Why electric cars recover today, Libian, Wolf Speed and indie semiconductors

Shares in electric vehicle (EV) stocks were up Thursday. Livian (NASDAQ: rivn) EV-related power chip manufacturers wolfspeed (NYSE: Wolf) and Indie Semiconductors (NASDAQ: Indy). These stocks had increased by 5.7%, 14.9% and 5.1% as of 1:30 PM ET, respectively.

There was no company-specific news about these three stocks today. This means that investors may have generally been responding to positive progressive news of EVs. Plus, considering how well these stocks were beaten, even “bad” news was probably enough to generate Short cover.

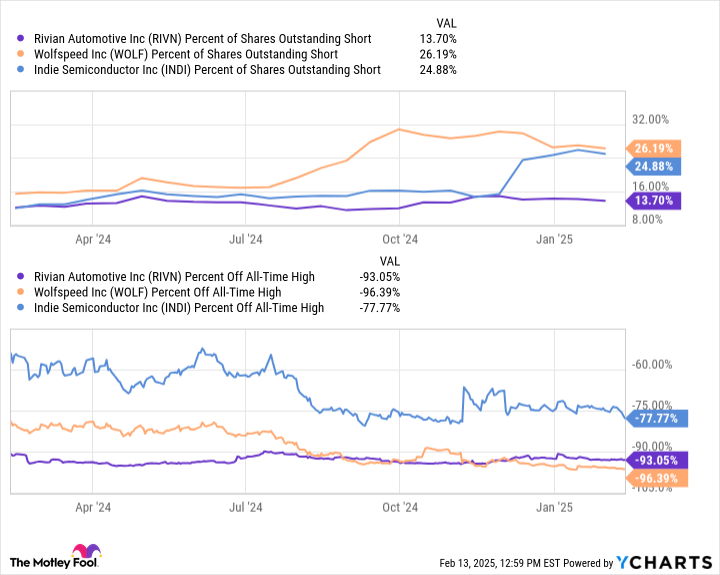

Each of these stocks are experiencing a major move today, but all three have been badly beaten. Indie semiconductors have fallen 78% from their all-time highs, while Libian and Wolfspeed have fallen 93% and 96% respectively. On the other hand, there is relatively high short interest in each of these strains. The short interest in Libian as a percentage of outstanding shares is 14%, while the short interest in WolfSpeed and Indie is both around 25%.

Currently, all three companies are losing money as they are investing in gaining share in the EV industry in the future. Livian They are trying to expand their manufacturing plants and top rivals in terms of technology, but this is expensive. WolfSpeed has invested heavily in US silicon carbide chip production plants, but so far there has been little revenue to show that. Indie is a small-cap production that produces both sensors and power chips for autonomy and electrification.

However, last year’s severe slowdown in electric vehicle sales has settled in demand for products after all three made large investments. The slowdown in demand was particularly painful as each share must invest capital in advance, but as they have not yet received much revenue from those investments.

It was unclear exactly why inventory exposed to beaten EVs moved today. The rise could be related to the media story announced today that the State Department had planned to buy 400 armored electric vehicles to transport diplomats and other high-level officials. . The story may be attracting attention because it was first reported. Tesla (NASDAQ: TSLA) Cyber truck. Given CEO Elon Musk’s involvement in the Trump administration, the story highlighted a potentially large conflict of interest.

Department officials later revealed that in December the State Department issued a request for information from private companies regarding the construction of armored EVs, with only one company likely responding. Officials then went on to state that the next step would be an official solicitation to the manufacturer to bid on the project. However, solicitations are currently pending.