“Shark Tank” star Rushnaun Williams says Gen Z can retire as a billionaire if he follows these three steps

I feel more and more dreams of a comfortable retirement Out of reach For the young people – especially even numbers Boomerthose who have spent decades saving are now forced into the workforce. For Gen Z, it’s easy to feel hopeless and turn to the following bad financial habits: Fateful expenditure As a coping mechanism.

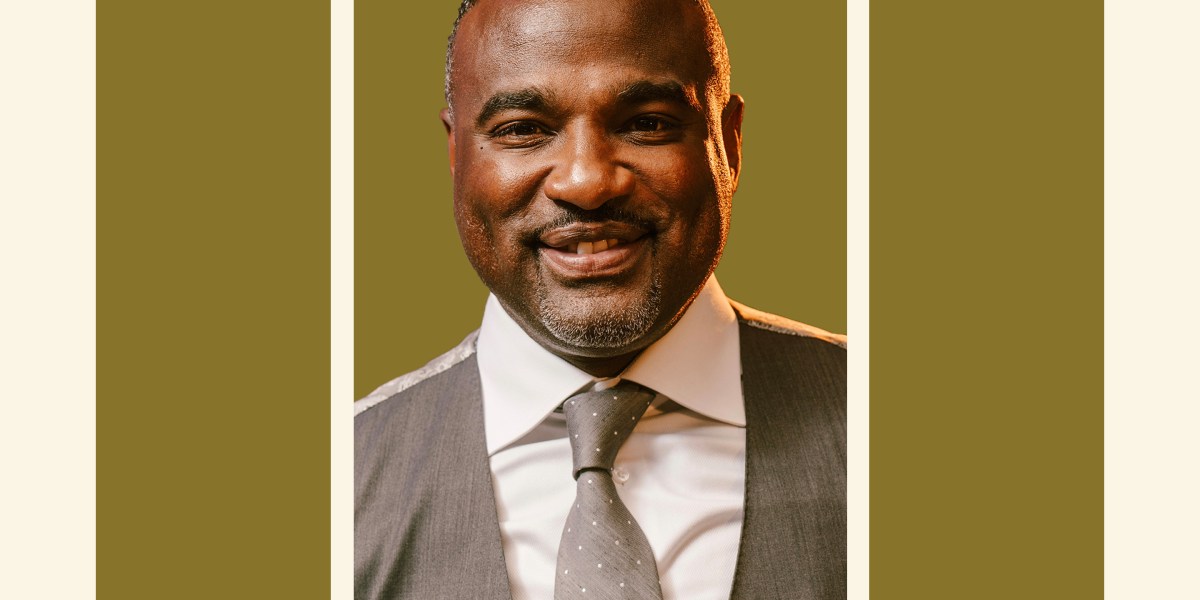

But the possibility of Gen Z retiring as a billionaire may not be as complicated as generations think. With proper financial planning, Gen Z can easily have seven numbers in their names, according to Rashaun Williams, a number of venture capitalists who have returned as guest judges. Shark Tank This next season.

Secret, he says luck, It relies on following three simple steps: establishing an emergency fund, maximizing your retirement account, and maintaining your investment.

Three steps for “Shark Tank” investors for Gen Z want to be a billionaire: 1. Create an emergency fund

The road to million-dollar wealth cannot be started without planning the unexpected. unemployment Or a medical emergency. Williams says Emergency Fund Start by saving 3 months’ worth of money in a savings account.

“Make sure you have enough cash on a rainy day, so don’t pull your 401(k) prematurely,” Williams says luck.

Many financial institutions, etc., for those who want to pay a little extra attention or are unlucky enough to bring it to life. Wells Fargosuggesting that up to six months’ worth of expenses could be worth it.

2. Maximize your 401(k) and Roth IRA

Saving money using tax-advocated accounts such as the 401(k) or Roth IRA continues to be one of the most efficient ways to grow your wealth. Williams says Gen Z should try to put a lot of money into his retirement account within the budget.

“If you’re between the ages of 25 and 50, I’m going to retire the billionaire,” Williams says. “… Just make the most of your 401(k) and your taxes will be postponed and not tax-exempt. There’s no better revenue than getting a return without tax.”

standard 401(k) Limit For employee pay deferrals, it would be around $23,500 in 2025. The maximum amount you can contribute every year Roth Ira People under the age of 50 are $7,000 (but your income is Specific adjusted revenue thresholds).

I recommend Fidelity Individuals save at least 15% of their annual income for retirement. This can be tough to ask Gen Z early in his career.

But that’s the number of friends Shark Tank Star Kevin O’Leary echoed: “Every week, or every two weeks when you receive payment, take 15% of your salary, put it in your investment account and don’t touch it until you’re 65,” O’Leary said. US every week 2023.

In fact, according to Fidelity, the average savings rate is around 14.1%. I use everything Employer Match Program It’s also important.

3. Keep your investment simple

There are many ways to invest money, including seemingly fun opportunities. Individual stocks or Cryptocurrency– Williams encourages people to keep their choices simple. He specifically calls the S&P 500 Index as one of the best places to invest and has a long history of sustainable growth. After all, that Average returns provided About 10% of the last century Unprecedented level billionaires and billionaires.

“You don’t need to be cute, you’re not international, you don’t need bonds. You’re not 90 years old. Just S&P,” Williams says luck.

4. Bonus tips for Gen Z to become a billionaire before resignation

For many young people, becoming a billionaire is more than just a retirement dream. desire They want to Hit as quickly as possible. And for some, hitting financial goals means saying goodbye temporarily. Expensive latte Or, one of the best ways to get away to Europe, building wealth is simply to create your own venture.

“Start what you can invest in, start something that allows you to grow and start your own business.” I said The wealthy Shark Tank Investor Robert Heljabeck. “It’s the only way to wealth.”