This San Diego married couple is paying for salaries ranging from $500,000 to $600,000 a year. This is Dave Ramsey’s advice

MoneyWise and Yahoo Finance LLC may earn fees or revenue through links to the content below.

The San Diego bill acknowledges that he and his wife struggle to save money despite earning an estimated income of between $500,000 and $600,000 a year.

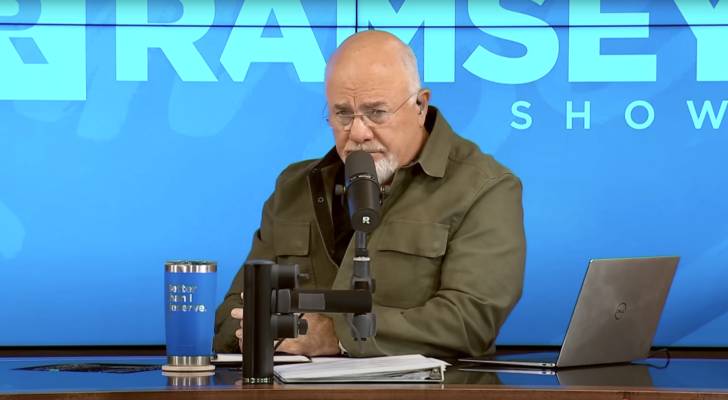

“We spend about $30,000 each month and we add taxes to it, so we’re out almost evenly every year,” Bill told Dave Ramsey in an episode of “The Ramsey Show” in a clip posted on January 13th.

Exploring the finances and spending habits of couples in San Diego, California, has revealed how even earning households can live their paychecks to pay.

A 2023 Empower Survey found that 71% of US adults believe that making more money would solve a large part of their problems. However, he learned that revenue growth cannot solve poor organizations and lack of details.

Bill’s case shows that increasing income is not enough. He and his wife spend $12,000 a month on mortgages, between $8,000 and $10,000 for charities and $750 for lease vehicles.

Advertisement: High Yield Saving Offer

Ramsey overconsidered their spending and compared it to “throwing a veil of dollars over the fence and coming back to see what’s left.” He advised them to create a detailed budget that tracks every dollar’s in and out.

Budgeting and tracking helps you understand where your money is heading, so you can make all your dollars for yourself.

and ynabtrack your spending and save everything in one place. Link your accounts so you can see the majority of expenses and net worth growth. You can prioritize savings on short- or long-term goals (such as vacation or down payments for your home) with the app’s goal tracking capabilities.

If you want to pay your debt faster, you can Create a personalized paydown plan Calculate how much interest you can save if you fill up a little extra monthly payment.

An easy-to-use platform will simplify your spending decisions and clarify your financial priorities. Plus, you don’t need to add your credit card information to Start a free trial now.

Read more: Rich Young Americans Throwing Stormy Stock Market – Instead, the alternative assets they list banks are:

Bank of America data shows that 20% of households who earned salaries over $150,000 in 2024 often pay more expensive homes and mortgages.