Why bond portfolio, which is 60/40 stock, needs to be transformed

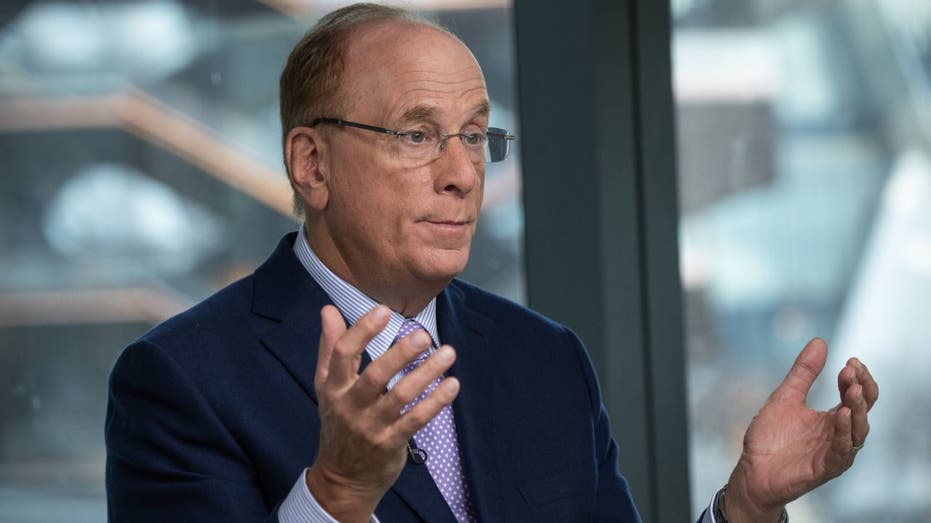

BlackRock Chairman and CEO Larry Fink gives his views on tariff negotiations with China and market volatility in the “Craman Countdown.”

The 60/40 portfolio was a proven way for people building retirement nest eggs in a diversifying safety net from bonds to stocks. But in times they’ve changed, with BlackRock CEO Larry Fink advising a makeover.

“Generational investors follow this approach and own a mix of markets rather than individual securities. However, as the global financial system continues to evolve, the classic 60/40 portfolio may no longer fully represent true diversification. Fink wrote in a 2025 letter to investors.

BlackRock CEO Larry Fink’s letter to annual investors

Larry Fink, chairman and chief executive of BlackRock Inc., and Adebayo Ogunlesi, chairman and chief executive of Global Infrastructure Partners (GIP), during a Bloomberg TV interview held in New York, USA on Friday, January 12th. (Photographer: Victor J. Blue/Bloomberg via Getty Images)

In the case of infrastructure, Fink touted its inflation protection properties. Payments, stability and unstable public markets, and revenue generation from solid returns, he pointed out, even a 10% allocation.

BlackRock recently paid $23 billion to Panama Canal Port. As an example, revenue can be generated by charging a vessel fee to pass through the waterway.

BlackRock pays $23 billion for Panama Canal Port

| Ticker | safety | last | change | change % |

|---|---|---|---|---|

| blk | BlackRock Inc. | 875.75 | +9.64 |

+1.11% |

nevertheless BlackRock, over $11 trillion in assets The world’s largest asset manager, and other splits with 50/30/20 mix or alternative assets make sense for small retail investors.

“For those who spend more time than they do and have assets that justify their private allocation, I think it’s a really exciting opportunity for the diversification they offer to their portfolio.” Katie KlingensmithEdelman Financial Engines’ chief investment strategist told Fox Business.

Mortgage fees skyrocket amid market volatility

“From a general perspective, when you think about building a really robust portfolio for your clients, but also when you think about what you think is best for the majority of investors that aren’t necessarily super-sourced, the private market has really interesting characteristics.

S&P 500, the broadest scale of the US stock marketlost 10% this year.

Click here to get your Fox business on the go

Morningstar’s US Core Bond Index has risen by around 2% this year. According to the company, this measures securities in US dollars, which are constant interest rates, and involves maturation for more than a year.