Trump has revived defense stocks, Wall Street pros say

Defense contractor stocks can help protect your portfolio from a summer of geopolitical risk.

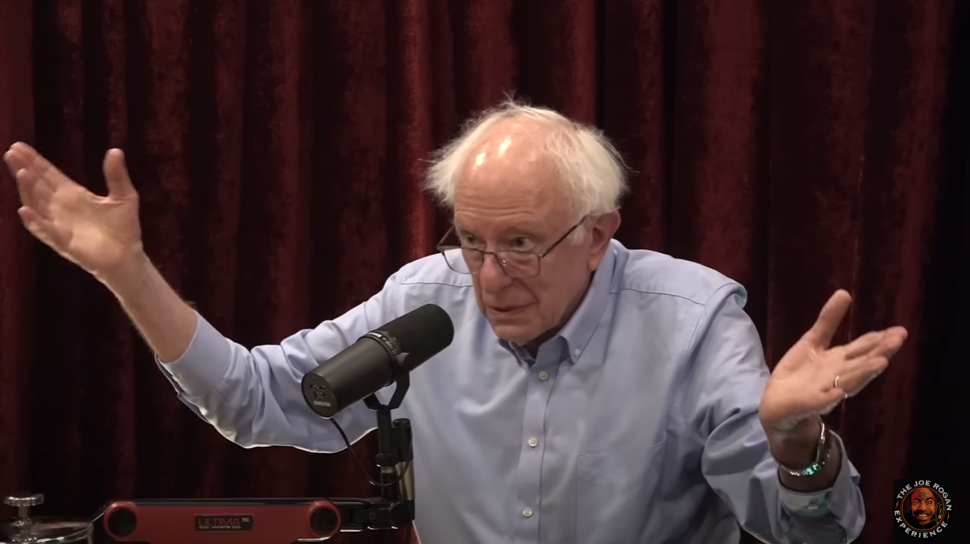

“I think I’ll use ETFs like Invesco Aerospace & Defense (PPA) Innovator ETFS’ chief investment strategist Tim Urbanowicz said of the opening bid for Yahoo Finance (the video above): “You probably make a lot of sense here. You pair it with watching this conflict. What’s happening with Russia and Ukraine’s defense spending hasn’t declined. It’s not falling in the US. It’s not falling globally.”

Top Holdings Investco Aerospace & Defense ETF includes Ge Aerospace (ge), Boeing (ba), Lockheed Martin (LMT), RTX Corporation (RTX), and Northrop Grumman (NOC).

Investors are paying attention to the escalation of tensions in the Middle East after President Trump confirms the US A surprising strike began at Iran’s nuclear site late on Saturday.

The situation on Monday was controversial as Iran promised retaliation for the US strike. Israel and Iran continued to trade fires. Oil prices remained upward March amid fears of disruption in supply from the Strait of Hormuz. Oil prices have risen 14% since Israel’s attack on Iran on June 12th.

Surprisingly, the market was very newsworthy. Dow Jones Industrial (^dji), S&P 500 (^gspc), and NASDAQ COMPOSITE (^ixic) Everything stuck to profits for half a half.

However, some of the most powerful profits on the market today come from defence stocks such as Lockheed Martin and Northrop Grumman. Lockheed Martin and Northrop Grumman shares have each advanced nearly 2% – the company’s ticker page Most active on Yahoo Finance.

Northrop Grumman has attracted particular attention as it builds the B-2 stealth bomber used in US attacks on Iran’s nuclear facilities.

The B-2 program accounts for approximately $500 million in annual revenues for Northrop Grumman, or 2% of its business, estimated Jefferies analyst Sheila Kahyaoglu.

“The escalation of global conflict leads to outperformance of defence inventory,” Kahiagur said.

Chad Morgan Lander, senior portfolio manager for Washington Crossing Advisor, said in the opening bid that the new conflict will only spark long-standing bullish calls for Lockheed Martin. Morgan Lander says he has owned the stock for nearly three years and is hoping for strong revenue growth over the next five years.

“We thought Northrop was a great company, profitable and well-capitalized, but from an evaluation standpoint that Lockheed was more attractive,” explained Morgan Lander. “It’s sitting on about 15 2026 PE multiples. There was no big multiple expansion like its competitors. I believe there is a flow of opportunity because there was an overhang of uncertainty regarding the F-16 or F-22 fighter jets.”