Why Wall Street Experts suggest investors take summer vacation

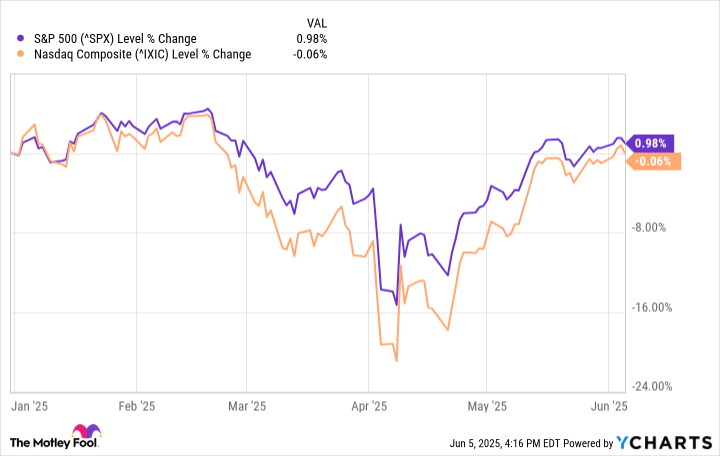

Stock is bounced sharply from the lows next spring Trump’s “liberation day” tariff announcementAnd some Wall Street pros say the worst may have ended and set the stage for a relatively mild summer session.

“Volatility will continue. … But I think extreme volatility is behind us,” Solidarity Capital CEO Jeff McLean told Yahoo Finance in an interview Wednesday.

During range-bound price action, Lack of clear direction from the Fedand headline fatigue from Washington, McLean said it might be better for investors to step in at least until a more clear signal emerges.

“Volatility will calm a little more this summer as people check out from the daily news that has caused a lot of tariff-related noise,” he said.

After hitting the low in April, the benchmark S&P 500 (^gspc) has risen to about 20% led by rapid rebounds in beaten sectors like communication services (XLC), consumer discretion (xly), and technology (xlk).

McGough, assistant chief investment officer at Prime Capital Financial, reiterated the view that even the long-term Treasury yields could result in the market quietly staying until summer. The biggest concerns of recent weeksmost maintain a range between 4% and 5%. Despite the continued noise from Washington.

“My recommendation right now is to enjoy the summer,” he said. “There’s absolutely nothing to be excited about the extent of its range being significantly increased or broken by a drawback,” he added.

Of course, many events will be able to keep investors busy for the coming months, starting with the Federal Reserve’s Jackson Hole Symposium in August. Important tariff deadline for early July Progress with expectations for rate cuts to form future Fed meetings Trump’s “Big and Beautiful Bill” Through the Senate.

But so far, traditional market drivers such as revenue, economic data and Fed policy have taken the backseat of politics.

“It’s an attractive market environment,” McGau said. “D.C. promotes many trickle-down effects through the stock market and trade policy through the basis of stocks.”

read more: How to protect your money during confusion, stock market volatility

CFRA Research’s Chief Investment Strategist Sam Stovall added historic background and said that in June there is a tendency for mild volatility stocks to be weak. He described the current amendment as “manufactured” and is primarily shaped by President Trump’s trade decisions.