Procap BTC creates a Bitcoin Finance Company by consolidating it

Crypto Investor and Financial Influser Anthony Pulliano’s Bitcoin-Native Financial Service Company plans to make it public through a special purpose acquisition company (SPAC).

Procap BTC will integrate with Columbus Circle Capital Corp. I, a SPAC belonging to financial services company Cohen & Company Inc. statement From Columbus Circle on Monday. As part of the agreement, the new company was established through a merger – Pro Cup Financial – will be headed by Pulliano to establish a Treasury Department of Up to $1 billion. Bitcoin When the merger closes. According to the statement, Bitcoin Treasury will be used to generate revenue and profits through various strategies, but has not disclosed exactly what they are.

List Procap’s financial plans above Nasdaq Constantine Carides, the contract’s chief attorney, said after receiving regulatory approval from the Securities and Exchange Commission. luck.

“Our aim is to develop a platform that implements risk initiation solutions to not only acquire Bitcoin for the balance sheet, but also generate revenue and profits from Bitcoin Holdings,” Pulliano said in a statement.

Prior to the merger, Procap BTC and Columbus Circle Capital Corp. It raised more than $750 million in funding from investors, including Crypto Prime Brakerage Falconx and Financial Services Company. BlockChain.comand investment companies from Chain Capital.

The announcement of the merger comes as more and more companies move to establish their own Bitcoin Treasury, along with crypto investment ambitions. This trend was pioneered by Michael Saylers strategyformerly MicroStrategy was a veteran software company that pivoted to buy Bitcoin in 2020. Since then, the company has acquired 600,000 Bitcoin, which is more than $600 billion at its current price. Over the past five years, the Strategic stock price has risen by more than 3,000% as Bitcoin continues to be valued.

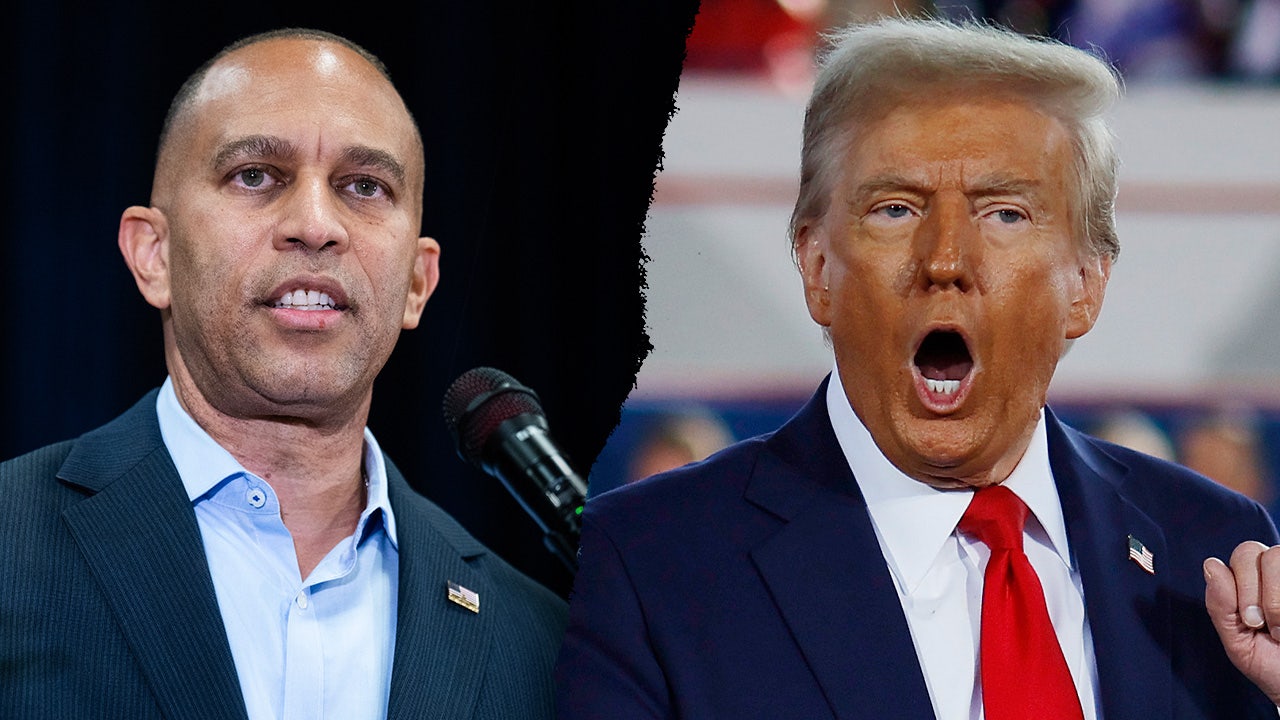

In April, Cantor Fitzgerald announced plans to use SPAC to create a Bitcoin Acquisition Company. 21 capitals Working with three other companies. Last month, the company behind President Donald Trump’s social media platform Truth Social, Trump Media and Technology Group announced plans to buy $2.5 billion Bitcoin value. flat GameStopsuffering video game retailer pivoted Investment Strategy Includes Bitcoin acquisitions.