What are tariffs and how do they work?

ties with Canada’s Minister of Energy and Resources Jonathan Wilkinson with the United States, and trade conversations between Prime Minister Trudeau and President Donald Trump.

president Donald Trump’s Moves to impose or threaten higher tariffs on countries like China, Canada and Mexico, America’s three biggest trading partners, are about what tariffs are and how they affect consumers. I urged questions.

Trump signed an executive order last weekend to impose a 25% tariff on imports from Canada and Mexico, with a 10% tariff rate applied to Canadian energy products. These tariffs were delayed for at least a month after Canada and Mexico announced measures to combat drug smuggling and illegal immigration along the US border.

He also increased the duties on shipments on duty on goods imported from China by 10%. These tariffs will come into effect on February 4th, with the Chinese government unveiling retaliatory tariffs on certain US energy exports and taking other punitive measures, including Google’s antitrust probes and restrictions on exports of rare earth minerals. I did.

Customs duties are taxes It is imposed on imported goods and services. Although they historically played a more important role in contributing to federal tax revenue, developed countries have been averse to relying on tariffs as the main source of funding, including income, salary, sales tax, etc. We have moved to a form of taxation.

What will happen to Trump’s tariffs in China, Canada and Mexico?

President Donald Trump has raised tariffs in Canada, Mexico and Canada. (Photo by Photo Somodevilla/Getty Images/Getty Images)

After the end of World War II, the global trading system moved in 1947 to a rule-based form of initially established tariffs on tariffs and taxes (GATT). ) In 1995, the Congressional Research Service stated.

The system established by GATT and the WTO has created rules governing the way countries use tariffs on their trading partners to resolve conflicts and prevent trade wars.

This has contributed to a decline in global tariff rates and a growing market for US exporters. As CRS pointed out, US exports have increased by more than 160% in terms of inflation since the establishment of the WTO.

Voters refuse to promote Trump’s tariffs. Most people believe that policy hurts the economy

A sign that says “Buy Canada instead” appears above the bottle and hangs near another sign that reads “American whiskey” following Trump’s tariff announcement on Canadian goods. (Reuters/Chris Helglen/Reuters)

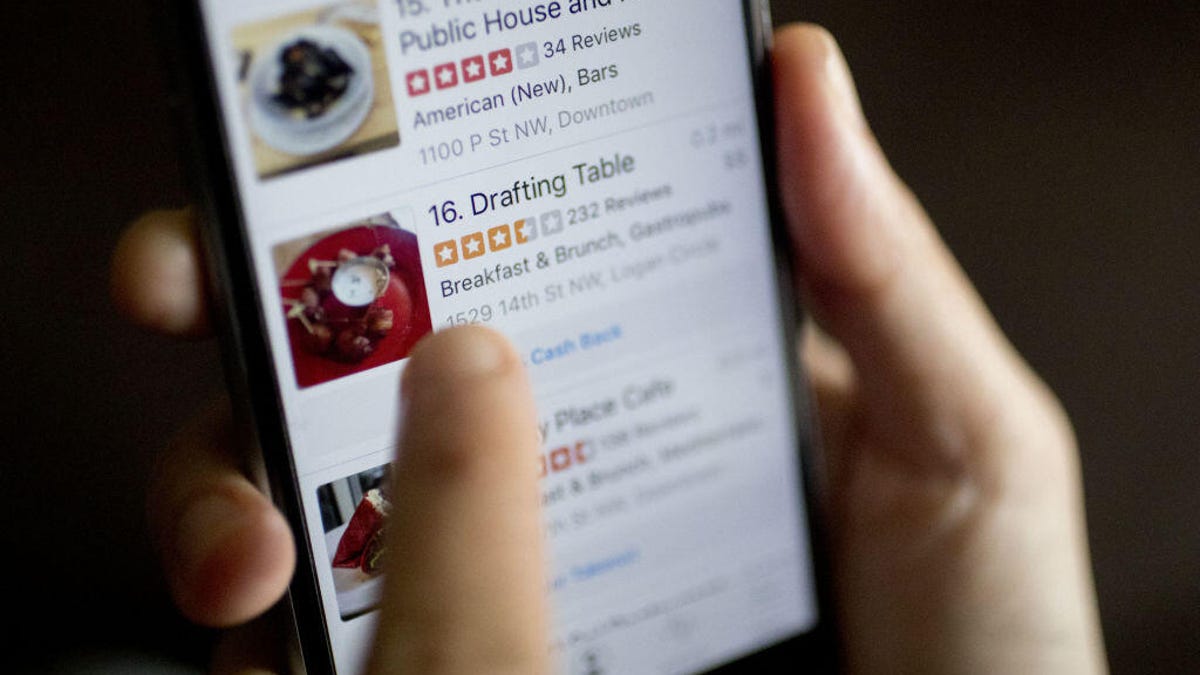

Who pays the customs duties?

Companies that import products covered by customs duties Payment of customs duties When those products enter the country of importing the goods.

In the United States, tariffs are collected by the Customs and Border Protection (CBP) Agency, a sub-agency of the Department of Homeland Security. Trump suggested “create.”External revenue services“It will be responsible for collecting customs duties, but it is unclear whether the plan will move forward.

Customs duties raise the price of the product to the importing company. This requires determining whether to raise the price consumers pay to maintain profit margins, or to keep prices relatively constant and absorb the costs of tariffs into revenue.

In some cases, exporters can consider keeping their market share by lowering prices and helping importers deal with the costs of customs duties.

Canada has announced border security measures that urged Trump to delay tariffs on Canadian goods for at least a month. (Kamara Morozuk / Bloomberg by Getty Images / Getty Images)

A quick warning from Trump’s tariff trade group

“It really depends on the sensitivity of the price of the product,” Brandon Parsons, an economist at the Graziadio Business School at Pepperdine University, told Fox Business in an interview.

“For producers who have a lot of leverage – consumers really want to buy their products. For example, there is a demand that is not as resilient as the iPhone. iPhones hold market share ” Parsons said.

Click here to get your Fox business on the go

“Consumers are more price sensitive, there are many alternatives, there are a lot of competition, and in that case producers may just reduce margins, lose market share, lose demand, or Instead of doing so, eating a little bit in relation to margins will reduce overall profitability,” he added.