Where will Dogecoin be in a year?

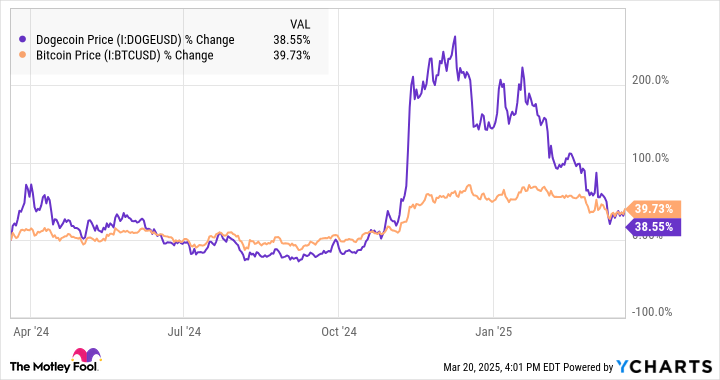

Prices fell 47% per year, Dogecoin‘s (Cryptography: Doge) The Trump-inspired rally is quickly unraveled. It is normal for volatile assets to abandon some of their profits after a major move, but the controversial memecoin is worse than many of their peers. Is this immersed in the opportunities and traffic lights for investors to run for the hill? Let’s dig deeper and see what the next 12 months have.

The rising tide can lift all boats, and the cryptocurrency industry is no exception. However, while digital asset prices tend to be highly correlated in the short term in the long term, some patterns begin to emerge. Meme coins like Dogecoin have been posted historically Explosive benefits When market sentiment is positive, but when the outlook collapses when it’s sour.

It’s not easy to pinpoint exactly why this happens. But it probably has something to do with the investment community of assets and its goals. When it was launched in 2013, Dogecoin was intended to satirize the cryptocurrency industry rather than to solve specific problems. This somewhat offensive perspective is part of the brand and can affect the type of investors trying to buy the asset.

Unlike Dogecoin, it seems to be another early cryptocurrency Bitcoin (Published in 2009) and Ethereum (released in 2015) attracted an increase in mainstream acceptance. Both assets are approved Funds traded on the exchange It opened the door for institutional investors such as (ETFs), pension funds, university contributions, and even national governments to add to their portfolios.

These deep pocket organizations tend to hold for a long time instead of panic sales to earn profits or pay for real emergencies, which could have a steady effect on crypto prices.

Meanwhile, Dogecoin attracts more retail-oriented crowds that are easily shaking with statements from influencers Tesla CEO Elon Musk frequently promotes Dogecoin to 220 million followers on X (formerly Twitter). Positive posts can raise the price of assets in the short term, but they are not sufficient to create sustainable value.

Furthermore, Dogecoin’s price boom and bust history has become a negative feedback loop, scaring long-term investors and even seducing short-term speculators, looking for quick amounts.

Cryptocurrencies cannot be evaluated based on traditional stock market metrics such as revenue and revenue growth, but that doesn’t mean they have no basics. Unfortunately for Dogecoin investors, this volatile Meme Coin was not designed to be a good value store.