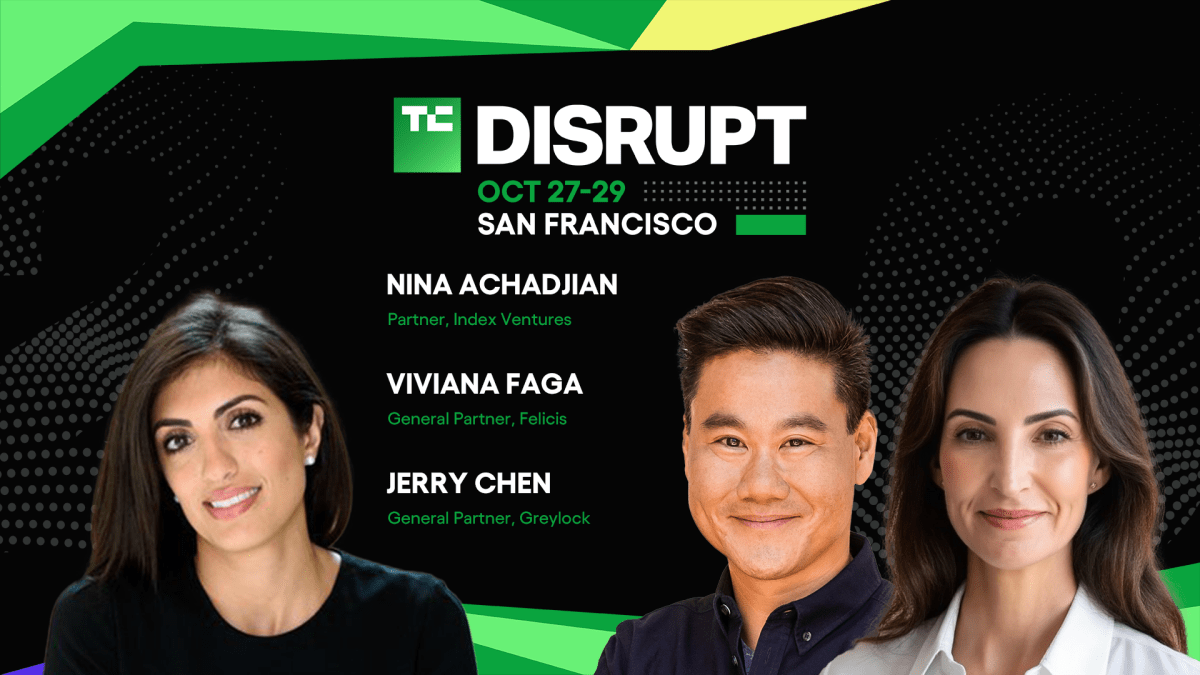

Want to know where the VC will invest next? See 2025 suspension

Early stage founders, listen! Front row seats will be required on the Builder Stage at 1pm on October 27th. In this session TechCrunch confuses 2025 We bring together Nina Atchajian, a partner at index ventures. Jerry Chen, general partner, Greylock. Viviana Ferga, General Partner, Felicis, all of them Share your investment priorities for 2026, including AI, data, cloud, robotics and more. This veteran VCS group gives you their views on emerging sectors and innovations that will attract their attention. Next, would you like to know where smart money is heading? attend.

It will be held in Western Moscone, San Francisco, October 27th-29th, 2025. Sign up here to get a lower price You will receive a discount ticket for up to $675 from your ticket before the price goes up.

Pencil down. It focuses on “forgotten” functions and industrial automation.

Nina Achajian I’m a partner of Index Ventureinvest across AI, robotics, enterprise software, and vertical SAAS seeds, ventures, and growth stages. She is excited about companies building solutions to automate “forgotten” features and industries, replacing pen, paper and siloed tools. She is inspired by founders who develop empathy for their clients, have insatiable curiosity, and run with a growth mindset.

Invest in product-driven founders across AI, cloud and data

General partner, Jerry ChenHe joined Greylock in 2013, backing founders with powerful products and operational implications across a range of sectors, including AI, data, business applications, cloud infrastructure, and open source technology. His current investment Greylock Cato Networks, Chronosphere, Docker, willing, Instabase, one home, notable, and other stealth. Before Greylock, Chen spent 10 years at VMware as a product leader and executive. As an early employment, he saw the company grow from 250 to over 15,000 employees.

Scaling the architecturalization of brand categories and cloud/SaaS to market

Viviana Faga General partner of luckybringing over 20 years of experience to designing and building brand categories for successful cloud/Saas and enterprise social enterprises. Her expertise includes scaling SaaS teams on the market, messaging and positioning, category creation, freemium product strategies, and sales possibilities. A highly experienced angel investor, Faga served as an operating partner and advisor for Eggence Capital. She has held leadership positions in marketing for Yammer, Salesforce, Platfora and Zenefits.

Agenda Confusion for 2025 – Ticket Prices Still Low

TechCrunch is disrupting the 2025 agenda Live! Check it out, come back and see new sessions being added frequently. Please register and use it Low price There is a maximum of $675 off before the price goes up.