.

The question is, why now? Nothing has changed last year, but what happened to Apollo and General Atlantic suddenly reverse the course?

Neither company responded to requests for interviews from BI to speak with executives in time for the story to be published. However, industry insiders pointed to a series of factors that made it easier for businesses to keep an eye on Dimon’s warning. A permanent slowdown in trading activities and The rise of artificial intelligencethat’s possible It replaces needs For some early career jobs.

Additionally, in recent years there has been an increasing number of complaints about the previously shifted recruitment process.

“The matching process has a low success rate, and many candidates sign without knowing what they’re doing,” Matt Ting, founder of Peak Frameworks, a popular Wall Street career course provider, told BI in April.

Some people said that if any of these factors change (for example, trading activity will recover), rat races could blar out.

“Ironically, it’s a simple time for them to make such decisions,” said a senior banker who asked the bankers to remain anonymous to protect their work and relationships with financial sponsors.