Do you think Libian is expensive? This chart may change your mind.

If you are monitoring Libian Automotive (NASDAQ: rivn) You may think that it has been in stock over the past few months and no longer has the chance to buy it. Since hitting a few months’ lows in November last year, stocks have skyrocketed at over 30%. However, the chart below proves why stocks are long-term screams.

Libian was tough in 2024. Sales were increasing year by year, but it was barely possible. The company shipped 51,579 vehicles in 2024 to 49,476 in 2023. Luckily, Libian is not alone. Tesla Sales fell 1.1% in 2024, with the initial decline in nearly 15 years. Meid GroupMeanwhile, the introduction of the new model has led to a 71% increase in sales and a new record.

Beyond last year’s results, Libian has a promising future. In 2026, the EV maker is planning to release three new mass market vehicles: the R2, R3 and R3x. All costs are under $50,000. This is a big deal when it comes to tapping on the biggest section of the car buying market. Sales growth rose considerably when Tesla introduced the affordable Model Y and Model 3 variants. The same can be said for Libian when a new model is hit by the streets.

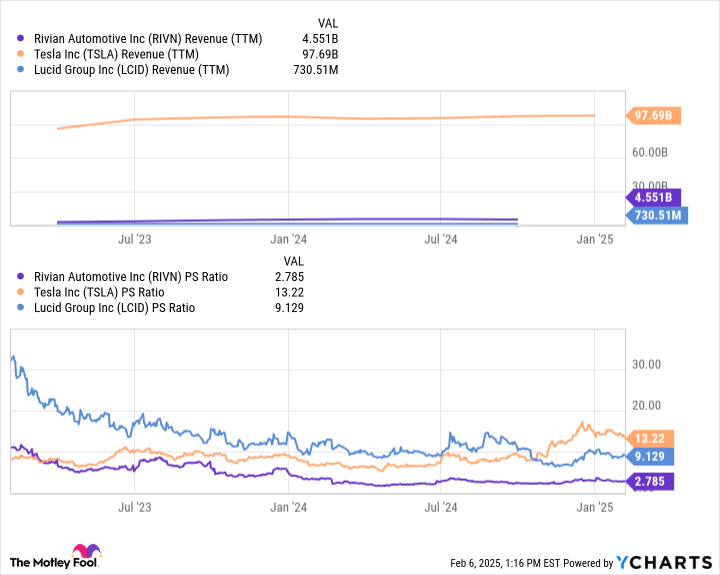

I don’t know that Libian was doing something bright a few years ago. Price to sales ratio. Lucid Group trades at Rivian’s ratings of more than three times, while Tesla trades at multiples more than five times. Lucid’s premium rating makes sense given its high sales growth and small size. However, as you can see from the chart above, Libian still has plenty of room for growth even if the next growth rate has not yet occurred until 2026.

If you understand the sales lamps that may occur after 2026, Libian stock is clearly not expensive.

Consider this before purchasing inventory with Rivian Automotive.

Motley Fool Stock Advisor The analyst team has identified what they believe 10 Best Stocks For investors to buy now…and Libian Automotive was not one of them. The 10 stocks that have made the cut could potentially generate monster returns over the next few years.

When should you think about it? nvidia I created this list on April 15, 2005… If you invested $1,000 at the time of recommendation, There is $795,728! *

Now it’s worth noting Stock AdvisorThe total average return rate 926% – Market-breaking outperformance compared to 175% For the S&P 500. Don’t miss our latest Top 10 list.