The trend in grocery lending reveals an increase in consumer division as grocery prices continue to rise

More and more shoppers are using buy now. Pay for post-groceries funding options.

In today’s economic environment, more consumers are funding basic necessities such as food by buying now, and paying for later funding options.

It’s a reality to emphasize “how consumer health is divergent,” according to Arun Sundaram, vice president and senior equity analyst at CFRA Research.

Today, the number of purchases that are growing now is later used by users on these short-term loans I’m buying groceries. Data from the April Lendingtree report shows that 25% of such users used the service and purchased groceries from 14% a year ago.

“Low-income families face far more severe financial choices than middle-income and upper-level families,” Sundaram told Fox Business. “If short-term cash flows take precedence over long-term financial stability, they can demonstrate deeper financial stress that could have ripple effects in the future.”

Buy Now, Pay Later: “Tickets to OverExpenses” Experts Say

Lending services such as Afterpay, Klarna, Affirm and Paypal have been gaining popularity in recent years as cash-bound consumers appeared to be trying to stretch their wallets. Traditionally, they have been used for expensive items. This allows consumers to often purchase, pay in installments and pay in return without interest or fees.

Safeway customers refer to the Fruits and Vegetables section at Safeway’s new “Lifestyle” store in Livermore, California on July 18, 2007. (Justin Sullivan/Getty Images)

Consumers will only earn interest on certain extended payment plans and will pay the deferred fee if they miss payments. However, research shows that not only shoppers use these services more, they are taking out multiple loans at once Lack of payment.

According to data from LendingTree, over 40% of users said they paid in the last year, up from 34% a year ago.

Experts warn you of hidden risks of buying now and pay later

Data from the report “is a sign that people are struggling and are looking for ways to expand their budget a little amidst higher prices and general economic uncertainty,” Lendingtree Chief Consumer Finance Analyst Matt Schulz told Fox Business.

From 2020 to 2024, the Total Food Consumer Price Index (CPI), a broad measure of everyday goods such as gasoline, groceries and rent costs, rose 23.6%, surpassing the overall index, which increased 21.2% over the same period.

Jacks of Lao sauce are on display along the shelves of grocery stores in New York City. (Spencer Platt/Getty Images)

According to the Agriculture Department (USDA), between 2020 and 2021, food costs increased was driven by Covid-19-related supply chain disruptions and changing preferences.

In 2022, food prices rose at the fastest pace since 1979. Highly pathogenic avian influenza (HPAI) and Russia’s invasion of Ukraine exacerbated inflationary pressures across other economies, such as high energy costs, the USDA reported.

Click here to get your Fox business on the go

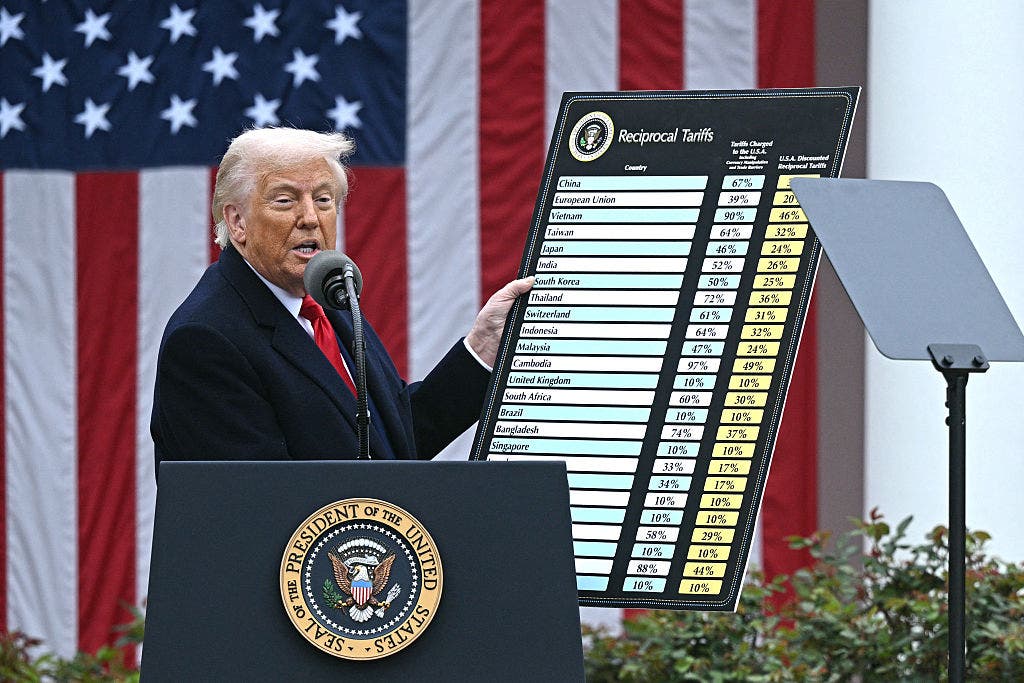

Food price growth slowed in 2023 and 2024, but some experts fear the president as wholesale food prices and these other inflation factors eased across the industry Donald Trump’s A continuing trade war could raise food prices again.

According to data from LendingTree, over 40% of users said they paid in the last year, up from 34% a year ago. (Photo: Spencer Platt/Getty Images)

“It’s imported, such as coffee, fruits, seafood, etc,” Schultz said. “Unfortunately, it’s likely that at least some of the items on your grocery list will be more expensive in the near future.”

Schulz added that consumers need to start factoring at a higher cost when going through their budgets.

“It may take some sacrifice, but it’s better to be pleasantly surprised than to prepare for the worst, hope for the best and scramble later,” he said.